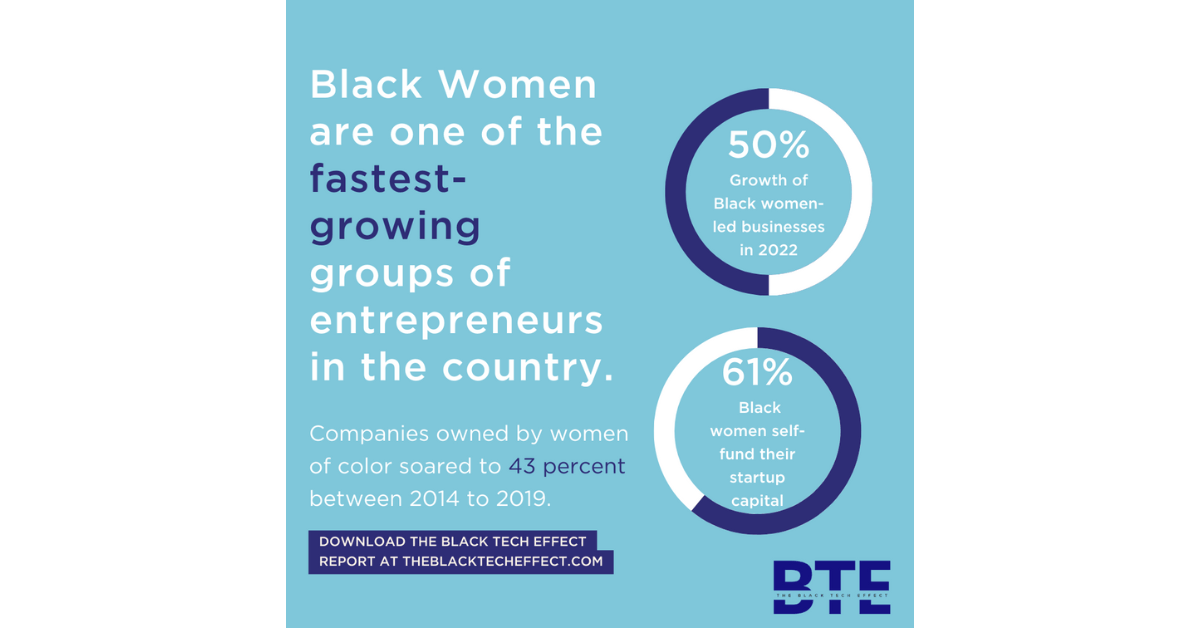

The racial wealth gap has ballooned after 41% of small Black-owned businesses were forced to shutter because of the coronavirus pandemic. Since 2016, the average white American family has had a net worth of $171,000, ten times the net worth of $17,150 for the average Black family. The pandemic further aggravated systemic racism and financial hardships.

Now, Visa and a new neobank First Boulevard are taking on the challenge, using crypto as one way to aid in wealth building for the underbanked.

While cryptocurrencies have existed for over a decade, a 2019 Crypto Radar study found that a mere 6% of Americans own Bitcoin, with African Americans less likely to belong to this small subset of cryptocurrency holders.

“Systemic issues all point back to a lack of money and a lack of understanding money,” Donald Hawkins, serial entrepreneur and founder of First Boulevard, told The Plug.

First Boulevard is a consumer-facing digital bank focused on improving Black people’s financial outcomes, created by Hawkins and cofounder Asya Bradley. The Kansas City-based entrepreneur sets out to bridge the racial wealth gap with First Boulevard, which launched in July 2020 after the murder of George Floyd. Less than a year later, the company announced Wednesday that it will be Visa’s first crypto API integration.

The global payment processing company will provide the infrastructure for First Boulevard customers to buy and sell cryptocurrencies, which will be held by another of Visa’s digital asset banking partners, Anchorage Bank.

Hawkins’ wife was pregnant with their second child, a son, when Floyd was murdered. The family saw how systemic oppression and a lack of capital and financial confidence persisted generationally.

“I grew up in a community in south Georgia where it was commonplace to think about living check to check and people had become comfortable doing that on a month to month basis,” Hawking said. “But when it’s time to thinking about retiring or a big emergency, they’re stuck.”

Hawkins studied how other oppressed groups who came to the U.S. used finance to support their communities, identifying it as a key component to building generational wealth. But Black people have often been robbed of this experience, perhaps most notably during the Tulsa Riots where “Black Wall Street” an economic and financial hub built by African Americans from 1906 to 1921, was viciously destroyed by a mob of white rioters.

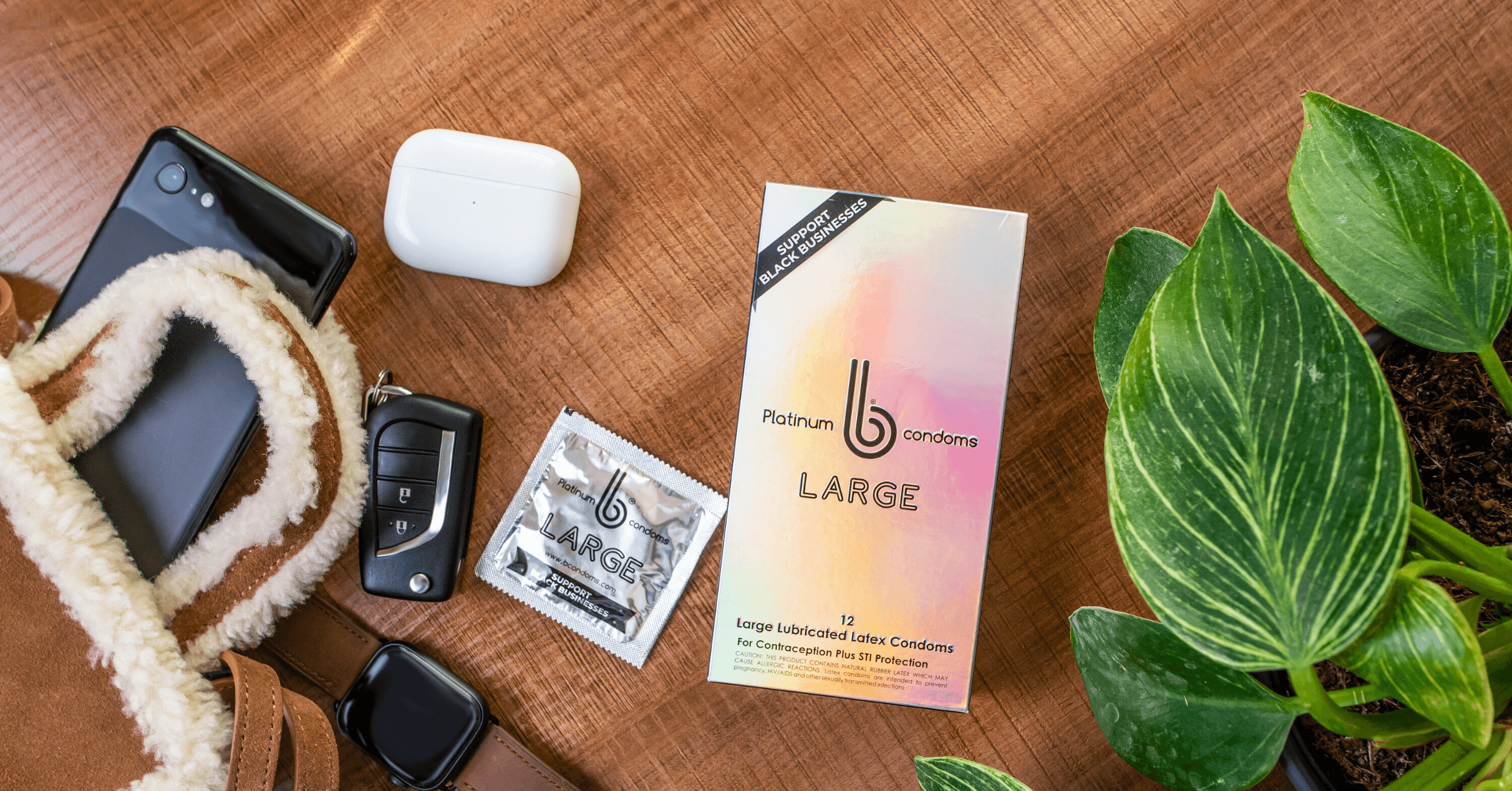

While a statistic that a dollar spent in a Black community only circulates for six hours before it’s put into a non-Black business has been debunked, Hawkins says that intentionally spending money in Black communities isn’t necessarily easier since the pandemic. First Boulevard also incentivizes its customers to buy from Black businesses by offering up to 5% cashback when customers shop with vetted Black merchants. Last year, Black people spent $1.5 trillion in the U.S. economy. The potential for growth, attracting wealth and belonging to a community that isn’t oversaturated with banking products makes more inclusive banking an imperative for financial services companies.

“For Visa, it’s a business imperative to support the fight for racial equality,” Cuy Sheffield, Visa’s Senior Director and Head of Crypto told The Plug. “We need our organizations and our products to better reflect the world that we live in.”

Visa’s journey into crypto began two years ago when the company started enabling merchants to use their payment processing to accept crypto payments. The partnership with First Boulevard is a part of a larger plan to give smaller banks digital asset banking infrastructure.

First Boulevard has $5 million in venture backing and is still in stealth with plans to launch in Q3 2021. The digital bank has built-in educational tools that teach users about investing and managing personal finances.

First Boulevard’s target audience might be especially receptive to learning about crypto. A 2020 study from Coinbase, which surveyed 5,126 adults across the U.S. and U.K., indicated that Black respondents were twice as interested in learning about crypto than white respondents.

Unlike fiat currencies, some cryptocurrencies are in limited supply. For instance, there are only 21 million Bitcoin in circulation, a factor that drives the demand and the price of the currency. One Bitcoin is worth $37,019 as of the market close on Wednesday. Trading these assets, even in fractals, teaches holders about financial markets and strategy.

“We’re mindful of ensuring that our members do have the education to make sound decisions, not only about cryptocurrencies and Bitcoin but other types of assets, certificates of deposits, Roth IRAs, we educate on many options,” Hawkins said.

There is a robust conversation around the potential of the blockchain even beyond financial services. When it comes to learning about cryptocurrencies, it could be a gateway to a firmer understanding of financial principles overall.

“Crypto is not a panacea but it should be a part of the conversation. We think it can help accelerate and encourage the conversation around learning about different types of assets,” Sheffield said.