Key Insights:

- Twenty-five percent of Black Americans own cryptocurrency compared to 15 percent of white Americans.

- The price of bitcoin is down more than 70 percent from its peak in 2021, but Web3 professionals say this is part of the crypto cycle.

- VC funds for crypto-focused start-ups continue to grow as evidenced by a new $4.5 billion fund by Andreessen Horowitz.

Despite scams, hacks, NFT frauds, and drops in crypto prices that have begotten the unwavering skepticism around Web3, many Black founders still see an opportunity for growth in the space.

Over the past few years, Black Americans have gotten involved in various aspects of Web3, whether that’s cryptocurrencies, non-fungible tokens (NFTs), or the metaverse. Twenty-five percent of Black Americans own cryptocurrency, compared with 15 percent of white Americans, according to a survey by Ariel Investments and Charles Schwab, two financial-services companies. Black respondents to the survey were more likely to be both new to investing and highly enthusiastic about crypto.

But with the recent losses across crypto, the crash had a particular detriment to Black Americans who have over-indexed. The global crypto market cap has fallen below $1 trillion, down from its peak of $3 trillion in November 2021. The price of bitcoin is currently about $20,000, which is well below the all-time high of around $69,000 in November 2021.

What Do Critics Say?

The appeal behind Web3 to some is that it’s decentralized, meaning instead of accessing the internet through services, individuals themselves own and control pieces of the internet.

But Jack Dorsey, Twitter co-founder and a major player in cryptocurrency, has criticized that thinking. Last December, Dorsey tweeted about venture capital firms and the state of Web3:

“You don’t own Web3. The VCs and their LPs do. It will never escape their incentives. It’s ultimately a centralized entity with a different label. Know what you’re getting into.”

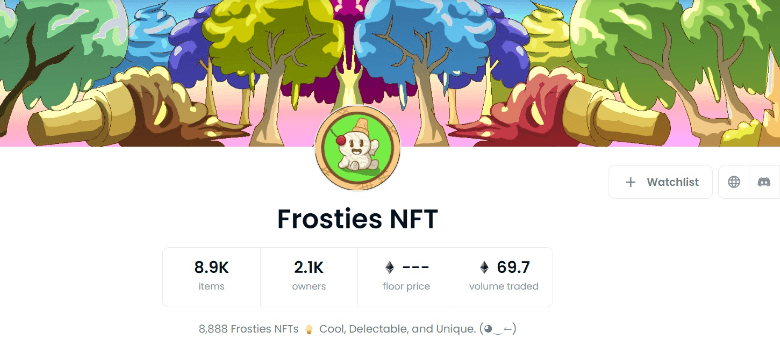

Anti-Web3 sentiment has also grown in part due to the lack of consumer protection and money laundering. Three men were indicted by the U.S. Department of Justice in June for an alleged global cryptocurrency-based fraud that investigators said generated around $100 million in revenue from investors. Chainalysis, a blockchain data platform, detected at least $1.4 million worth of potential money laundering involving NFTs in 2021.

There has also been controversy around the Bored Ape Yacht Club (BAYC) series of NFTs that garnered fans like Meek Mill, Serena Williams, and Mark Cuban. Yuga Labs, the creators of BAYC, is suing artist Ryder Ripps, who previously claimed the origin of BAYC is connected to Nazi imagery. The case claims Ripps scammed consumers into purchasing counterfeit Bored Ape NFTs, from which he has made more than $5 million, according to Bloomberg Law.

Black Web3 Enthusiasts Remain Optimistic

Jeremy Fall, the founder of Probably Nothing, a Web3 media brand, aims to change this negative narrative around Web3. Fall joined the community after working in hospitality and selling the 14 bars and restaurants he owned in 2019.

“After I sold my company, just like everyone else stuck at home during the pandemic, I was looking through things online and I stumbled upon the NFT space and really fell in love with the community building there,” Fall told The Plug. “My thing was wow, this is really similar to food. People are connecting through this central thing.”

As he got more involved in Web3, Fall realized there was a big gap among smaller investors in NFTs, major players in the crypto space and the general public. That’s where the idea for his brand, Probably Nothing was sparked.

The company’s goal is to educate the world about Web3 by collaborating with corporations on NFTs and creating a yet-to-debut show about NFTs and the metaverse on the video platform Triller. The company is self-funded and was launched at the beginning of 2022, around the same time as the general public’s interest in NFTs diminished, according to an April report by Non-Fungible.

The fall in NFT interest has mirrored the fall in crypto prices, but some experts say the drop in bitcoin is part of the fluctuating nature of the crypto world.

Armando Juan Pantoja, a crypto expert who works as an advisor at Blockchain 360, told The Plug the decrease in the price of bitcoin is a part of this cycle.

“A lot of people are scared, they don’t know what the future holds, they don’t know what’s going to happen, but it’s coming back well enough. It’s a four-year cycle. It happens all the time,” Pantoja said. “Bitcoin’s going to go up again.”

Yet even with the downturn in crypto markets and public sentiment, venture capital is still flowing into Web3.

Global venture capital investment in blockchain-based projects and crypto-focused startups reached a record $30 billion in 2021. In May, Andreessen Horowitz announced a fourth fund of $4.5 billion to invest in crypto start-ups. In June, Binance, the world’s largest cryptocurrency exchange, announced it raised $500 million for its own debut venture capital fund.

Daniele Jean-Pierre, the co-founder of Zimbali Networks, a Web3 Financial Ecosystem, told The Plug what people are seeing now is a “market correction.”

“The market was very heated, in fact, some would say overheated. People were creating these crypto projects that really didn’t have much utility,” Jean-Pierre said. “What you’re finding is that at the end of this bear cycle, crypto projects that have solid communities and actually added value to people’s lives, will increase in value and continue to grow and sustain themselves. The projects that didn’t really have any underlying value to them may eventually fall away.”

“It’s pretty standard in any market that you have highs and you have lows, you can’t continue to grow without some level of correction,” Jean-Pierre said.