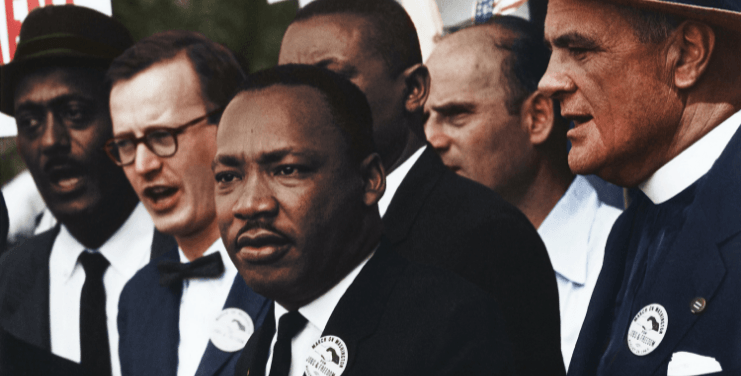

There’s no sugarcoating the economic turmoil that has turned the world upside down and mercilessly altered our way of life. Analysts predict a 17-month time horizon before job growth rates match pre-pandemic levels. But ongoing job losses, evictions steadily on the rise, lagging governmental support, and families making deep sacrifices to educate children at home for the first time have made ends tight at home.

Though hope of a vaccine is on the horizon, many Americans are turning to friends, family, and other financial services to help stand in the gap when the ends don’t meet.

But turning to friends and family might not always be a viable solution. Asking for help, even for a small loan, can feel intimidating, embarrassing, or even shameful.

Since 2017, SoLo Funds, led by founders Travis Holoway and Rodney Williams (whom you might recognize as co-founder of mobile payment platform Lisnr) has been helping to arm Americans with a tech-enabled lifeline. Through its peer-to-peer lending platform, SoLo Funds facilitates personal loans between borrowers and investors—complete strangers—ranging from $50 to $1,000 within minutes.

According to Holoway, the app has garnered over 400,000 downloads and has been responsible for facilitating an average of $1 million per month in transactions between borrowers and “lenders.” Since the start of the pandemic, Holoway says the company has seen a 40% month-over-month growth rate.

Loans on average are paid back within 15 days. Terms are established between lenders and borrowers, responsible borrowers increase their ability to borrow more following every transaction they successfully return the loan to their lender. Those who default are not allowed to use the platform again.

“Historically, we’ve had better success at payback. Our default rate is 11% compared to the industry average, which is 33%,” explains Holoway.

To further decrease potential delinquencies, the company introduced its SoLo Protection product in July, a small insurance fee that investors can opt into per transaction with a borrower. For 5% of the original loan principal, investors can add additional security in the event the borrower defaults. Since its launch, Holoway says that 48% of its investors opt-in.

An Origin of Necessity

SoLo Funds is among a mix of next-generation financial products that provide an alternative to traditional banking products, allowing users to borrow in small increments and return the loans back in a matter of weeks.

Traditionally, financial products providing consumer-level bailouts are part of systems we’re told to stay away from. Think check cashing establishments, which represent an $11 billion dollar-plus industry, as well as payday lending where interest rates and fees can exceed upwards of 400%.

Holoway says they wanted to help take the stress out of asking for help while also figuring out how to unlock the discretionary income of those who have the means to lend.

“Ultimately, we want to prevent people from taking out predatory loans,” Holoway says. “We wanted to take the stress out of asking, so we asked, How do you figure out how to unlock discretionary income? And prevent people from taking out predatory loans.”

In June, the company partnered with Kiva, the California-based platform that allows people to lend money to low-income entrepreneurs across 77 countries. Kiva refers those seeking personal loans to SoLo Funds; and borrowers on the SoLo platform looking for larger-sized business loans are sent over to Kiva.

Another key partnership for the brand has been with Visa, which enables immediate cash availability via debit card to borrowers once a transaction is complete. Terry Angelos, senior vice president and global head of fintech at Visa, credits SoLo Funds for its role in helping to solve payments challenges for a vulnerable population.

“Whether it is changing the way people invest, manage money, send real-time payments or receive loans, Visa is a natural partner for fintechs like SoLo Funds,”says Angelos “We are committed to helping SoLo Funds further their mission of providing affordable loans for individuals who live paycheck to paycheck, something that has become increasingly important amidst the pandemic.”

2021 Expansion Plans

SoloFunds has raised a total of $7 million from investors such as MaC Venture Capital, entrepreneur Richelieu Dennis, Tech Stars, Impact America Fund, Plug and Play, and others.

Holoway says the company will add at least 25 new employees over the next year. Key roles the company will add will include advancing its engineering and data science team as SoLo adds sophisticated product offerings to larger investors and makes it easier to deploy larger sums of capital.

They also anticipate a future for bigger investors who are coming on the platform interested in lending to businesses and entrepreneurs in need of quick access to capital.

“We’ve seen higher net-worth individuals come on to the platform who have the ability to lend $10,000 to $20,000. We want to be able to create a way for them to select their risk preferences and lending across the platform,” explains Holoway.