Interested in getting HBCU stories straight to your inbox? Sign up for our executive HBCU newsletter to make sure you get exclusive videos, news and analysis in your inbox every Wednesday morning.

HBCU Innovation Reporter Mirtha Donastorg hosted a live discussion with Ali Emdad, Executive Director of the Morgan State University FinTech Center, about about fintech, HBCUs and how to prepare students for the future. Morgan State University has the first-ever financial technology center at an HBCU.

This interview has been edited for clarity and length.

Mirtha Donastorg: Dr. Emdad is the Associate Dean of the Graves School of Business and Management at Morgan State University up in Baltimore. He is the founder and executive director of the National Center for the Study of Blockchain and Financial Technology, also known as the FinTech center, and that’s going to be the thrust of our conversation today. Dr. Emdad manages a multi-year, multi-million dollar grant fintech company Ripple awarded Morgan State in February 2019.

Previously, he served as a Founding Chair of the Department of Information Science and systems in the Graves School [of Business, where he is also a professor. Dr. Emdad has more than 40 publications on various subjects of IT. He focuses on blockchain education, program development and adoption models. He has organized international conferences and has been an accreditation consultant to colleges.

Before joining academia, Dr. Emdad worked at Kennecott Corporation’s business and legal divisions. He has established strong partnerships with corporations and government agencies and has brought in many large grants to Morgan State University. A 2007 Fulbright award recipient, he holds a Ph.D. from Case Western Reserve University and has completed executive management leadership and technical education programs at Harvard, Yale and MIT. So welcome. Thank you so much, Dr. Emdad I’m really excited.

Ali Emdad: Thank you so much for the invitation. I’m honored to be here, of course.

MD: Now, I just want to set the stage. Can you talk a little bit about the FinTech Center at Morgan State and why you wanted to start a fintech center at an HBCU?

AE: Our journey started in 2017 when I noticed our students from different disciplines were gathering in informal groups and they were discussing cryptocurrencies. I found that the interest level was high and after some discussion with my colleagues at Morgan, we decided to offer a number of programs and make sure that our students learned about the technology that is evolving and fast-growing.

At that point, we decided to start developing a course and we developed the first course in blockchain fundamentals. We were the first HBCU to offer that course. And then in the following months, we offered workshops and the national panel discussions that brought experts to the campus and again, we had an auditorium packed with students, faculty, and staff that came to hear, understand what the future of finance and business is in the digital era. So that was the beginning.

And then later, in 2018, with the support of [Morgan] President David Wilson, other administrators, the dean of the school of business and my other colleagues, we created the Center for the Study of Blockchain and Financial Technology. We brought a number of goals, to reach out not only to Morgan State University but also to the other HBCUs.

MD: So when you launched, why did you also want to incorporate other HBCUs and not just have this a Morgan State-only center?

AE: In a meeting with the senior Ripple executives in San Francisco, I presented the idea of “Why limit our impact to just Morgan? Why not reach out to all the HBCUs and bring them into this space that is growing very fast?” We wanted to be among the first to be in this in this space.

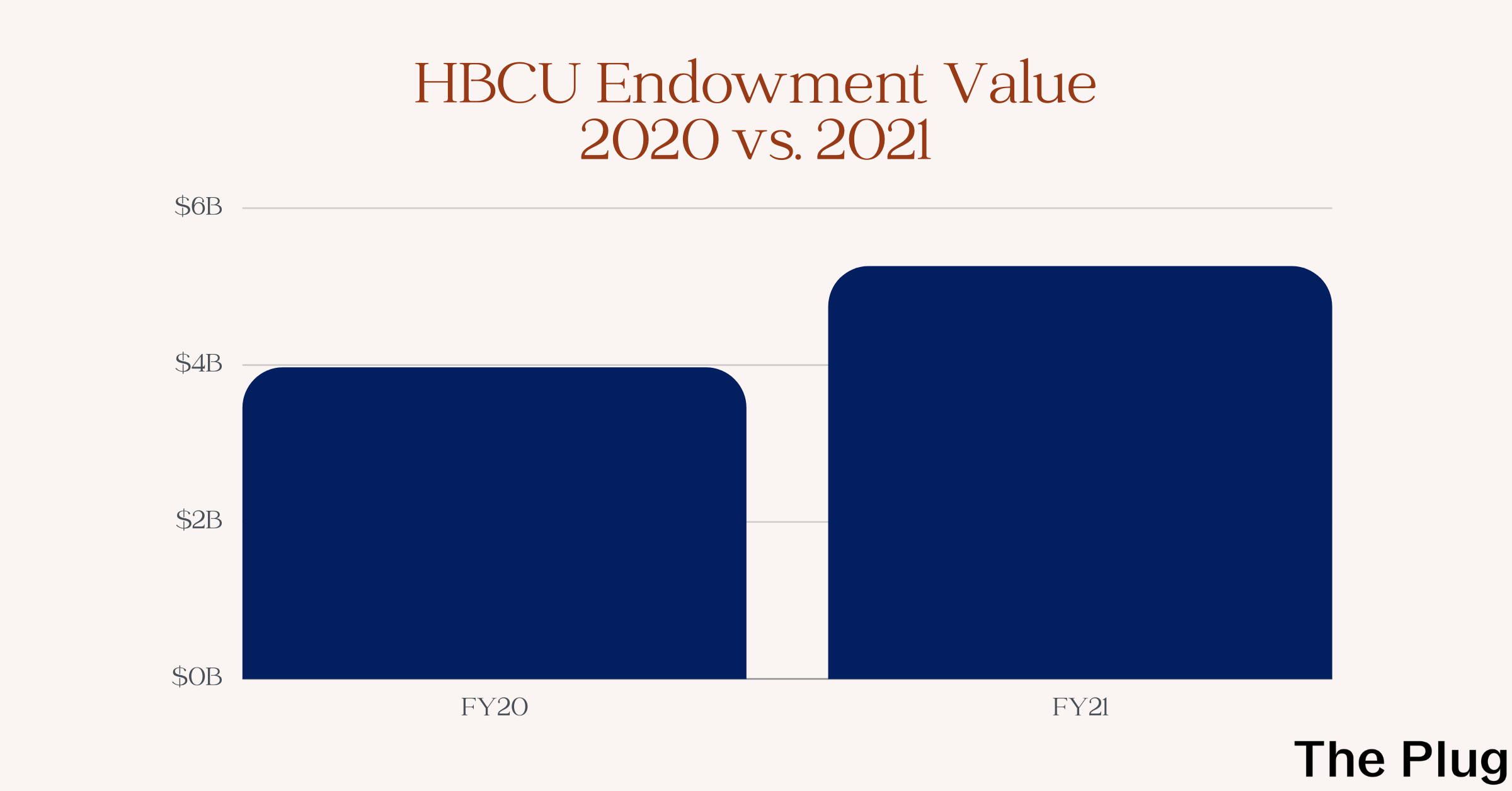

MD: I feel like when people think of HBCUs they don’t quite know the diversity that there is at HBCUs. They don’t quite know the depth and breadth of teaching and opportunity. I feel like the National FinTech center is showing yes, fintech is new but innovation at HBCU campuses isn’t new and being on the cutting edge isn’t new. Being underfunded is something that unfortunately HBCUs have struggled with, but with the multi-million dollar, multi-year grant from Ripple, it seems like that was able to give the boost to Morgan State and to HBCUs to access the innovation that’s already on campuses.

AE: Exactly. As you know, there is what we call the knowledge creation imperative at HBCUs. [The National Science Foundation] found that about one-third of all African American science and engineering doctorates completed their undergraduate education at an HBCU. So naturally, we thought about offering our programs to the HBCU community and making sure that they are at the forefront of all of these developments.

MD: Right. What programs have you been able to offer to the HBCU community and how are you building up this knowledge of fintech?

AE: In terms of programming, since we expanded our mission and our vision of how to embrace the HBCU community, we started with a smaller group rather than focusing on all [HBCUs]. And initially, we had about 34 HBCUs come to the first summit that we organized in the spring of 2019. So the programming started small but then soon, we were able to scale it so that now we are approaching 60 Different HBCUs that are coming regularly to our events.

We did program development from different perspectives. We wanted the faculty to be involved, train the trainers so to speak. Then we wanted the students to be directly involved. So we had a program curriculum development institute we started in the fall of 2019 in New Orleans, and we brought 45 faculty from 30 different universities to New Orleans and over three days, they developed curriculum and courses that they wanted to either revise and include some blockchain content or fintech content, or they had worked on some new courses and they wanted to finish them up. So they all came to New Orleans and collaboratively, we all developed these syllabi, and when they left they had all of them ready to go on their campuses and start offering them.

MD: What sort of subject areas were these professors incorporating fintech into?

AE: The faculty were coming from economics, finance, computer science, engineering, psychology, agriculture, biology. All of these faculty saw some benefit from incorporating some blockchain and fintech into their courses and exposing their students to this new topic. As part of their learning, whether they’re undergraduate or graduate students, they want students to learn about it. And that was the goal, which was extremely successful.

The diversity of disciplines really encouraged us that we needed to expand our reach and our offerings and that’s what our programming is based on.

MD: So how have students at different HBCUs been able to learn about fintech and get hands-on experience with the blockchain, fintech and crypto?

AE: For the students, we decided to approach it from the experiential learning activity perspective. Although we had webinars and workshops, we thought something that would be exciting and completely innovative was the Crypto Challenge that we offered.

We were able to actually offer that program to 20 or so universities. And Binance.US funded all of this, put $200 in each student wallet. We had something like 30 or so students that were involved in it, and it was a very successful learning activity for our students because the CEO and some of the other executives from Binance.US came and actually taught and answered questions. That was a fantastic learning opportunity for our students.

The second time that we offered it, within two days, 100 students from more HBCUs registered for the competition so we increased the numbers and now we’re in the third round of it. And we’ve partnered with Gemini, which is another exchange, and we’re developing that third round of competition and learning. All of these have associated activities around it, including some workshops, webinars and panel discussions where students can ask questions and be experts, including previous winners of the competition.

MD: It seems like a very holistic approach there. Specifically, at Morgan State there is an entire blockchain course but then students can also learn physically about crypto and blockchain by trading it with real money on a real platform and hearing from industry professionals about blockchain and crypto.

AE: Exactly, yes. We believe that it’s an important activity for students to learn. It’s not a simulation, it’s actually real money. We just want the students to learn and be informed. We want them to be educated investors rather than just hearing from one friend or another and investing in these markets and crypto or digital assets.

MD: Can you speak a little bit about how you feel the FinTech Center is preparing HBCU students for the future of work?

AE: I think a number of programs that I mentioned. We try to work with the faculty to incorporate some of these concepts into their courses. So that our students really become familiar with the terminology and they understand what is the driving force behind all of this.

They help our students to learn the nuances of the space understand that, as I mentioned, the terminology and the jargon of the field and be able to communicate and contribute when they go out to the job market. It’s important for companies to hire people that can contribute to their teams with all of the latest technology and information about financial markets and be able to really contribute to the development of innovative programs.

MD: We have a question here from a user. Will the FinTech Center offer assistance to students, startup companies? Will there be an incubator component?

AE: The Center doesn’t have an incubator in it, but we have access to incubators, of course, through our participating HBCUs in our network. For instance, in Atlanta, we can refer students in that space to the appropriate people who work in that area. In Baltimore, there are several incubators that we can refer our students. The entrepreneurship program at the Graves School of Business is one of the few at any HBCU that has a strong curriculum and they also focus on working with entrepreneurship activities, and with entrepreneurs and startups.

And we provide some innovation mini-grants to HBCUs they use them for these specific purposes.

We have mini-grants in innovations in blockchain education and we have also mini-grants in research that different HBCUs can apply to.

MD: And the grants, how much are you able to give to these projects?

AE: They range up to $10,000 for the research grants, but $10,000 each for the innovation grants because of the nature of the activities that they do.

MD: Now can you speak a little bit about what to expect with the FinTech Center this year? I know that there’s going to be a bit of NFT education starting.

AE: Yes. You know, with the popularity of the NFTs and people’s interest in the metaverse, learning about creating NFTs became one of our goals and we said, let’s offer a workshop.

We started working with Hyperledger, which is part of the Linux Foundation and they work with IBM and they have a platform called Fabric.

We said, let’s use the opportunity for teaching our community and work with professional groups that have developed this and bring it to our faculty and students. Teach them the creation process, how is it done. Not just the economic model and the financial model, but also the nuts and bolts of how the coding is done.

It’s going to be offered in March. It’s going to be a series of workshops. And we’re really excited about that opportunity. And, you know, we hope that we get a large group of participants and already I know that Jack Crumbly from Tuskegee has shown interest in bringing his students and using this as a testbed for developing NFTs for his class. So that’s an exciting development.

MD: It just shows the national reach of the FinTech Center.

We have another audience question here. Can you talk to the specific research the center may be looking to support around consumer adoption, particularly on the role that digital assets/blockchain can provide towards wealth building with the Black communities and other communities of color?

AE: Well, it is top of mind for all of us at the Center. We did actually a wealth creation webinar.

There was a fireside chat with one of the executives at Visa to talk about how we can focus on wealth creation and generational wealth in minority and marginalized communities, the unbanked and underbanked communities.

We have funded some programs that address how to reach out to the community and the research in the social aspects of fintech is one of the streams of research that we fund.