A fintech company geared towards providing banking opportunities for Black and Latino customers has hired a new vice president of engineering in hopes of developing and scaling the highly-anticipated platform by the fall.

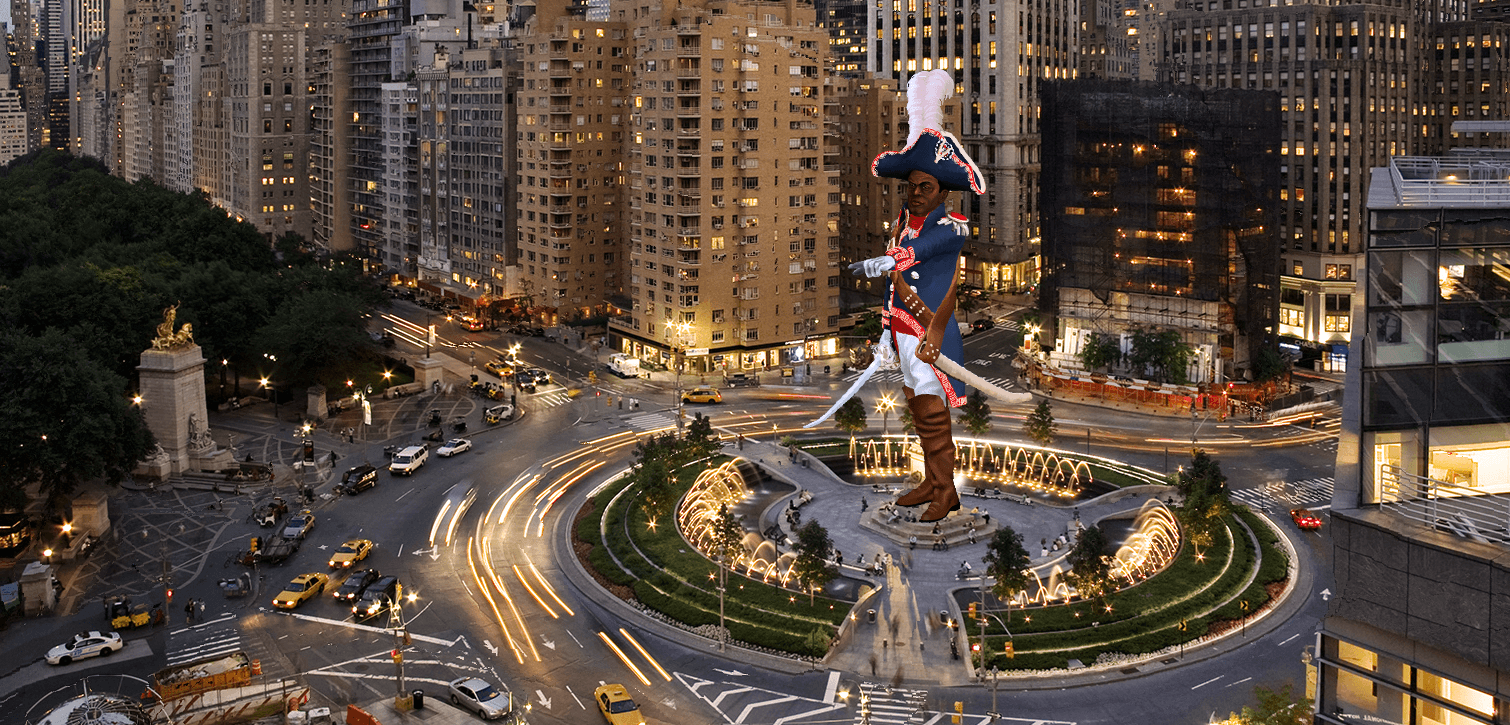

Greenwood, named after the historic district in Tulsa, and preparing to launch a century after the race massacre destroyed the homes and businesses of Black residents in the city, The digital bank has amassed a waitlist of more than 550,000 people. The company was founded by Bounce TV founder Ryan Glover, rapper Killer Mike and Andrew Young, former U.N. ambassador and Atlanta mayor.

The bank’s new VP of engineering, Dylani Herath, previously served as the director of engineering at FIS. She also had a short tenure at JPMorgan Chase and Co., where she worked on the company’s banking platform.

Herath told The Plug she was drawn to the opportunity to work for Greenwood because of its mission-driven banking model and the opportunity she’d have to completely build the platform. She says her three priorities for the platform, which is scheduled to launch among waitlisted customers this fall, are “quality, security and scalability.”

The Greenwood banking platform touts services such as savings and spending accounts, a sleek black debit card, Apple and Google pay, peer-to-peer transfer, mobile deposits, no hidden fees and two-day early pay, but has postponed its launch date twice, attributing its most recent delay to the unanticipated high demand the company has received since it was announced last year.

“Launching a financial platform within one year span is a monumental milestone. I know there’s mention about the delays, but having worked on large organizations that do have the resources and the scalability, where we are today is a huge forward stretch,” Herath said.

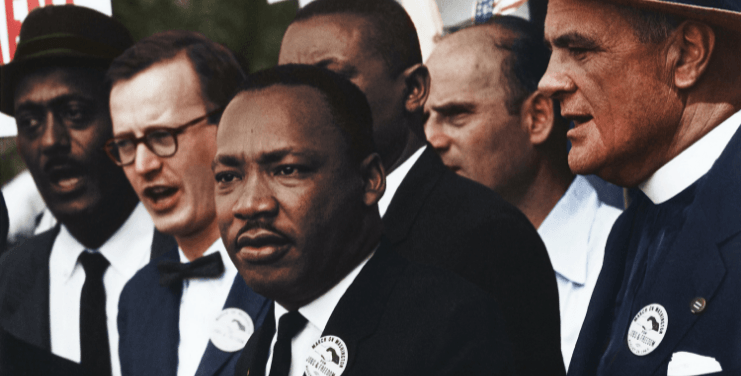

Since its launch, Greenwood has raised $40 million in Series A funding. “The challenge of the racial wealth gap can only be effectively addressed by a coalition focused on the mission of financial equity,” Killer Mike previously told CNN regarding the significance of the raise.

Aside from its goal of catering to underbanked communities, Greenwood’s goal to recirculate money within the Black community has gained attention. The bank will offer a $10,000 small business grant every month to a Black or Latino-owned business. Additionally, customers of the digital bank will have the opportunity to donate to the United Negro College Fund and NAACP by rounding up their spare change.

The bank has also partnered with Goodr to send five meals to a family every time a new Greenwood account is created. Reese-Giddins, president and CTO of Greenwood, said initiatives such as these inspired him to join the company last August.

“I thought the opportunity to be a mission-based fintech in our community was something that was desperately needed and I could see it from my time working at some of the larger banks,” told The Plug. The CTO previously worked as a senior vice president at Bank of America where he led strategy on the company’s mobile products.

Greenwood hopes to expand services beyond its waitlisted by 2022. The company eventually hopes to offer loans, mortgages and investment services, in addition to educational resources such as a financial literacy podcast.

“With the amount of people on the waitlist and the continued interest in Greenwood, the education opportunities present themselves almost daily, Reese-Giddins said. “As we bring on more products, we definitely want to educate people about those products and what they mean to your overall financial health and picture.”