Key Insights:

- Employers offering salaries in Bitcoin have gone mainstream.

- For Black workers who earn less on average, payment in crypto could open up new and needed investment activity.

- Hopes have been hinged on the volatile investment class as it evolves with the emergence of DAOs.

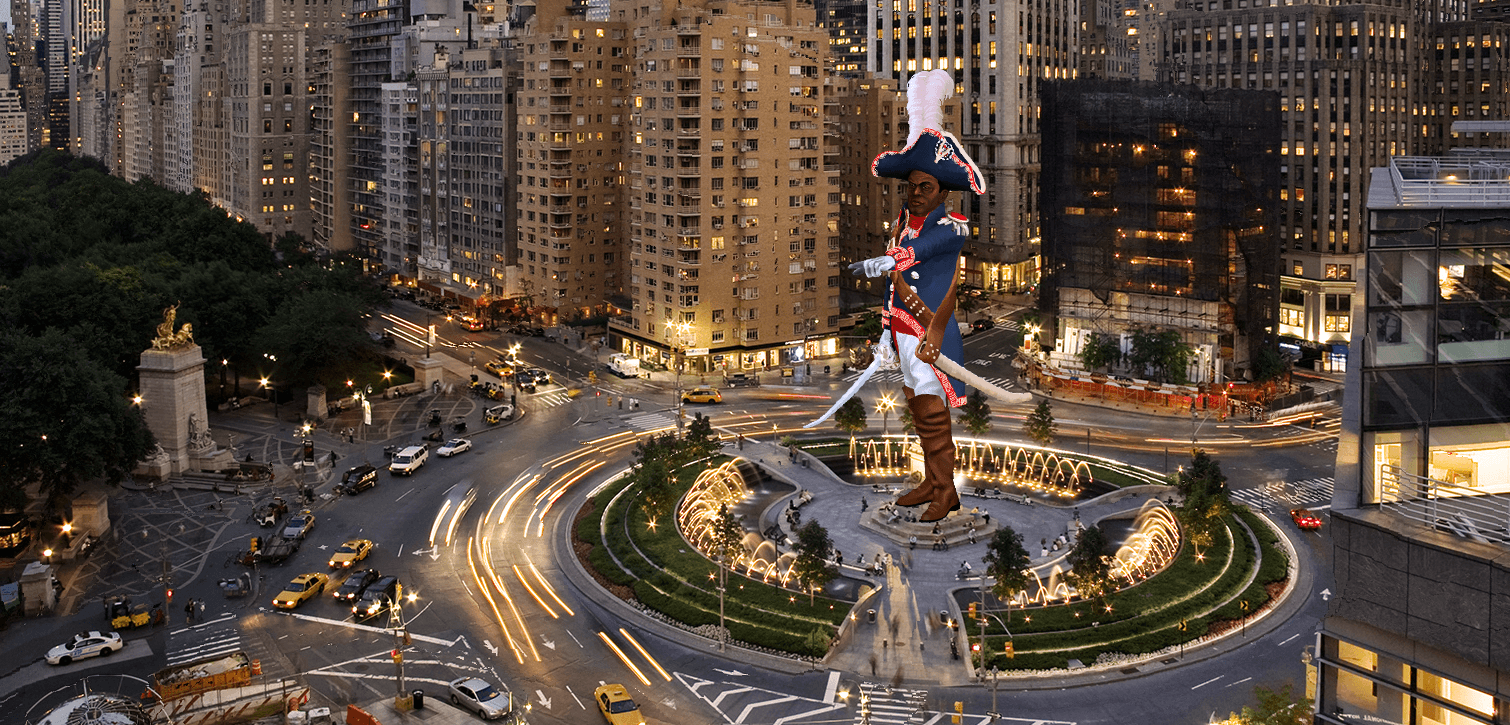

Multi-million-dollar athletes and New York City Mayor Eric Adams have made headlines for requesting to be paid in Bitcoin, something that could benefit the average person in a few ways, specifically African Americans, who are concentrated in lower-paying occupations and many of whom earn a median income below the national average of $42,000.

At market close on Friday, Bitcoin cost $49,000, but ownership of the cryptocurrency would be fractional at best. Yet, setting aside a portion of pay in the form of Bitcoin or another cryptocurrency could be an investment vehicle to grow Black wealth.

Employees run the risk of being vulnerable to market volatility. As with any investment, coin-holders stand to lose money when the markets fluctuate, this would complicate a fixed payment in the case of a salaried employee. Not to mention a headache of a tax filing from potential gains and paying employees in what is considered property rather than cash. And there are still other barriers.

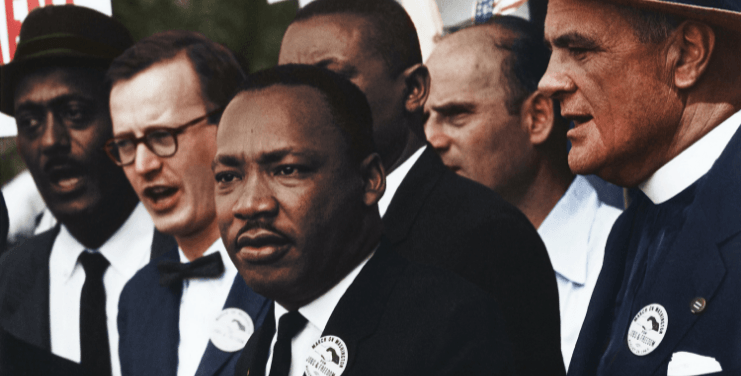

Investment, in crypto and other asset classes, continues to be a luxury of those with higher disposable income. For instance, half as many Black households had invested in the stock market compared to white households which had higher annual earnings. The capacity to create more wealth through investment has largely been lost to the average Black worker who is less likely to tie up their lower wages and liquidity in investments.

There is an effort to increase the number of Black investors and employers are increasingly offering to pay employees in crypto, including a few major tech companies..

The hopes that have been hinged on decentralized technologies on the blockchain and specifically its financial applications are changing as more decentralized autonomous organizations (DAOs) emerge and help us reimagine how wealth is created and disseminated.

For Black folks turning current economic and wealth-building structures upside down is a welcome opportunity to be a part of an albeit risky and unproven opportunity for change.

Personally, I’ll take that paycheck with a side of .eth