KEY INSIGHTS

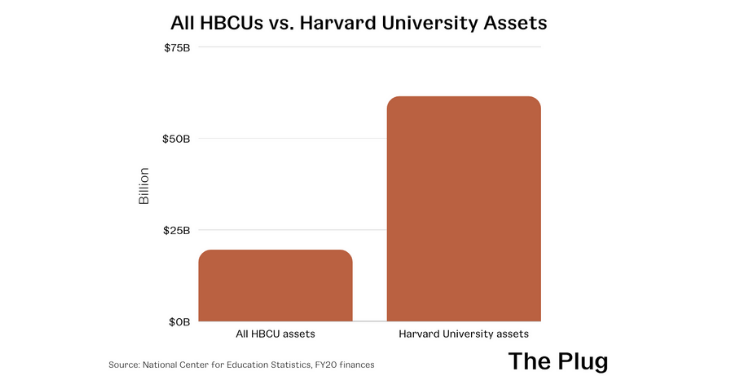

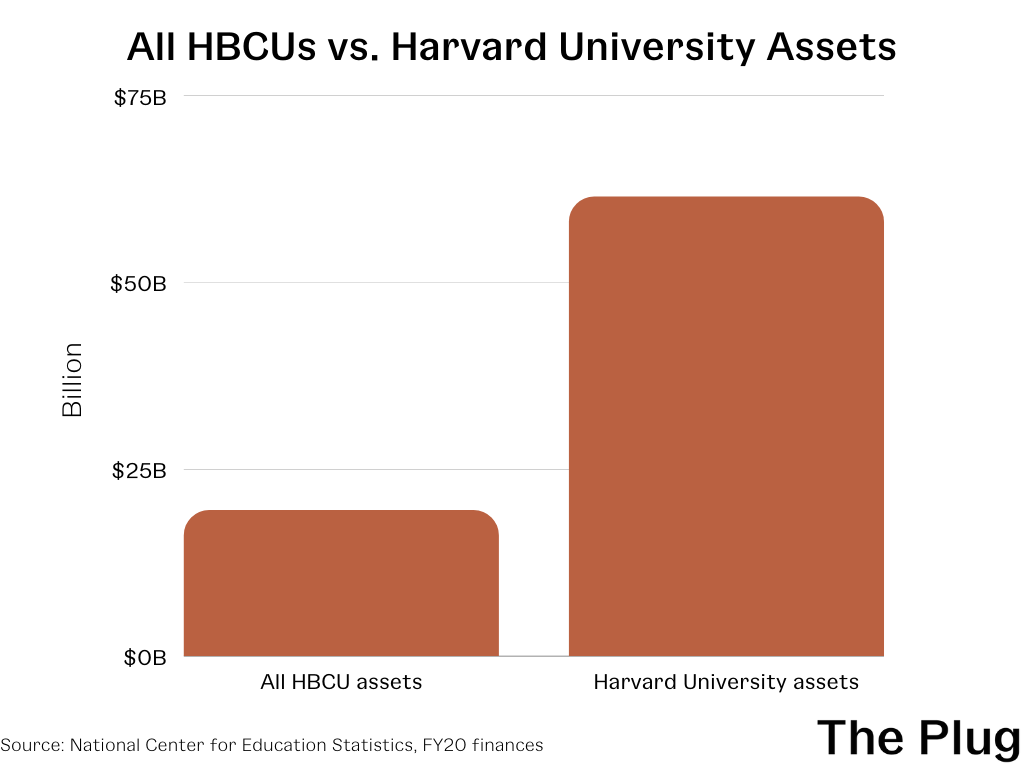

- Howard University has the most assets of any HBCU at $1.6 billion, which is contrastingly just a fraction of Harvard University’s $61.4 billion in assets.

- Multiple states have been sued for systemically underfunding their HBCUs.

While HBCUs play an outsized role in educating Black students, they are underfunded.

The Plug analyzed six years’ worth of data from the National Center for Education Statistics to create a database of the value of HBCUs’ total assets from June 2015 to September 2020, the most recent data available.

Total assets look at most everything of monetary value that a university owns including endowments, cash gifts, buildings, other owned properties, equipment, art and library collections, other investments and cash equivalents.

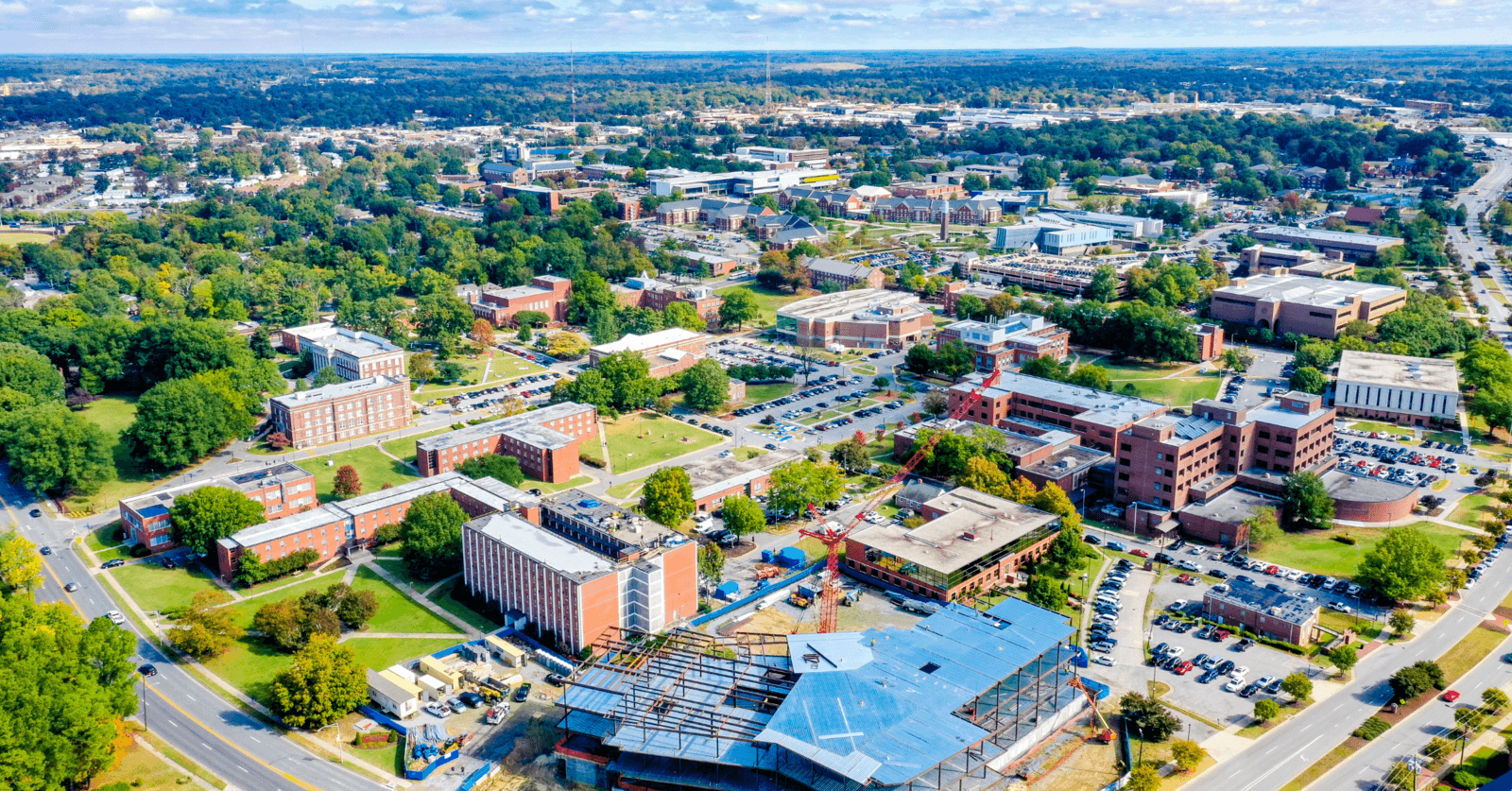

Although HBCUs make up just three percent of America’s colleges and universities, they are responsible for educating more than 20 percent of African American graduates even though they lack the money and resources of Ivy League institutions.

In 2020, the assets of all 102 HBCUs combined was valued at $19.5 billion — less than one-third of Harvard University’s $61.4 billion in assets in 2020.

The effects of underfunding are exponential. When primarily white schools who are receiving more than adequate funding from the state are able to invest those funds into their endowments and campuses, the returns just widen the gap between these institutions and HBCUs.

Multiple states have been sued for systemically underfunding their HBCUs. After a nearly 30-year long court battle that eventually involved the Department of Justice, Mississippi came to a $500 million settlement agreement in 2001 to improve three of the state’s HBCUs, although critics say just a fraction of the money has materialized.

In April 2021, Maryland settled a lawsuit alleging the state had chronically underfunded HBCUs. Maryland will now provide $577 million over 10 years to four HBCUs.

That same month, a Tennessee legislative committee determined that Tennessee State University could be owed anywhere between $150 million to $544 million due to decades of unpaid funding from the state.

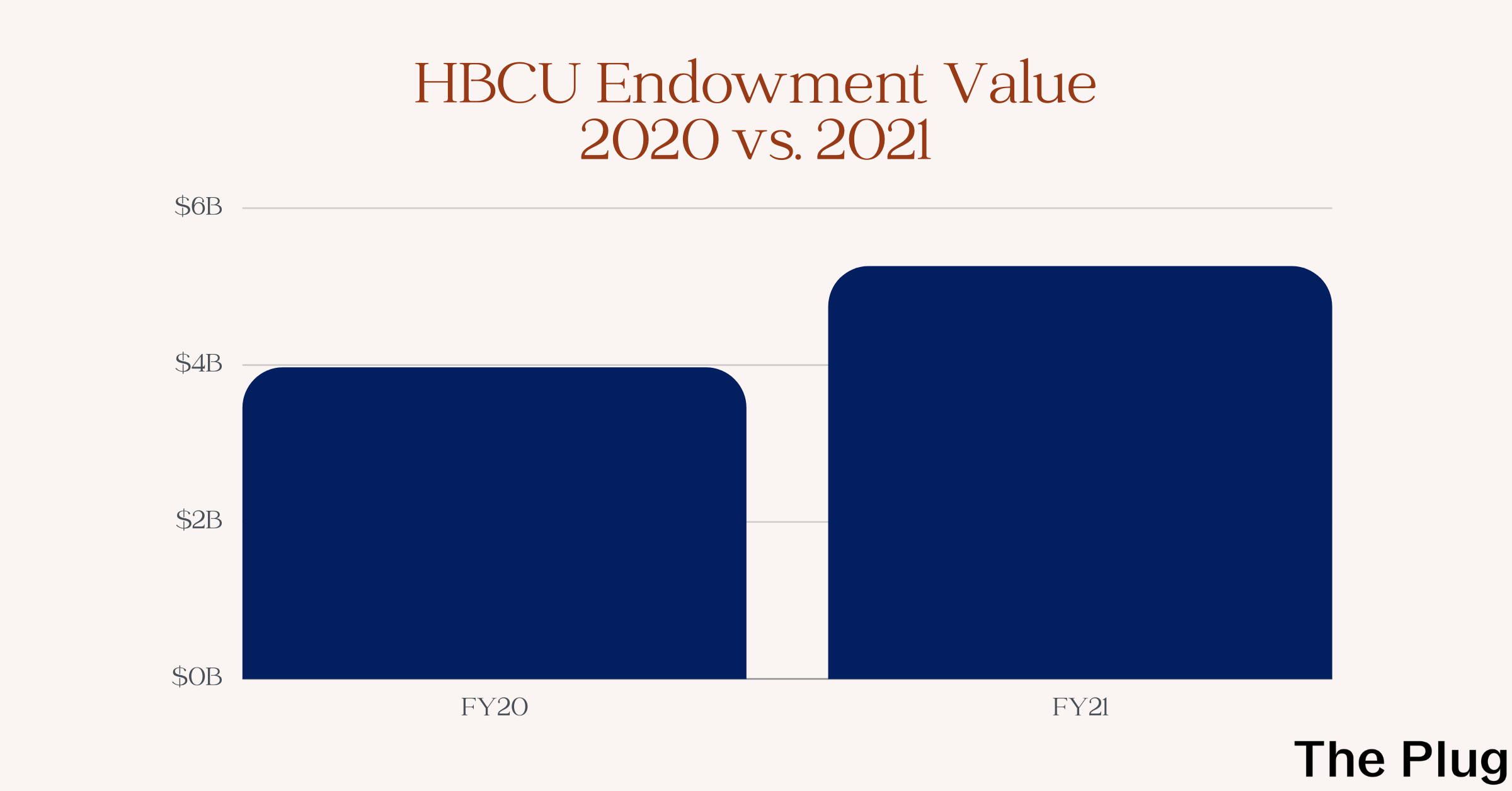

After the murder of George Floyd, HBCUs received renewed attention and an influx of money. However, the impact of this influx of cash remains to be seen since the Department of Education has yet to release fiscal year 2021 data.

Here’s a breakdown of the HBCUs with the most assets, their growth and their decline:

HBCUs with the most assets

- Howard University: $1.67 billion

- Hampton University: $779.2 million

- Prairie View A & M University: $767.2 million

- Florida Agricultural and Mechanical University: $746.6 million

- Spelman College: $668.9 million

- Morgan State University: $637.8 million

- North Carolina A&T State University: $621.9 million

- Texas Southern University: $503.5 million

- Xavier University of Louisiana: $416.6 million

- North Carolina Central University: $406.9 million

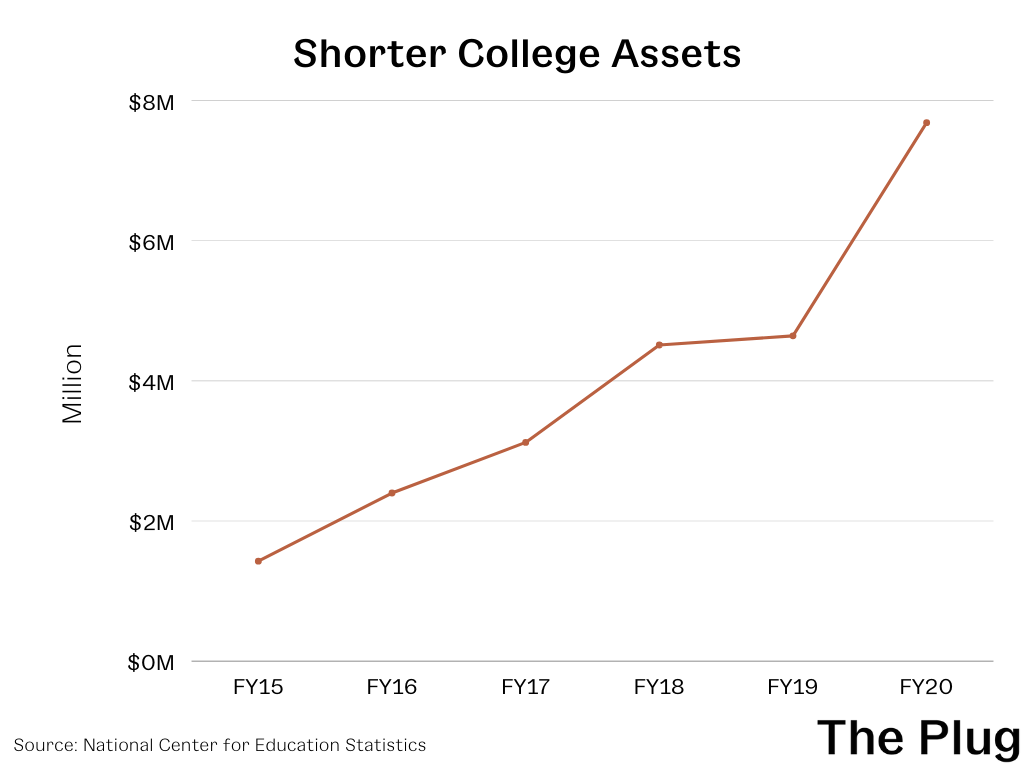

HBCUs whose assets grew by more than 50 percent from 2015 to 2020

- Shorter College: Increased by 439 percent

- Texas College: Increased by 106 percent

- Paul Quinn College: Increased by 75 percent

- Southern University at New Orleans: Increased by 53 percent

HBCUs whose assets decreased by 15 percent or more from 2015 to 2020

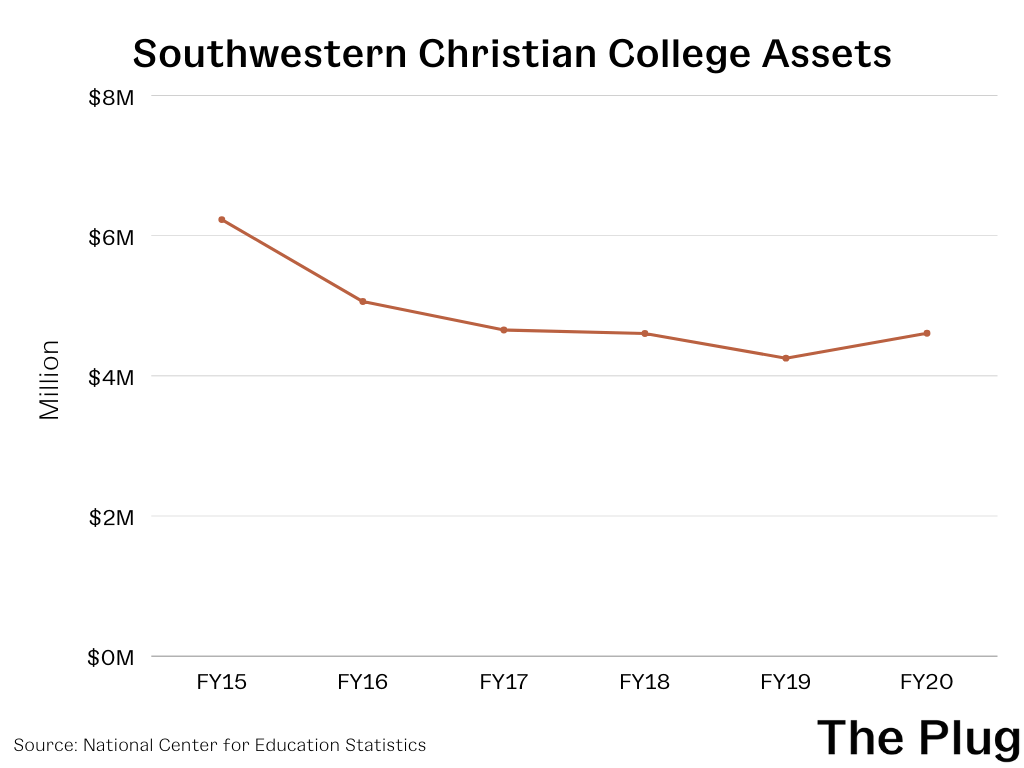

- Southwestern Christian College: Decreased by 26 percent

- Denmark Technical College: Decreased by 23 percent

- Wilberforce University: Decreased by 19 percent

- Arkansas Baptist College: Decreased by 16 percent

See the full database below: