The emergence of blockchain technology is accelerating the adoption of cryptocurrency to bring about social change and financial inclusion in developing nations.

Non-industrialized countries have not kept pace with digital advancements, but the ever-evolving landscape of blockchain has provided a proliferation of smart innovations to bridge the tech gap. The decentralized ledger technology is being utilized by some pioneering women to engineer solutions for more equitable opportunities in emerging economies.

“The concept of financial inclusion wasn’t something that I realized until I moved to the U.S.,” recalls Carmelle Cadet, CEO of EMTECH told The Plug. Growing up in Haiti, Cadet said the structure of the financial system can be economically crippling to citizens who are reliant on high-fee remittance payment systems to send and receive money. Remittance transfers shrank 14 percent—the first decline in a decade due to the economic crisis brought on by the pandemic. The $3.5 billion dollar industry makes up 23 percent of the country’s GDP in 2019, and is the 6th highest in the world.

“I always thought about “‘How do I go back to Haiti to fix the financial inclusion problem and provide access to finance?’”, Cadet said before founding her company, EMTECH, a fintech company using blockchain to help central banks in emerging economies modernize its financial systems. “A $500 credit gets you a start in the U.S., but you can’t do that in every country —it’s harder to have financial independence and freedom.”

Initially starting a nonprofit to educate adults about financial literacy, Cadet grew frustrated with the tedious task of soliciting donors for funds, “I told myself that I had to find another sustainable way to have an impact other than just [relying] on aid money,” she said. “When I first heard about blockchain I knew it was what we needed to provide finance [to people] regardless of how much money you have, or the country you live in.”

A plethora of crypto trading platforms have emerged in recent years, allowing anyone to join a global market whose growth is expected to reach $5.1 billion by 2026, a 30 percent increase from 2019. The growing popularity of digital assets like bitcoin and ethereum have become the most popular in the crypto-economy, and are responsible for the surge in interest from sophisticated and novice investors. In the third quarter of 2020, there were around 18.5 million bitcoins in circulation worldwide, and more than 43 million active crypto traders just on Coinbase, the largest cryptocurrency exchange platform in the U.S.

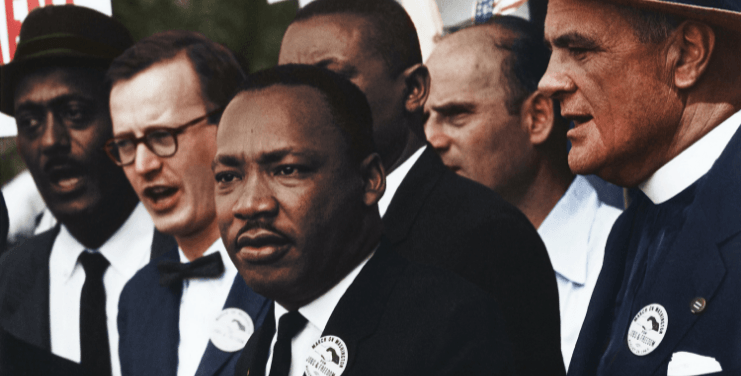

Outside of finance, blockchain has also been an invaluable resource for a secure peer-to-peer pipeline of communication for social activists.

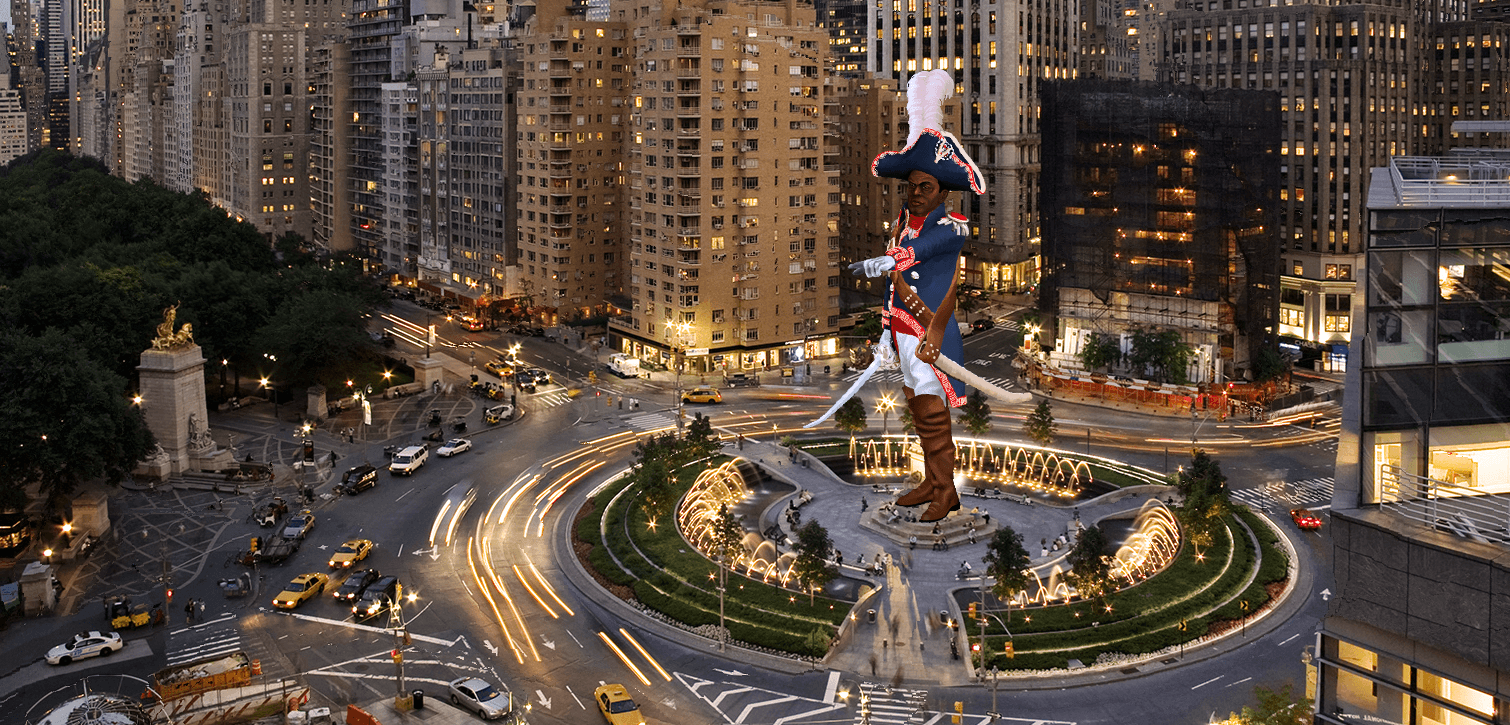

“The revolutionary nature of blockchain technology to empower people with the economic freedom and give them back control,” Cleve Mesidor, founder of LOGOS, a decentralized social platform exclusively for activists, told The Plug. “There’s a standard case for decentralization and that’s we don’t want a centralized power controlling the message.”

During the #EndSARS protests that erupted in Nigeria over the summer calling for the disbanding of the Special Anti-Robbery Squad because of police brutality, donations to support protesters through bank transactions were found to be purposely slowed down. Activists then turned to bitcoin and began leveraging other digital tools to fund the campaign.

Mesidor’s serendipitous venture into cryptocurrency and blockchain came after serving as the Director of Public Affairs for the U.S. Department of Commerce’s Economic Development Administration, under former President Obama. Tasked with developing economic programs to advance innovation and entrepreneurship, she described her extensive career in politics and public policy as being a perfect prerequisite for her transition into cryptocurrency.

“The wonderful thing about the blockchain ecosystem is that you don’t have to be a tech person, and you don’t have to know how to code,” Mesidor said. “The regulatory conversation [about cryptocurrency] started heating up in 2018, and I was one of few people in crypto who had a background in public policy.”

Leveraging her relationships on Capitol Hill, along with her passion to educate minorities and women about blockchain technology, she launched The National Policy Network of Women in Blockchain. Yet, ensuring an accessible and equitable playing field for women and minorities in cryptocurrency continues to be an uphill battle. Only 14 percent of females identify as being a part of the bitcoin and blockchain community, according to bitcoin statistics website Coindance.

“I started to engage members of Congress and realized that there was a need to engage the Black Caucus, Hispanic Caucus and Asian and Caucus,” she said. “What people don’t hear about is that people of color are the fastest-growing demographic in the crypto and blockchain marketplace. There is a need for [Congress] to see people of color who are building in this space.”

The gender imbalance in cryptocurrency is exceptionally stark. Across ages, millennials are the most enthralled with educating themselves and actively engaging in crypto trading. There is no comprehensive data around engagement in cryptocurrency by ethnicity, but the racial representation for entrepreneurs is not hard to miss.

“When I first started going to these blockchain meetings and conferences, there were 500 people in the room, and I was the only Black woman,” Emma Todd, CEO of MMH Blockchain Group, told The Plug. “But, one of the characteristics that most Black women have in blockchain is that we are fighters, and we are going to go out there and make things happen.”

As cryptocurrency adoption accelerates across the world; Africa, Brazil, Peru and some regions in Latin America are among a few countries with the largest share of cryptocurrency users. Countries with weaker currencies and high inflation have been quicker to embrace cryptocurrency as an alternative. According to a Global Consumer survey conducted by Statista, out of 74 countries, Nigerians were most likely to say they’ve either used or owned cryptocurrency.

In Toronto, where Todd’s company is based, the government has moved swiftly in the global arms race to implement a regulatory framework for the usage of virtual currency. While Canadians are allowed the use of digital currencies, including cryptocurrencies, they’re not considered legal tender in Canada. The concern amongst Canadian entrepreneurs in the blockchain community is that some of the country’s policies to excessively regulate and tax cryptocurrencies can be problematic for businesses in the space.

“The challenge that we have is that innovations are stifled by regulation,” said Todd, whose portfolio of clients are mostly blockchain platforms in the financial services sector. “People are giving up their residency in Canada and going to other countries because Canada has some very archaic laws.”

In the U.S., cryptocurrency is in circulation. Although not considered a legal tender at the federal level, laws governing whether or not it’s legal vary by state. There are still no definitive regulatory guidelines regarding the usage of digital currency. Last week, in conjunction with the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC), lawmakers introduced legislation to provide more clarity on digital currency regulation in the U.S.

Africa is becoming the next frontier for digital currencies, with some governments moving forward to integrate crypto assets in their financial systems by making it a legal tender to be used by citizens. Tunisia became the first country in Africa to issue a national digital currency, and earlier this month, Ghana’s central bank launched a regulatory and innovation sandbox, with a focus on projects building on blockchain technology.

EMTECH serves as a resource for central banks and continues to expand its operations in Africa, the Caribbean, and the U.S. Recently, Cadet partnered with The Bank of Ghana to help provide products and services with the ultimate goal of promoting financial inclusion to close the gap between underbanked and unbanked Ghanaians.

According to a survey conducted by the International Journal of Central Banking (IJCB), 65 percent of central banks are researching, or exploring launching a digital currency. A former IBM Global exec, Cadet is hoping to change the narrative on how central banks can establish a more equitable banking infrastructure by using blockchain to their advantage.

“There is a real possibility for central banks to be disrupted, but the better alternative is [for banks] to engage,” Cadet said. “If you say you want to have financial inclusion – blockchain and digital cash can give you that.”