If there was a pervasive theme in 2020 it was uncertainty. So much has happened that could not have been predicted, but the forward-looking venture capital community must do just that. Their forecasting tools range from gut checks, social listening to deciphering the proverbial writing on the wall for what’s to come in 2021. There are some intuitive picks for technologies and services that will be in higher demand next year, like those in the telehealth and enterprise tech space. But also emerging sectors, like those dictated by the rise of the conscious consumer, according to Marlon Nichols, Managing General Partner at newly formed MaC Ventures with $100 million in AUM.

What we’re really doing is trying to identify what emerging behavioral shifts are going to become a part of social norms, said Nichols, adding that once the firm catches on to a trend, they set out to research what they’re seeing. Their ‘state of technology and culture ‘ reports capture this interest area as a heads-up to entrepreneurs. On Nichols ‘ radar for 2021 is a company called Ready Responders, which Nichols says ‘marries emergency response with the gig economy ‘ by deploying off-duty first responders and medical professionals for non-emergency care to consumers, often at a lower cost than traditional care.

For the enterprise, he’s intrigued by Pipe, an exchange for companies with recurring annual revenue to finance their growth. Pipe’s model does away with SaaS companies raising debt or equity by creating a marketplace for other companies to trade on the value of their recurring revenue. When a company buys an interest in the SaaS company’s bookings, it creates an additional revenue stream.

Because it’s an exchange, the folks that are buying that position, they also get to earn money on their position, much like a stock exchange, said Nichols. A few marketing technology companies have also caught Nichols ‘ eye, including Ryff, a product placement software that utilizes AI, and Finesse, which uses social media to understand consumer sentiment around fashion then helps brands produce outfits sustainably. As varied as these verticals are Nichols says there’s something all smart VCs will lean into next year.

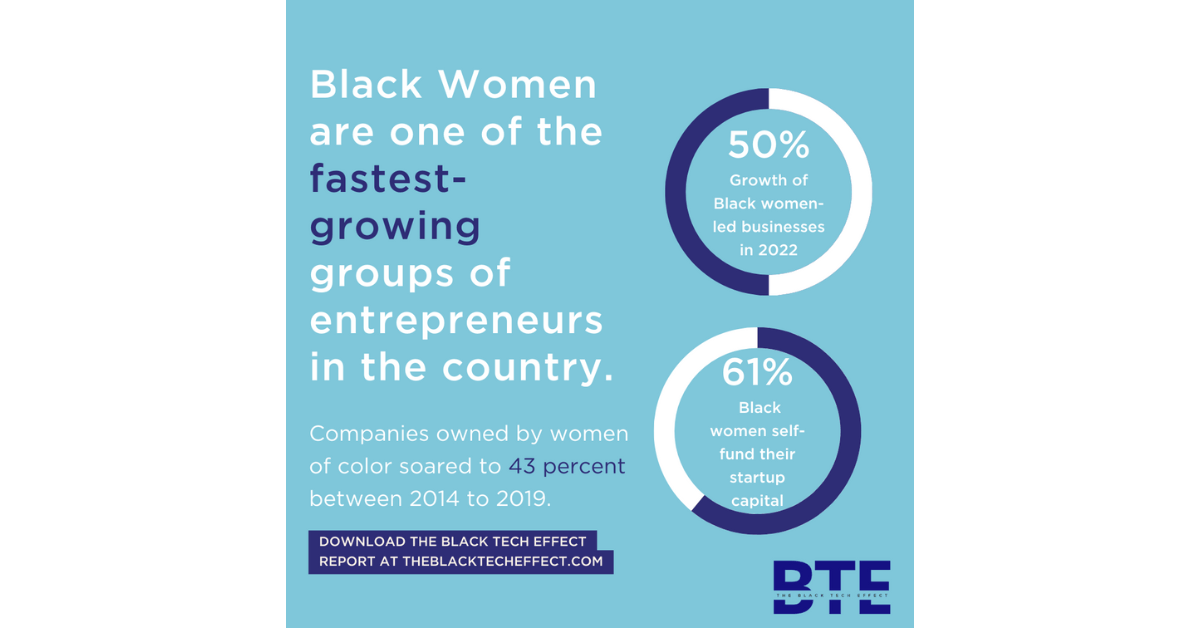

There are some VCs that have been awakened to the fact that if you continue to ignore certain demographics, especially those demographics that are growing at tremendous rates in this country and throughout the world, you’re going to be left out of amazing opportunities that really speak to where the world is going, said Nichols. Greed and ambition are going to force some groups to continue to go down this path of diversity, the smart ones anyway.

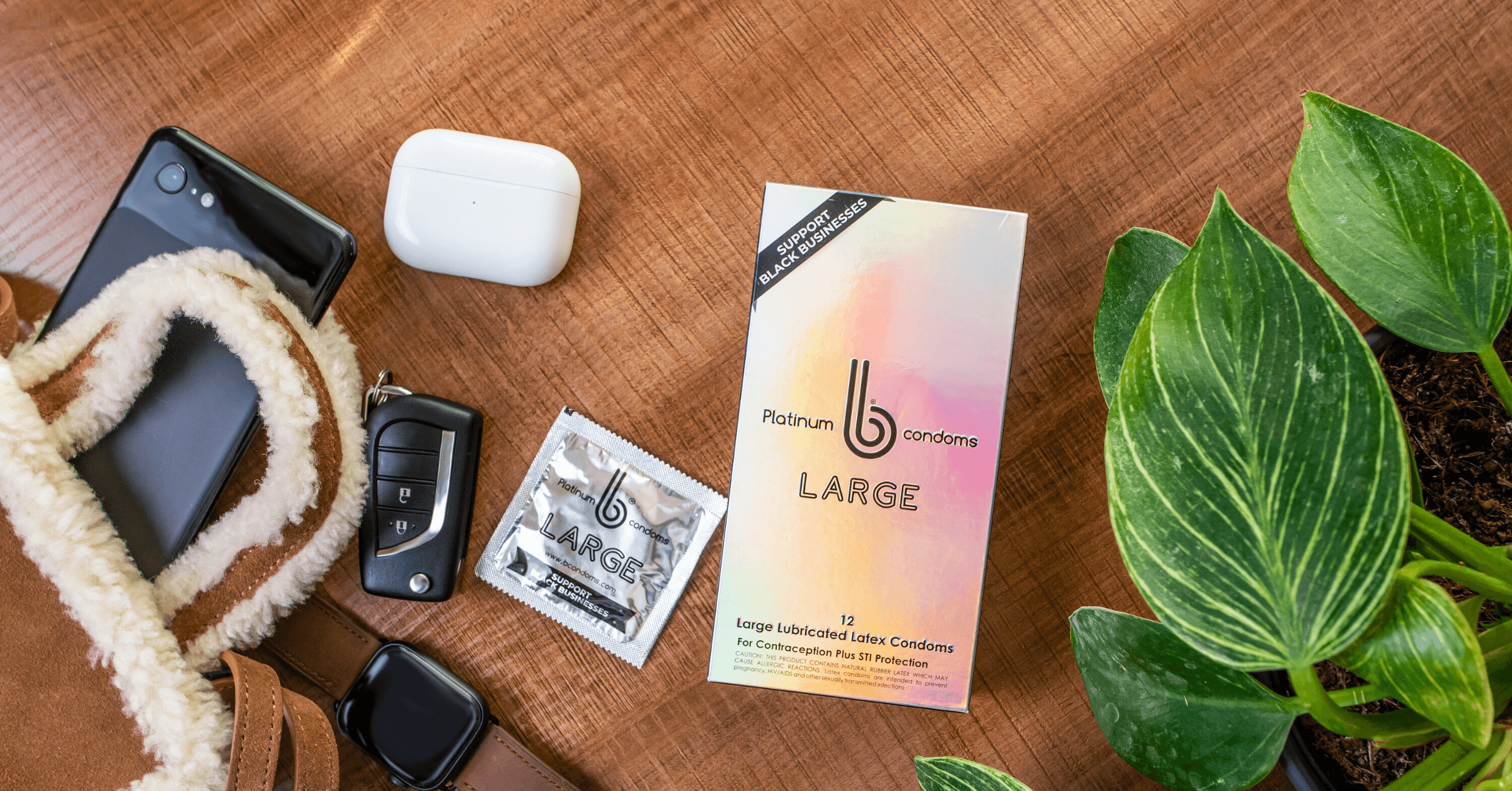

He acknowledges that interest in diversity may fade in and out of fashion for VCs. Other VCs have made diversity a constant at their firms.McKeever ‘Mac ‘ Conwell, the 34-year-old VC behind RareBreed Ventures, which set out to raise $10 million in AUM since the fund launched in October, says his approach has been to find founders from unlikely places and innovation of commonplace consumer products.¬†In light of this investment strategy, Conwell says Covid has accelerated the need for more practical applications of VR and AR technology and internet infrastructure.

With the digital divide and Covid it was easy to see the people who didn’t have access to certain technological abilities, the issue is how much bandwidth can you send to a home, said Conwell. Because of Covid, we’re going to see our infrastructure get stronger and a future of virtualization being pushed forward.

This virtualization will also displace tech hubs, as seen in HP and Oracle moving headquarters to Texas. Being forced online has also made it easier for founders who aren’t located in California or New York to participate. As a result, VCs are getting more comfortable investing in founders they’ve never met in person.

Everybody had to figure out how to generate deal flow while staying in their homes, which helped democratize access for a lot of founders, said Conwell. Even with the advent of the vaccine, I’m hoping that we’re able to keep that up. RareBreed hopes to close pre-seed rounds in beauty and personal care, software developer tools, and tools and services catered to Gen-Z. Paramount to executing these plans is the ability to get past biases.

We look for the founder mindset, of how the founder thinks about acquiring customers, customer experience, and retaining customers, said Conwell. That allows me to get out of my biases and see purely how well a team understands their industry.