Key insights:

- Zillow’s house-flipping algorithm has lost the company $1.4 billion since 2019.

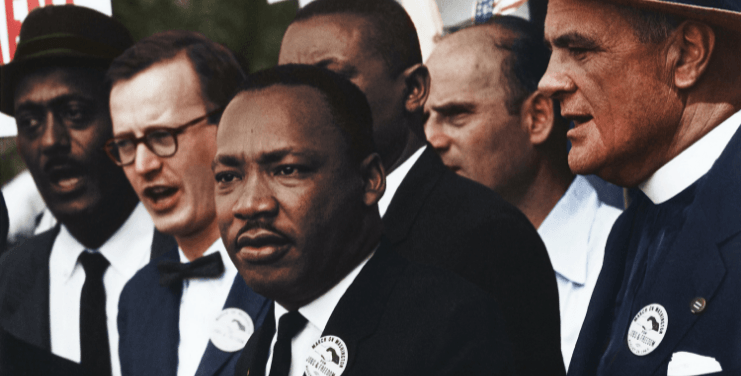

- The company’s Zillow Offers tool bought overpriced houses at a high rate, inflating home prices, pricing out buyers, including Black homebuyers.

- Compass has notably performed better and will post quarterly earnings this week.

Zillow failed investment rule 101 to buy low and sell high as it reported net losses of $328 million on Q3’21 earnings. The company has lost $1.4 billion since 2019 from its house-flipping algorithm going haywire, as a result, 25 percent of the Seattle-based company’s staff has been laid off and, as of last week, the company’s stock had plunged 32 percent from its typical range. Meanwhile, Black-led, online real estate rising star Compass has been on an acquisition spree, posting an impressive $2 billion in Q2’21 earnings.

In April, Zillow published a report on increased rates of homeownership being a key to growing Black wealth by $500 million over the next 10 years. However, their Zillow Offers tool that bought overpriced homes will price buyers, especially Black buyers, out of the market by inflating housing prices in an already volatile market.

To blame this failing line of business on an algorithm implies that it had no human oversight.

Compass plans to report Q3’21 earnings after market close this Wednesday, and may likely draw some comparisons to Zillow.

No matter what the past fiscal quarter has looked like for Compass CEO Robert Reffkin and team, it would be hard to top Zillow’s spectacular failure, which has been years in the making.

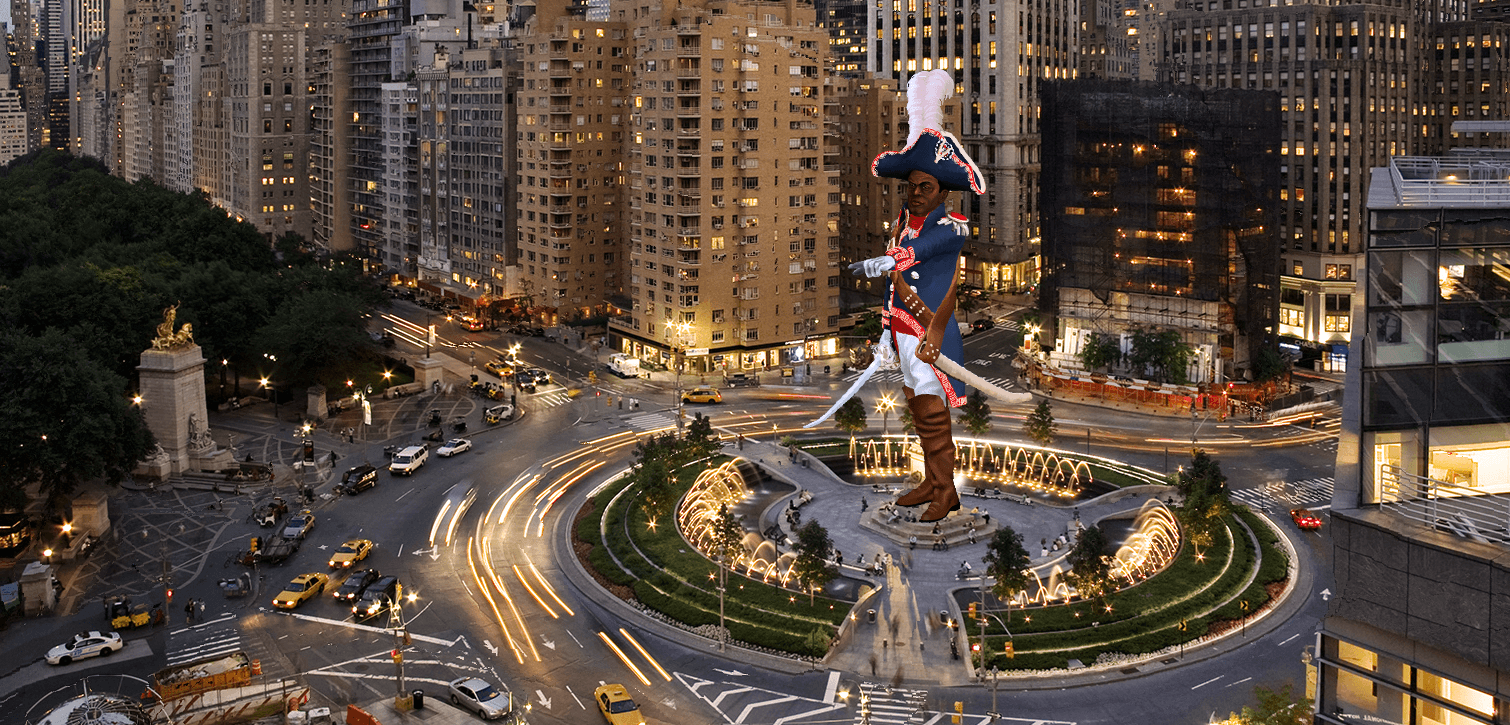

Zillow’s errant buying spree demonstrates a failed strategy while Compass can seize the opportunity to remove home buying blockages to the Black community so homeownership can help bridge the racial wealth gap, aided by accountable property tech.