Indianapolis-based venture firm Sixty8 Capital announced today the close of their first fund to the tune of $20 Million dollars. Supported by Allo Ventures, the seed-stage venture capital firm will invest upwards of $250,000 to $500,000 in 25 to 30 companies led by Black, Latinx, women, and LGBTQ+ founders.

Sixty8 Capital’s name stems from the political events and civil rights legislation of 1968—a watershed year in the civil rights movement.

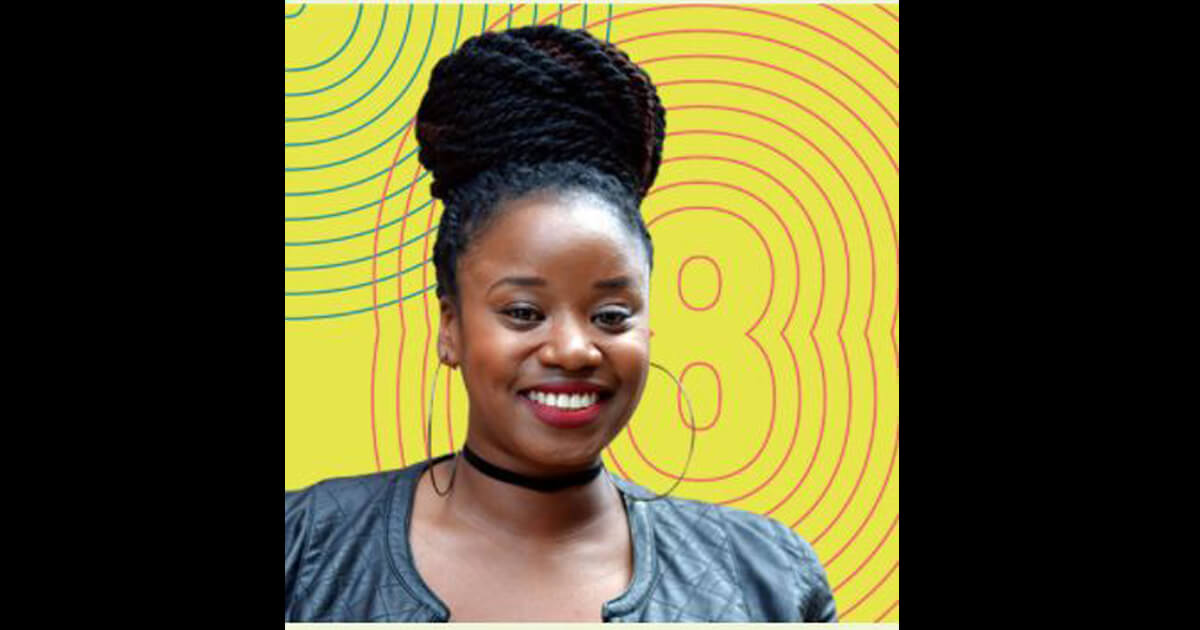

“We believe there is an opportunity to truly level the playing field when it comes to capital access for diverse founders in any industry,” said Kelli Jones, Sixty8 Capital’s co-founder and managing partner, in a statement.

Jones represents one of just a very small percentage of Black women working in venture capital today, and one of just 10 documented Black-women-operated firms with over $25 million in assets under management.

“There is a $4 trillion missed opportunity when we don’t put a focus on diverse founders. Venture capital has a significant opportunity to change the trajectory of SMBs and microenterprises by helping them build products and services that utilize tech and have the opportunity to scale.”

Sixty8 Capital cut its first investment check in March to HRtech company Qualifi, led by Darrian and Devyn Mikell. The firm did not disclose any new investments in the works.

Jones’ efforts in Indianapolis include leading accelerators like Techstars. In 2016 she co-founded Be Nimble, a social enterprise organization supporting entrepreneurs and aspiring technology talent through training, programming, conferences, pitch competitions throughout Indianapolis.

Investors in the fund include The Indiana Next Level Fund, 50 South Capital, Bank of America, Eli Lilly and Company, First Internet Bank and the Central Indiana Community Foundation.