Three multibillion-dollar asset management firms are banding together to launch a 10-year, $90 million initiative aimed at opening more pathways for students from Historically Black Colleges and Universities to enter the alternative investment industry.

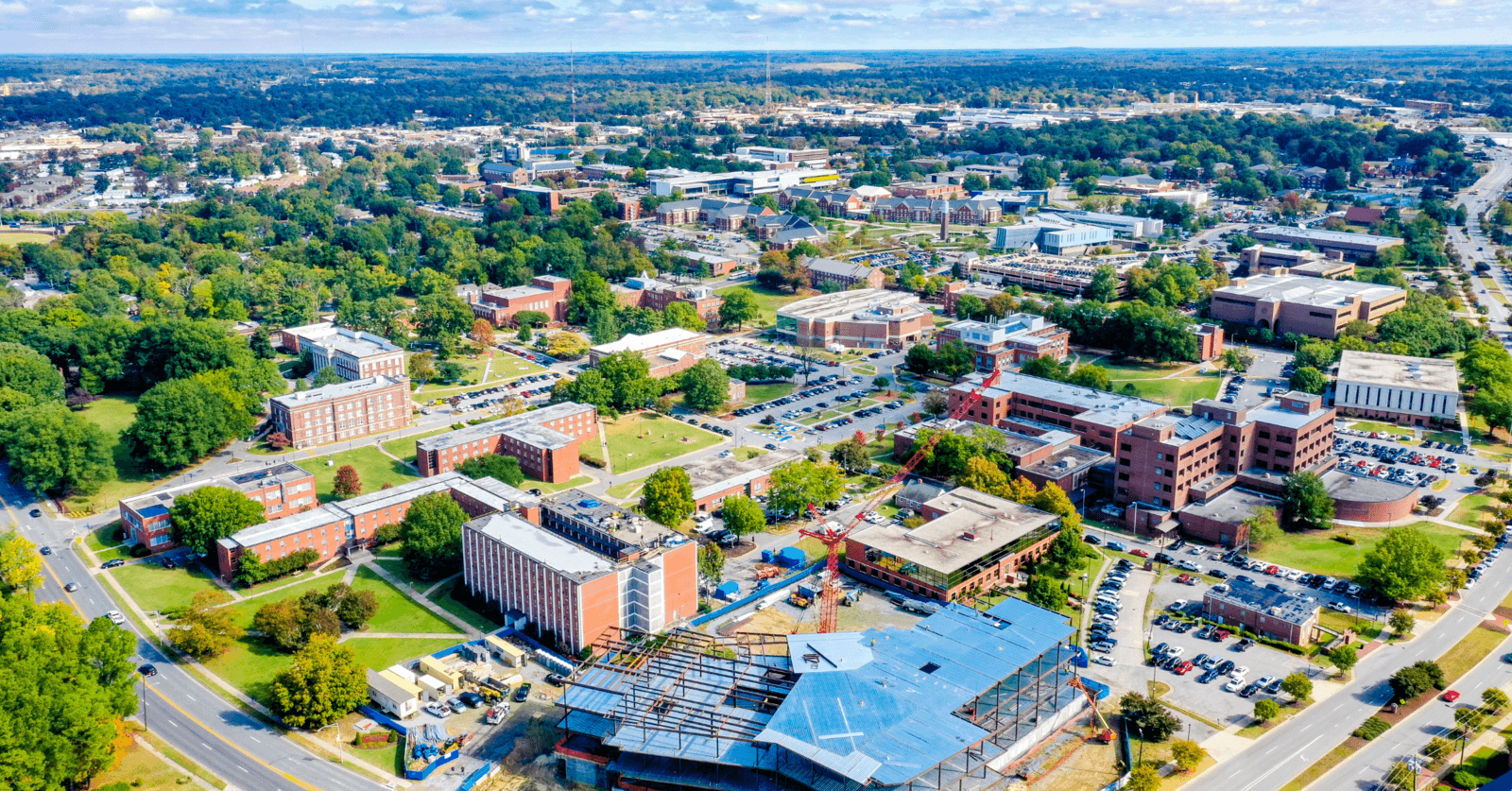

Apollo Global Management, Ares Management and Oaktree Capital Management are partnering with Clark Atlanta University, Howard University, Morehouse College and Spelman College to launch the AltFinance initiative. Participating students from the schools will have the chance to get paid fellowships, mentors and need-based scholarships.

The University of Pennsylvania’s Wharton School of Business will also create a virtual institute open to students at all HBCUs to learn about the alternative investment industry, which includes private equity, venture capital, hedge funds, managed futures, art and antiquities, commodities and derivatives.

“[The firms] looked at the fact that within the marketplace, around the world from Wall Street on, that there was a lack of color, there was a lack of Black and brown people within that space,” George French, the president of Clark Atlanta, told The Plug.

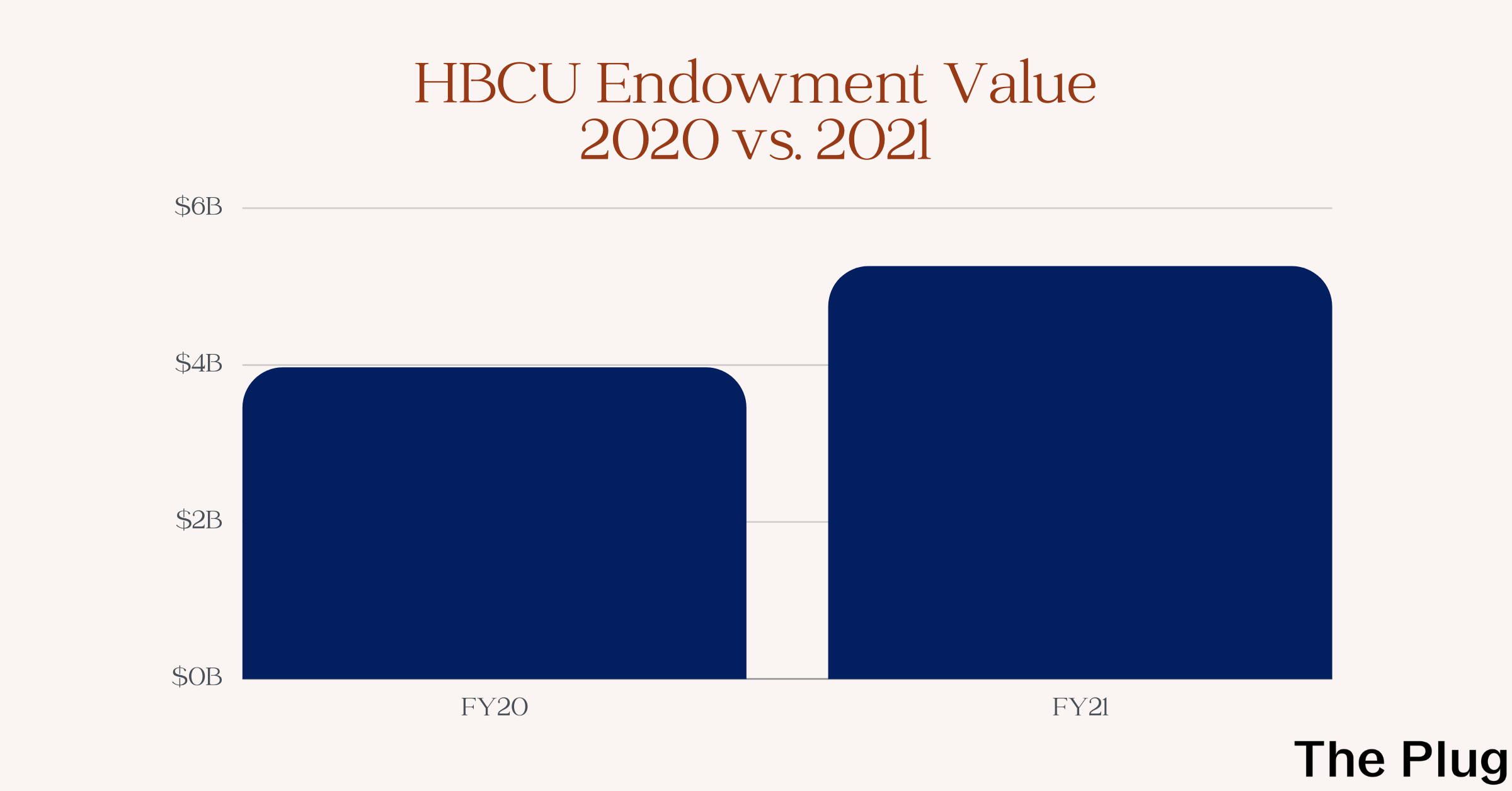

According to a McKinsey report published in March, US investment teams were only about one to two percent Black in 2020. A different McKinsey report from April found that Blacks and Latinos at private equity firms made up just 13 percent of entry-level positions and less than 5 percent of senior roles.

For the next 10 years, Apollo, Ares and Oaktree will each give $3 million a year to a non-profit they established to administer AltFinance, a contribution that is roughly just 0.001 percent of their $461 billion, $227 billion and $153 billion assets respectively. It’s unclear exactly how the $9 million will be spent every year. A spokesperson for AltFinance did not respond to requests for comment.

According to French, students can go to the firms’ offices and observe their work up close. The initiative will expand Clark Atlanta’s existing business school curriculum and students will be able to receive credit for some classes taught through the virtual institute, he said.

Recently, a college student-led venture capital firm opened an office in Atlanta with hopes of improving its racial diversity and creating a pipeline for students of color to jump-start their careers. A few students from Atlanta HBCUs are already working with the firm.

While no launch date has yet been set for the AltFinance initiative, French hopes it will be up and running on the campuses by this fall. A statement from the firms said it is expected to launch by the first half of 2022.

For at least one of the firms, this is not the first time they’ve given money to an HBCU.

In January 2020, the Karsh Family Foundation, created by a co-founder of Oaktree and his wife, gave Howard University $10 million to establish scholarships. At the time, it was the largest donation the university had ever received. Apollo and Ares did not comment on if they had made any previous donations to HBCUs.

“For us to teach our students about venture capital, hedge funds and private equity, it’s a new day,” French said. Statements from Howard, Spelman and Morehouse echoed those sentiments. “We are becoming this global market it seems like at the speed of light, and we want to prepare our students so that they know more about finance than just stocks, bonds and cash.”