Just a few weeks before another school year kicks off, students at more than a dozen historically Black colleges and universities will return to campus this fall with a lighter debt load. Since May, more than 20 HBCUs have cleared over $60 million in outstanding student balances.

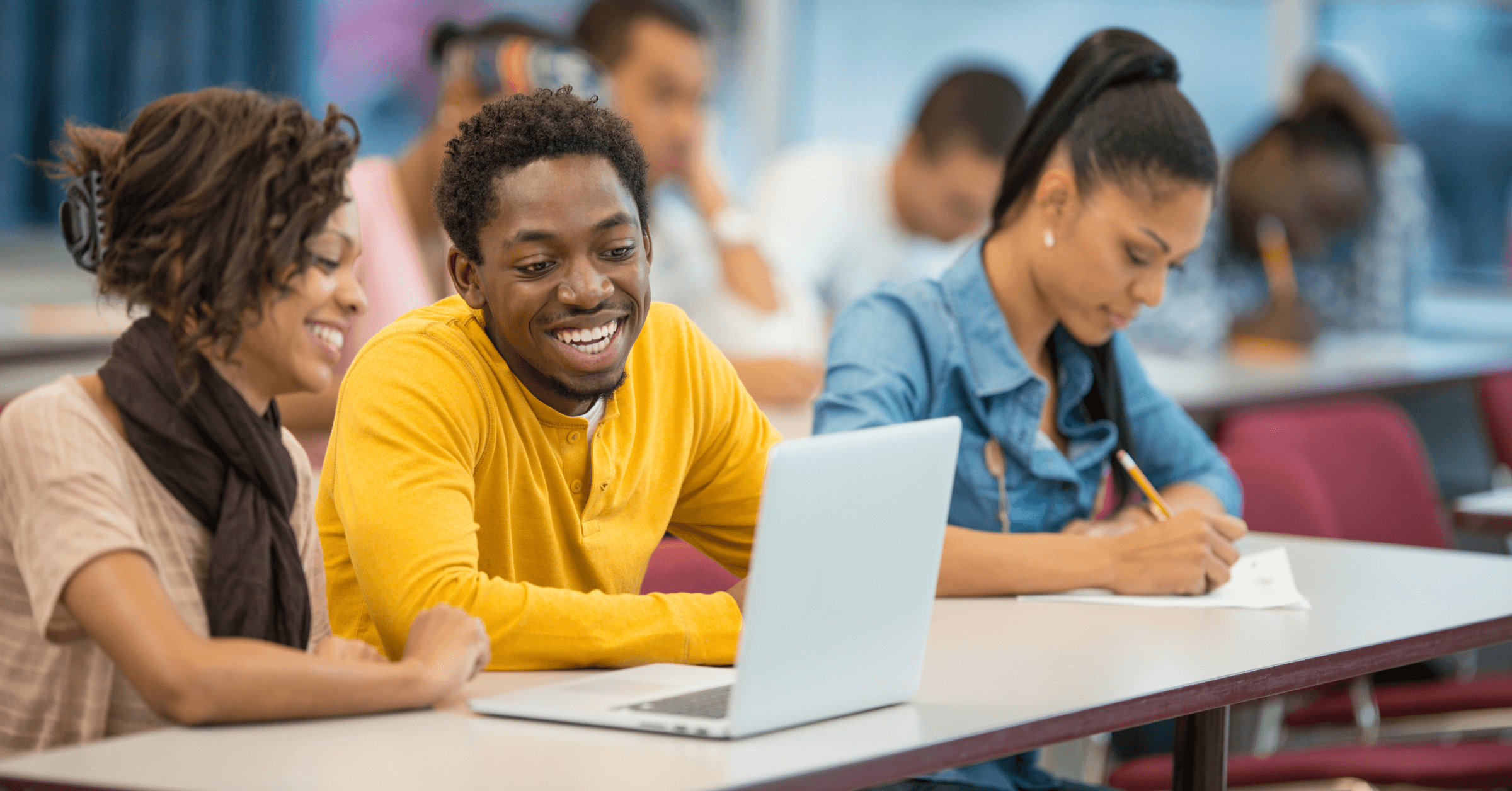

“It was a relief,” Jaelyn Barnes, a rising senior at Saint Augustine’s University, told The Plug. Barnes and her mother have had to take out loans to help cover her education, but this fall they won’t have to.

In general, HBCU students have higher student debt burdens than other students. According to the United Negro College Fund, 80 percent of HBCU students use federal loans to finance school versus 55 percent of their non-HBCU peers. National student loan debt stands at $1.57 trillion, according to the Federal Reserve of New York. The average Black college graduate owes nearly $53,000 in student loan debt four years after they graduate, which is almost twice as much as their white counterparts, the Brookings Institution found.

The HBCUs clearing debt so far are: Rust College, Coahoma Community College, Claflin University, Elizabeth City State University, Fayetteville State University, Wilberforce University, Shaw University, Delaware State University, Philander Smith College, South Carolina State University, Clark Atlanta University, Spelman College, Saint Augustine’s University, Fort Valley State University, Virginia State University, Norfolk State University, Virginia Union University, Cheyney University, Florida A&M University, Miles College, Grambling State University, Morehouse College and Savannah State University.

For most students, the debt relief applies to any balances they had from spring 2020 to summer 2021. It will not forgive any federal or private loans they may have already taken out.

At least three schools will be providing relief for fall 2021 tuition too — Wilberforce University is reducing tuition for new in-state students and Spelman College is resetting tuition and fees to rates from four years ago (although it will still be a $1,200 increase for students compared to 2020’s steep discount).

But the largest relief this fall will be at Saint Augustine’s, where students will not have to pay any tuition out of pocket for the upcoming semester.

“We saw that it would have a cumulative effect on students if this year we took that burden away,” Christine McPhail, President of Saint Augustine’s University, told The Plug. “Then students could return to the university in a way that was just one more thing off of their plate.”

Saint Augustine’s has spent $4 million to clear spring and summer 2021 balances, and is prepared to spend $5 million to cover fall 2021 tuition.

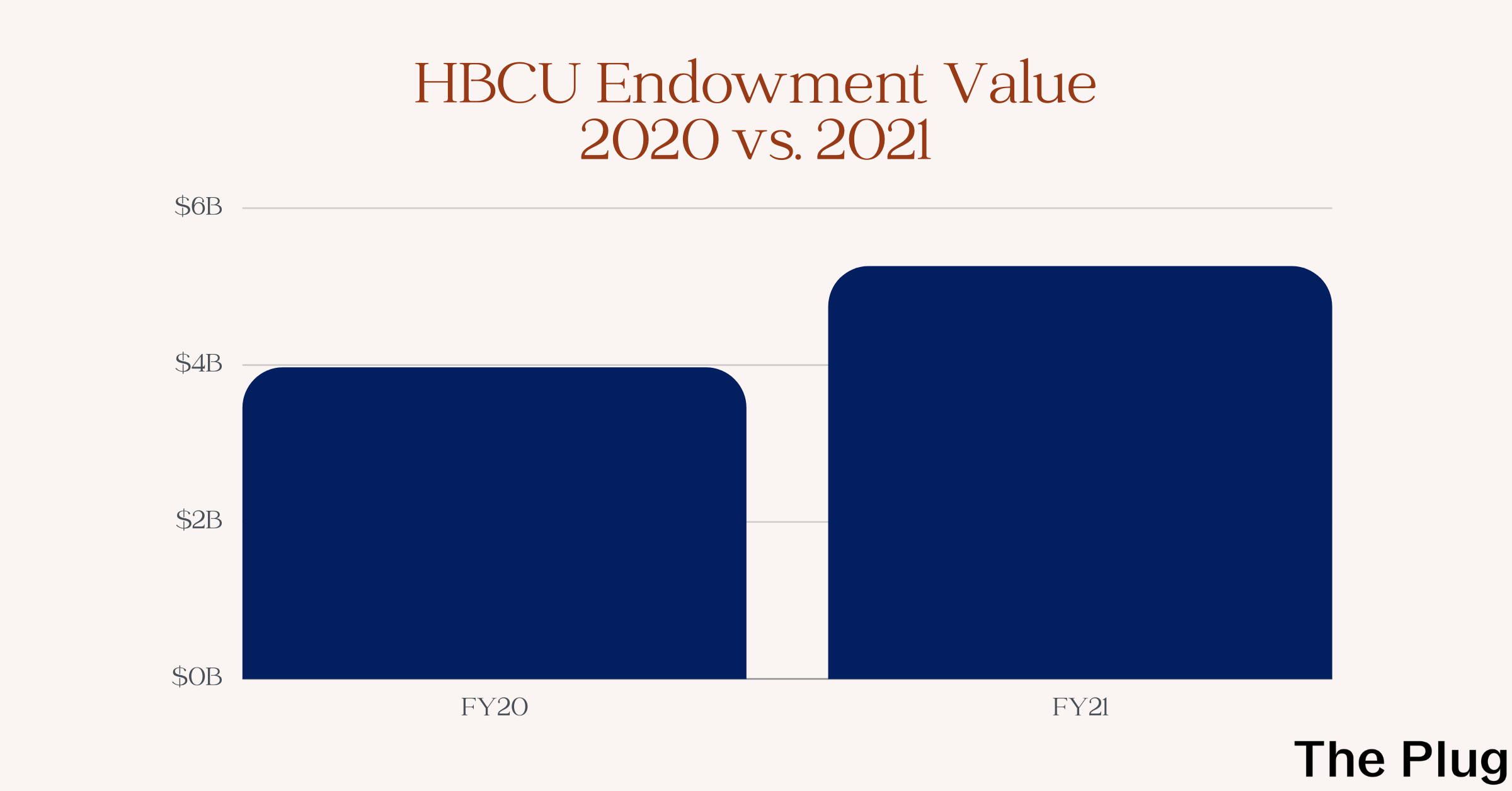

Since the beginning of the pandemic, HBCUs have received at least $3 billion from Congress, most notably through the CARES Act, the CRRSA Act and the American Rescue Plan, which have made the debt relief possible.

For Alexander Conyers, South Carolina State University Acting President, clearing debt was one of the first things he did once in office. He was appointed July 13 and just two days later, SC State announced $9.8 million of debt forgiveness for 2,542 students.

“I thought it was important to clear these balances one, because it was allowable through the federal guidelines to do so, and two, to demonstrate to our students that we cared about them, we understood their family situation,” Conyers told The Plug.

“I thought about the fact that many students dropped out of college with $1,000 or $2,000 in debt. I knew that those students had probably tried everything to get back into school,” he said.

Unlike most other schools, SC State did not limit the debt forgiveness to any specific semesters, but did cap it at a maximum of $15,000 per student.

Alongside clearing the balances, staff and alumni of the university have been calling students who are not yet enrolled for fall 2021. The school has faced falling enrollment numbers for years, but it said more than 250 students have enrolled as a result of this effort and specifically cited the debt relief in their reasons for returning.

After Jaelyn Barnes graduates next spring, she wants to go to grad school and eventually open her own child therapy practice that is fully Black women-owned and operated. Barnes said Saint Augustine’s debt relief has quelled doubts about having had to leave her child while getting her college degree.

“They are giving me no reason for me not to come back to school because they’re paying for it,” Barnes said. “They’re helping me become a better mother and I cannot repay them enough.”