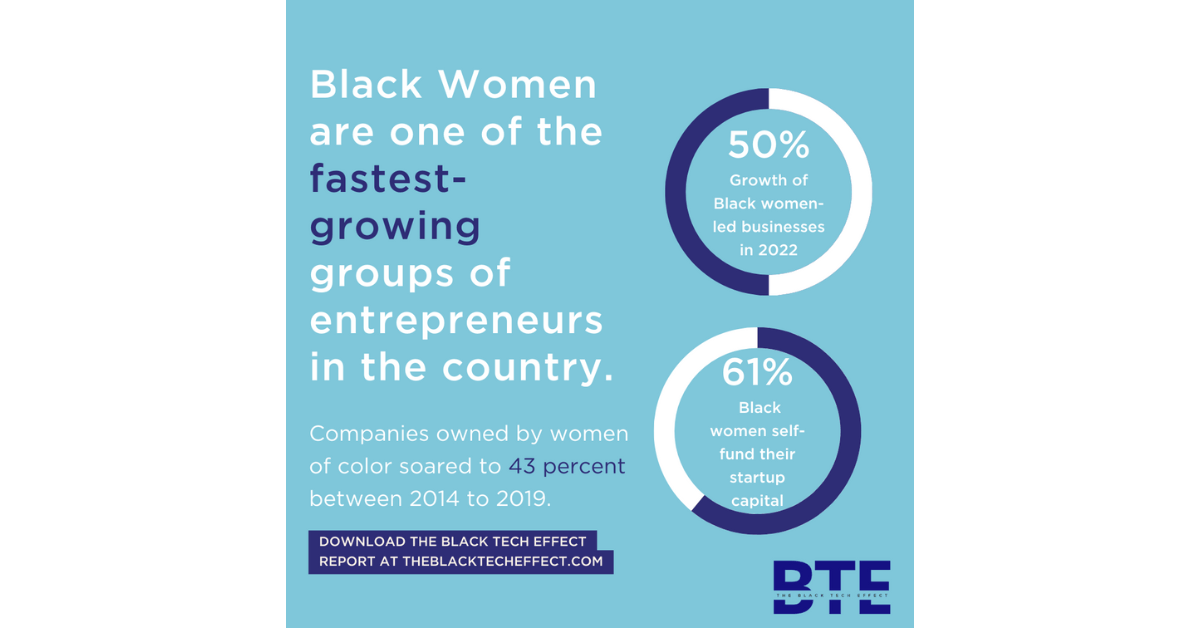

MaC Ventures has raised $110 million, becoming one of the largest first-time fundraisers by a majority Black-owned venture firm. Based on planned investments, the raise will mint about 40 $1 million venture-backed companies. With 76% of its current portfolio of companies having Black, Latinx or women founders, MaC Ventures has the potential to shift the landscape of venture funding to underrepresented founders.

We can power companies that can close the gap of opportunity for large groups of people, creating more diversified access across a wide range of verticals, Marlon Nichols, founding managing partner of MaC Ventures, told The Plug. By expanding to a total universe of BIPOC and gender agnostic entrepreneurs, we’re convinced we’ll see the best talent out there. MaC has calibrated tools to gauge the global pop culture shifts to peek around corners for future solutions. With foresight baked into the formula of how MaC seeks out founders, companies with predictive tools float to the top.

We want to invest in companies making an impact and providing solutions‚Äîwhether that is a predetermined issue they are solving for, or one we don’t know exists yet, Nichols said. Firms and individual LPs may have a reputation that precedes them, as such Nichols recognizes that perception of a venture firm can either welcome or dissuade an increasingly coveted diverse group of founders. An important part of maintaining founder relations is operating in a way that encourages diverse founders to present themselves.

Entrepreneurs are realizing they have choices now. Founders talk, the more we do and the better we treat diverse founders the more they come in, Nichols said.A steady stream of diverse founders with the propensity for exits has contributed to MaC being among the first majority Black-led firms to raise such a large first fund. Nichols pointed to syndicate fund allocators and the role they play in how much capital Black LPs can deploy.

The root of the problem of Black entrepreneurs not getting funded equitably is at the fund allocator level. The percent of Black founders that receive venture financing mirrors the percent of Black decision-makers in venture capital‚Äînot a coincidence, Nichols said. To solve this issue, more Black venture capital fund managers have to start receiving funding at similar levels to our white counterparts.There are a handful of majority Black-owned firms that preceded Nichols’ MaC Ventures to raise over $110 million on their first capital raise. In 2000 Willie Woods’ ICV Partners raised $132 million, Troy Dixon’s hedge fund Hollis Park Partners founded in 2013 had a first fund of $175 million, Stellex, headed up by Raymond Whiteman raised $870 million on the first fund in 2017.

Sengal Selassie’s Brightwood Capital, founded in 2011, came close with a $75 million initial fund. These firms, including Nichols MaC Ventures, are each an outlier for Black financiers. Having successfully raised $110 million for our inaugural seed fund gives me confidence that things are trending in the right direction, Nichols said.

MaC’s limited partners include Greenspring Associates, Goldman Sachs, University of Michigan, The State of Michigan Retirement System, MacArthur Foundation, Foot Locker, PayPal, Twitter, Mitch and Freada Kapor and Howard University.