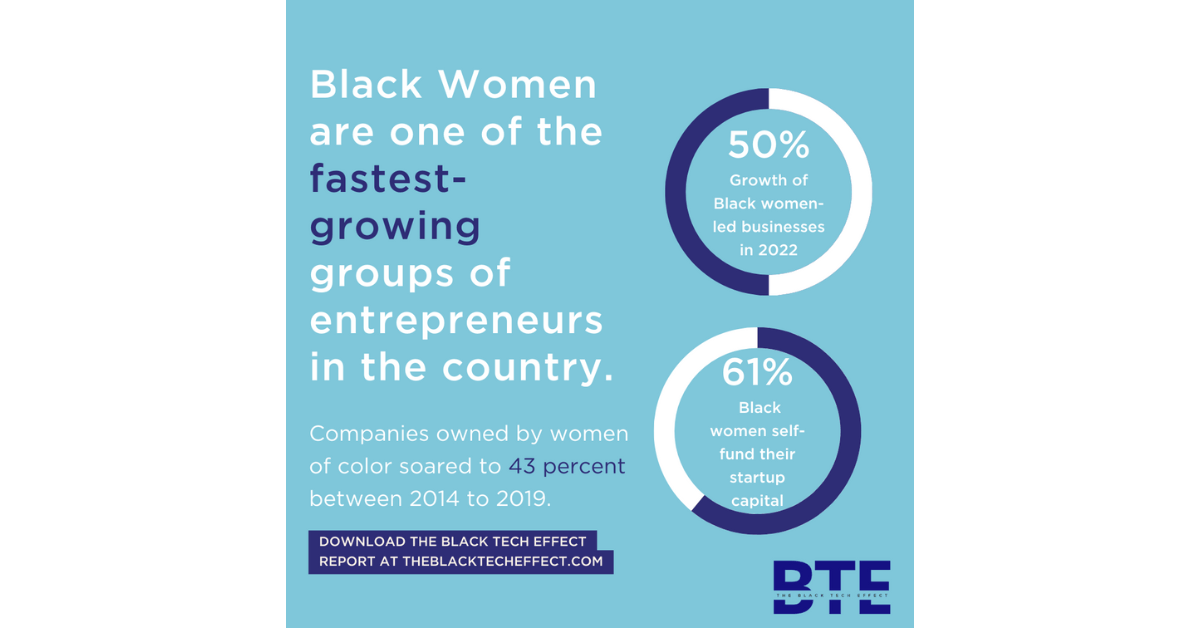

Venture capital firms continue to cannibalize themselves – for all the right reasons. As long-standing VC firms in the last ten months have announced allocating offshoot funds investing in companies led by Black, brown or women founders, the reckoning of VC behavior evidenced by data around funding disparities appears to be continuing to trend upward.

Motley Fool Ventures (MFV), an early stage, technology-focused venture capital fund launched in 2018, recently dedicated $5 million (3.3%) of its $150 million fund to 13 firms funding underrepresented founders, including Black-led VC firms WOCstar Fund, founded by Gayle Jennings, Sarah Kunst’s Cleo Capital, and Zeal Capital Partners, led by Nasir Qadree.MFV now joins a roster of heavy-hitting fund managers redirecting their dollars to align with the climate: VC has to behave better, capitalize those who have traditionally been left out, and move to mitigate the current stats of just 2.6% of capital going to underrepresented founders.

By investing in, and collaborating with, this outstanding cohort of fund managers, we are intentionally opening our network to fellow VCs and founders who are being overlooked and underestimated, Ollen Douglass, MFV Managing Director, wrote in the firm’s announcement about the fund. When raising our fund, we told our investors that we would look inside and outside the norms for great investment opportunities, and this is just one way that we are making good on our commitment, Douglass said. The funds are headquartered in San Francisco, and New York, with outposts in Los Angeles, Seattle, Chicago, Dallas, Houston, Atlanta, DC, Maryland, and Virginia (DMV).

Motley Fool Ventures’ current portfolio has over 28 companies, with 40% led by female founders and 10% led by Black and brown founders, according to the firm.”Motley Fool Ventures’ commitment has a profound effect outside just the capital they provide. This catalytic investment unlocks a large network of other capital, media, and partnerships, Pialy Aditya, co-founder of the WOCstar Fund, which hyper-focuses on funding women of color, led startups, told The Plug. WOCstar has made investments in companies like Uncharted Power, Possip, and Zero. But despite boasting a portfolio that could rival the diversity metrics of most mainstream venture capital firms, and although the data suggests it might, Douglass describes the move as an opportunity to do better.

According to Douglass, the firm conducted an assessment last quarter of companies they were seeing and realized they needed to tap the right partnerships and LPs to see more deals coming from diverse founders. It’s been a fishing problem, not a pipeline problem, Douglass told The Plug. We’re doing okay with industry standards but we want to blow it out of the water. In addition to dedicating less than 5% of the total fund size to firms targeting the mission of cleaning up venture capital’s messy, homogenous past, Douglass said MFV is also working toward increasing more pipelines via co-investing.

“The program has not had our inaugural meeting yet, but we have already co-invested with one partner in a woman-led company and have another company with a founder of color being evaluated for co-investment, explained Douglass. We’ve also begun to set up joint introductions where a founder has the opportunity, in a single meeting, to meet with MFV and another VC we’ve specifically identified for them.