Microloans fuel businesses around the world. According to the 2019 Microcredit Barometer Report, 139.9 million borrowers have benefited from the services of microcredit, totaling an estimated $124.1 billion. In the United States however, the idea of securing a loan that equals $10,000 or less through an institution other than a major bank is still considered unconventional. Across the country, many African-Americans are not waiting for old-school institutions and policies to change. To overcome the hurdle of funding upstart costs, many Black entrepreneurs are using Kiva.

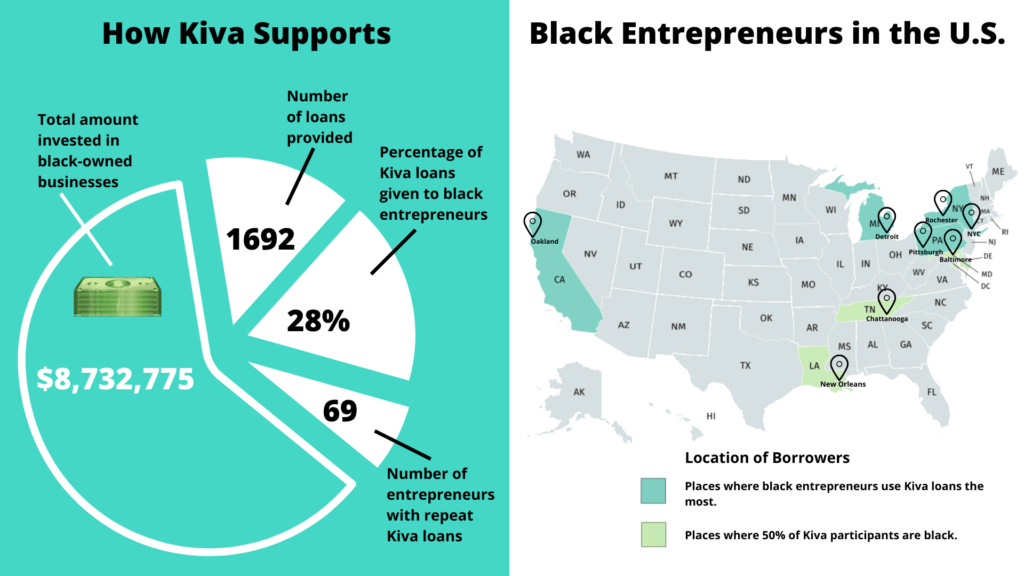

The nonprofit organization works in countries around the world to provide microcredit to individuals who lack access to capital but are ready to launch small businesses. Through its crowdsourcing platform, entrepreneurs can secure a loan of up to $10,000 with a 0% interest rate. Kiva borrowers have 36 months to pay the loans back. The data visualization below breaks down exactly how Black-owned businesses have used Kiva to date.

The top cities where Black entrepreneurs have taken advantage of Kiva loans the most include: New York City, Oakland, Pittsburgh, and Detroit. Other locations where Black entrepreneurs represent at least 50% of Kiva participants include: Baltimore, Chattanooga, Rochester, and New Orleans. Kiva has partnered with different organizations like the Harlem Commonwealth Council and Build Institute Detroit to connect potential business owners with more access to microlending capital. These partnerships have helped fund everything from food catering businesses to construction companies.

In 2045, white Americans will officially become the minority in the United States. And while the data is still relatively fresh, crowdfunding platforms like Kiva are offering a practical conduit for what is only inevitable: the expansion of Black generational wealth and ownership.