Students returning to Xavier University’s campus this fall will now find a new opportunity: the New Orleans-based historically Black university has partnered with Victory Capital Management to start an investment club with a $100,000 seed fund.

“There’s nothing like real-world investing experience and actually managing money,” Nikhil Sudan, President of the Direct Investor Business for Victory Capital Management, told The Plug.

Victory, an investment firm with a $2.2 billion market cap, is providing $50,000 to Xavier’s new club, with another $50,000 coming from the school’s donors. Beyond giving students hands-on experience trading real money, the club’s returns will be used to fund scholarships.

The club will be run by two business professors from Xavier and will have two mentors from Victory to provide guidance and advice, the firm’s Head of Capital Markets & Trading and its Director of Responsible Investing.

“I think a common misunderstanding of higher education from the outside is that it’s a place where one comes to learn chemistry or learn finance,” Reynold Verret, President of Xavier University, told The Plug. “At Xavier, I think it’s about where one comes to do chemistry or comes to do finance.”

For students who join the investment club, doing finance will mean many things — creating an investment policy statement to set the parameters of what to invest in, what types of returns they are aiming for and how much risk they are willing to take, deciding the ethics around their trading decisions and the companies they will or will not choose to invest in and more.

Along with Victory’s gift to help seed the club, the company has also created a new scholarship program, giving Xavier another $50,000 for small scholarships that cover the expenses that financial aid does not.

“There are a lot of students who will not persist, not because of academic good standing issues, but really because of financial issues,” Verret said. “Especially with families that are economically challenged, small things can become disastrous.”

But when students do graduate, they are more likely to reach rungs of the economic ladder that are higher than their families. Among nearly 600 selective private colleges, The New York Times has ranked Xavier as ninth in its overall mobility index, the likelihood that a student from a low-income family moves up two or more income quintiles as an adult.

But the investment club and scholarships are just one part of a long-term partnership the multibillion dollar firm is building with Xavier.

“Our main goal is impact and making sure that it is much more than money,” Sudan said. “It is engagement between us, our employees, students, faculty and the leadership of Xavier, so we can create many more connections that will help students who are interested in the career for the long term.”

David Brown, Chairman and CEO at Victory, is joining Xavier’s presidential advisory board and the company plans to expand the partnership with mentoring and an internship program that could serve as a recruiting pipeline for students to enter a financial services industry that struggles with diversity.

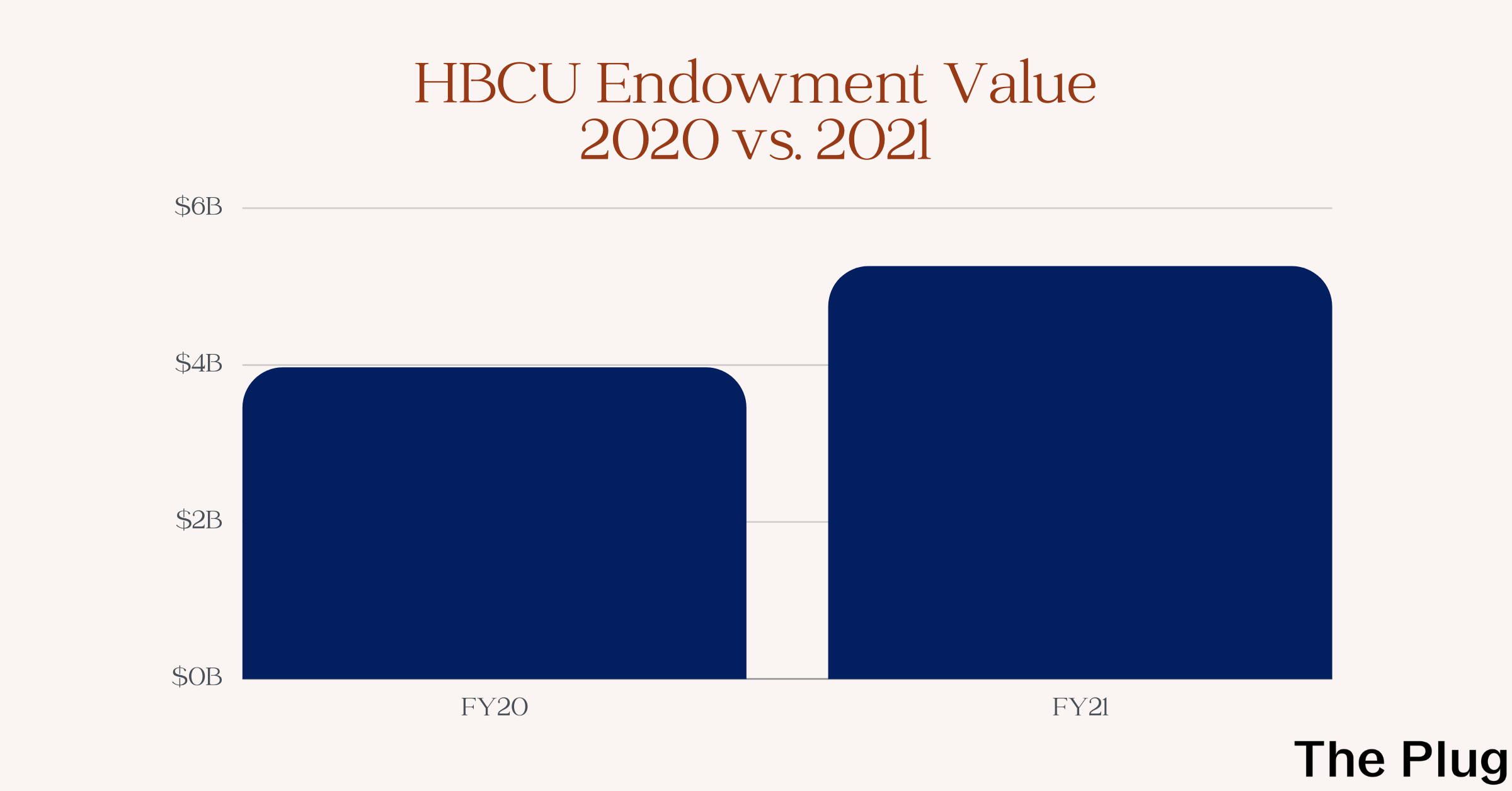

According to a McKinsey report published in March, US investment teams in 2020 were only about one to two percent Black. A different McKinsey report from April found that Blacks and Latinos at private equity firms made up just 13 percent of entry-level positions and less than 5 percent of senior roles.

Victory is not the only investment firm to recently partner with an HBCU. In June, three multibillion-dollar asset management firms announced they were launching a new initiative at Clark Atlanta University, Howard University, Morehouse College and Spelman College.

Both Sudan and Verret hope the impact of Victory’s investment through scholarships and the investment club will compound.

“If students participate in the Investing Club and they never get to the industry, but they become a little bit better investors for their own life, they could fund their kids’ college, and then they maybe don’t have to rely on the gap scholarship which can go to somebody else,” Sudan said. “Even that small impact on anybody’s personal investing over their lifetime could be huge.”

“You can see the impact on individual students, but really the impact is much broader than that because there’s a cascading effect,” Verret said. “Very often students who attend an HBCU are the first in their family to go to college. When that young woman or man graduates they become an example, others will follow them.”