In January, The Plug released a report analyzing 100 high-growth, Black-led technology companies. The Black Tech Effect report is a launchpad for investors who are not just looking for diverse founders but are looking for good investment opportunities.

Although the report focuses on founders with venture backing, a common thread that unites them is the trials and tribulations of their funding journey. The report celebrates the success of these founders and companies while acknowledging the ongoing challenges affecting the Black tech ecosystem.

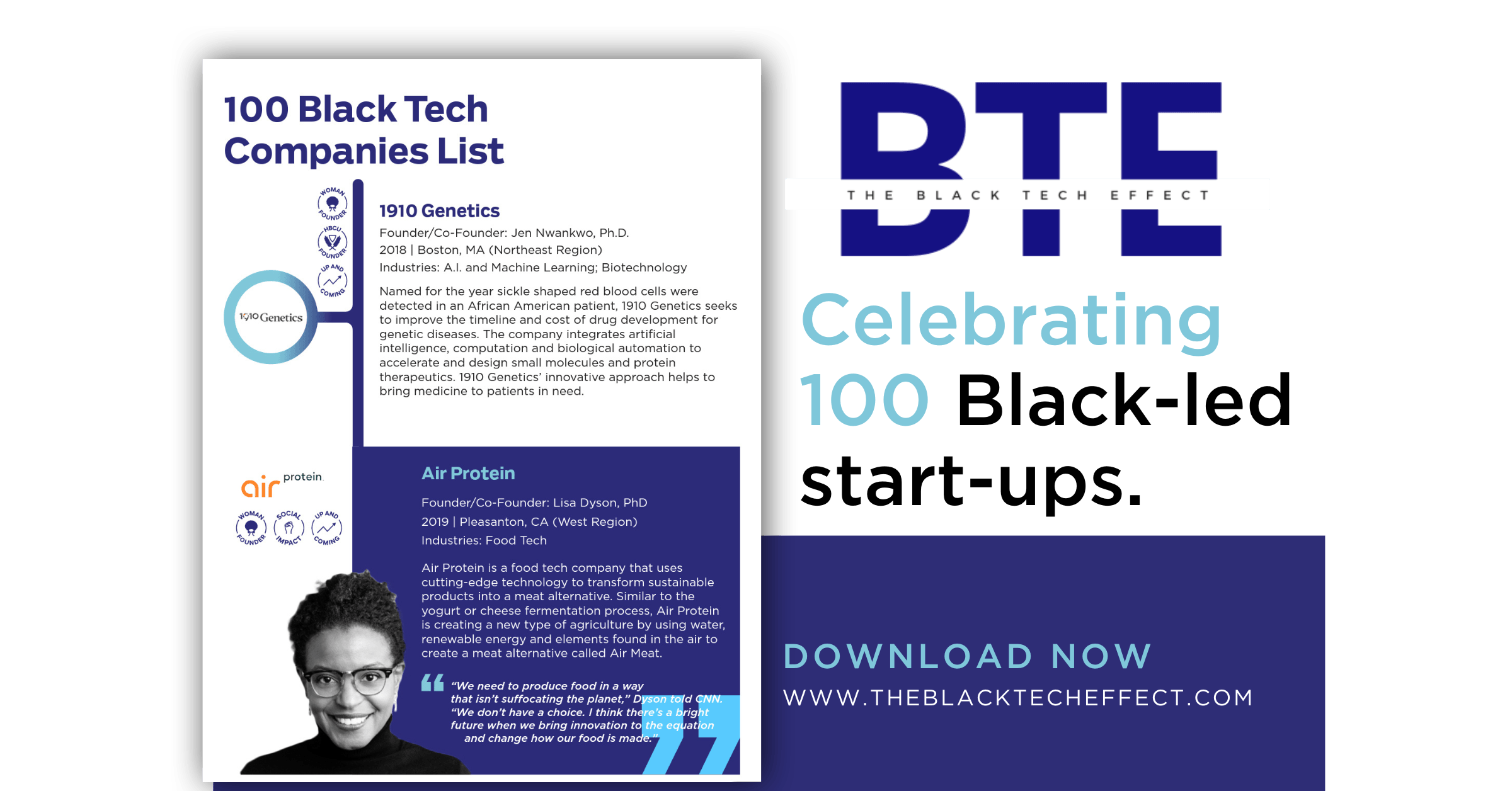

The companies identified are pioneering innovation in fintech, clean tech, media and telecommunications, artificial intelligence and machine learning, and more.

“Any investor who says that they can’t find Black founders or Black companies within the climate change space, I’ve been able to prove them wrong. If they say that they cannot find someone in the fintech space, I’ve been able to prove them wrong,” Tayler James, Director of Research at The Plug, said. “They’re out there.”

Though the report is thorough, it still only captures a fraction of Black-led tech companies. James and her team identified over 1,000 companies before whittling down the list, all through public data. Investors who are looking to gain exposure to Black founders can also work with organizations like Goodie Nation, Black Ambition, Techstars, Black Innovation Alliance and digitalundivided.

“It takes a little effort and takes some commitment,” she said. “You just have to make sure that you’re intentional about making those connections and infusing yourself within those organizations.”

In 2020 and 2021, Black founders saw exponential growth in funding that was unfortunately short-lived, with 2022 seeing a slight drop. Black founders raised about one percent of the total VC funding in America last year, an estimated $2.25 billion out of the $215.9 billion allocated. This funding disparity stems from a lack of diversity among venture investors and racial bias in assessing risk for Black-led companies.

“Now that the halo effect of the death of a Black man has gone away, we’re going back to the difficulties of supporting diverse founders. And we don’t need sympathy dollars, we need investors that are dedicated to really advancing these products,” James said.

James suggests that investors look at the categories and the verticals identified in the report to make strategic investments. The Black Tech Effect identifies companies under the following categories: HBCU founder, international, legacy, social impact, unicorn status, up-and-coming, veteran-founded, and women-founded.

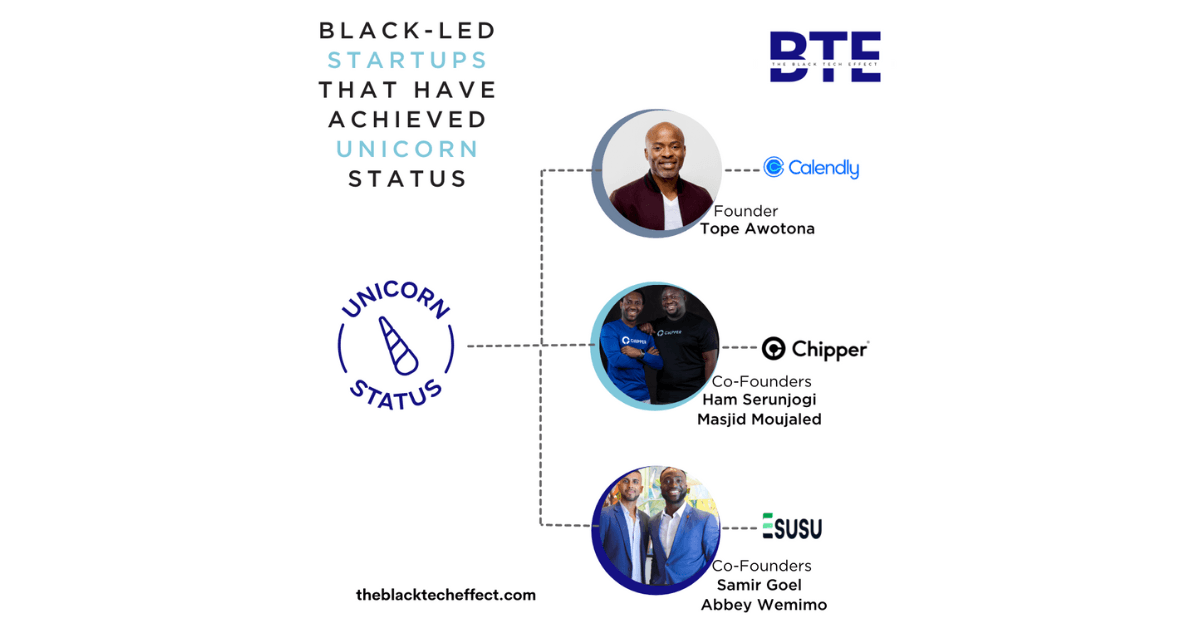

The report includes three of six Black-founded unicorn companies and James believes that more companies on the inaugural list are going to reach the status in the next few years.

Beyond direct investments as an individual, people can show support to the companies as consumers. Some examples include Goodr, a sustainable food waste management platform; Resilia, a grants management software that supports nonprofits; Air Protein, a food tech company transforming sustainable products into a meat alternative; Breakr, which connects musicians and artists to influencers; Bambee, an HR tech solution for small and medium-sized businesses.

“I’m amazed at all of the categories and industries that we’ve been able to tap into,” James said. “There are so many different ways you can support and even if they’re not a consumer-facing company, if they’re B2B, share their business. Congratulate them, reach out to them, get involved.”

As the companies are scaling, they are also creating job opportunities and James urges people to consider working with these growing companies.