Photo courtesy of HBCUvc

KEY INSIGHTS

- At least a dozen HBCU alumni have founded investment firms.

- Only three percent of investment partners at venture firms are Black.

- But HBCUs have started to incorporate investing, specifically VC investing, into their curricula in new and innovative ways.

In late January, Black co-founded company Esusu, which reports rent payments to credit companies, announced a Series B financing that vaulted it into the rarefied category of unicorn with a $1 billion valuation. One of its early investors was Nasir Qadree, Founder and CEO of Zeal Capital Partners and HBCU graduate of Hampton University.

“Proud to be an investor in a mission-driven [company] that continues dismantling barriers to housing for all families!,” Qadree wrote on Twitter when the unicorn valuation was announced.

Qadree is one of at least a dozen HBCU alumni who have founded investment firms, a small but important group in a space where Black people are vastly underrepresented.

- Nasir Qadree: Founder of Zeal Capital Partners, Hampton University graduate

- Arian Simone: Co-Founder of Fearless Fund, Florida A&M University graduate

- Ayana Parsons: Co-Founder of Fearless Fund, Florida A&M University graduate

- Keisha Knight Pulliam: Co-Founder of Fearless Fund, Spelman College graduate

- Jessica Patton: Founding Member of 5th Century Partners, Howard University graduate

- Adrian Fenty: Founding Managing Partner at MaC Venture Capital, Howard University School of Law graduate

- Philip Reeves: Partner at Apis & Heritage, Morehouse College graduate

- Todd Leverette: Partner at Apis & Heritage, Morehouse College graduate

- Rashaun Williams: General Partner at Manhattan Venture Partners, Founding Partner of QueensBridge Venture Fund, Morehouse College graduate

- Jewel Burks Solomon: Managing Partner of Collab Capital, Howard University graduate

- Aaron Holiday: Co-Founder of 645 Ventures, Morehouse College graduate

- Paul Judge: Managing Partner at Panoramic Ventures, Co-Founder of TechSquare Labs, Softbank Opportunity Fund Investment Committee, Morehouse College graduate

Only three percent of investment partners at venture firms are Black, according to the 2021 VC Human Capital Survey. During the first half of 2021, a record-breaking $147 billion in venture dollars was invested in U.S. startups. Of that money, only 1.2 percent, or $1.8 billion, went to Black founders.

“If we want to close this gap in access to capital, if we want to make sure that dollars are in the hands of Black founders, then we need Black investors,” Chelsea Roberts, Chief Operating Officer of HBCUvc, an organization working to give HBCU students opportunities in the VC industry, told The Plug. “HBCU students and alumni have some of the best networks in terms of Black professionals.”

“In thinking about who investors invest in, they invest in people that they trust. It’s very natural to have, you know, the idea that more HBCU investors means more HBCU founders are getting capital because you’re going to naturally invest in people in your network,” Roberts added.

That is the case with some of the companies that the Fearless Fund, a venture capital firm started by three HBCU alumni — Spelman College graduate Keisha Knight Pulliam and Florida A&M University graduates Arian Simone and Ayana Parsons.

The fund has raised more than $25 million, Simone told The Plug last August, and invests in early-stage women of color-led companies that are in the food and beverage or beauty and technology industries. Among its portfolio of two dozen companies, some were founded by HBCU alumni, including Hairbrella and Slutty Vegan of Spelman and Clark Atlanta University, respectively.

But HBCUs have started to incorporate VC investing into their curricula in new and innovative ways. Last fall, Xavier University in New Orleans partnered with Victory Capital Management to start an investment club with a $100,000 seed fund.

“There’s nothing like real-world investing experience and actually managing money,” Nikhil Sudan, President of the Direct Investor Business for Victory Capital Management, told The Plug in August.

Just a few months prior, in June 2021, three multibillion-dollar asset management firms announced they were launching the AltFinance Initiative at Clark Atlanta University, Howard University, Morehouse College and Spelman College, aimed at opening more pathways for HBCU students to enter the alternative investment industry.

Participating students from the schools will have the chance to get paid fellowships, mentors and need-based scholarships. The University of Pennsylvania’s Wharton School of Business will also create a virtual institute open to students at all HBCUs to learn about the alternative investment industry. The institute is slated to launch sometime this year.

As HBCUs work to have more representation in the VC world, Roberts of HBCUvc said the issue is not with the schools themselves.

“Going to an HBCU is not a deficit,” Roberts said.

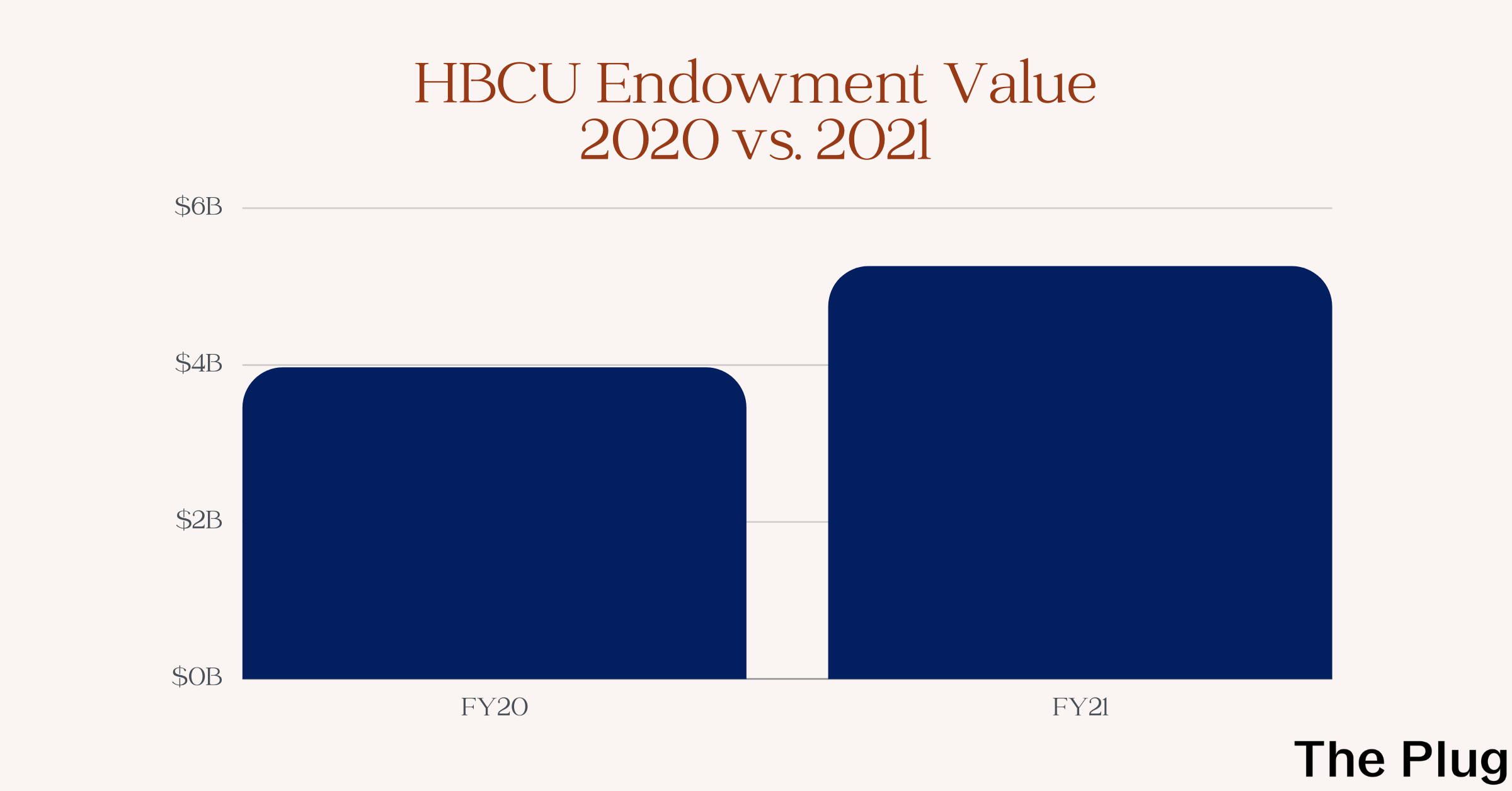

“The barrier isn’t having gone to an HBCU though. Yes, HBCUs oftentimes have less resources than the Ivy Leagues and their endowments are smaller, but I think the biggest barrier is the racial wealth gap in this country and systemic issues.”