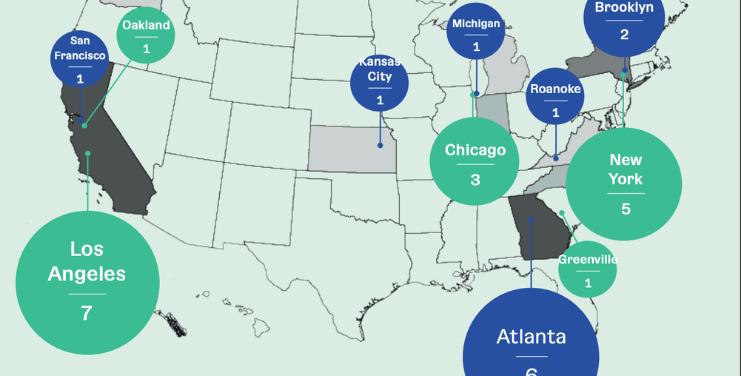

There are a few fintechs in the peer-to-peer lending space, but SoLo Funds has managed to generate a consistent buzz largely by word of mouth. The Los Angeles-based company has amassed $34 million in venture backing and has provided an alternative to predatory payday loans with their tens of thousands of loans currently on the platform.

In a case study, The Plug has taken a closer look at the company and how it’s carving a niche in an active, mission-driven segment of the financial services industry.

Cofounders Travis Holoway and Rodney Williams outline everything from their start, going through the Hilman Accelerator formerly led by Lightship Foundation, to a relaunch at the onset of the Covid-19 pandemic last April.

Key takeaways from what’s inside include:

- How the company has expanded its reach to include services to 77 countries

- SoLo Funds’ share of the $870 million U.S. peer-to-peer lending market

- Outlooks on the 63 million underbanked and unbanked Americans

- The playbook behind a staggering sustained 40 percent month over month growth rate mid-pandemic

- Rethinking traditional creditworthiness and mainstays like FICO Scores

“The best stories are borrowers who come here and then come back as lenders later on,” Holoway told The Plug.

Download the full report here.