Key Insights:

- In 30 years U.S. Black wealth has increased 0.2 percent, which could have dire consequences as minorities become the majority.

- The country’s middleclass, which has served as a buffer against economic instability, is at stake due to racial inequity and the racial wealth gap.

- Federal intervention and breaking the cycle of ‘poveteering’ could issue a reversal.

By the year 2040 minority populations are expected to exceed the white population in the U.S. While the changing racial demographic will drive innovation across business and government, it will also present the need to finally address systemic racism in earnest.

As a wealthy and developed nation, the U.S. already lags behind peers in key areas of healthcare, education and social safety nets, which will only be exacerbated by the racial wealth gap. Left unchecked, the median wealth for the average Black U.S. household will level to $0 by the year 2053, according to a 2017 study. Hispanic families are not far behind, with household wealth reaching $0 for this racial group by 2073.

A substantial middle class that sets the U.S. apart may disappear if opportunities are not expanded to more communities of color.

“White wealth continues to rise, and tax policies put in place in 2017 under the Trump administration only widened the gap,” Henry McKoy PhD., Director of Entrepreneurship, School of Business North Carolina Central University, told The Plug during a Black Innovation Alliance conference.

“Even if you look at something supposedly put in place for the Black community like opportunity zones, the idea was that Black folks would have access to capital to invest in their own community, but the way that was set up basically says, ‘all you have to do is invest money into a Black community, it doesn’t matter who benefits from it or what it looks like afterwards’ and you can get tax exemptions,” McKoy said.

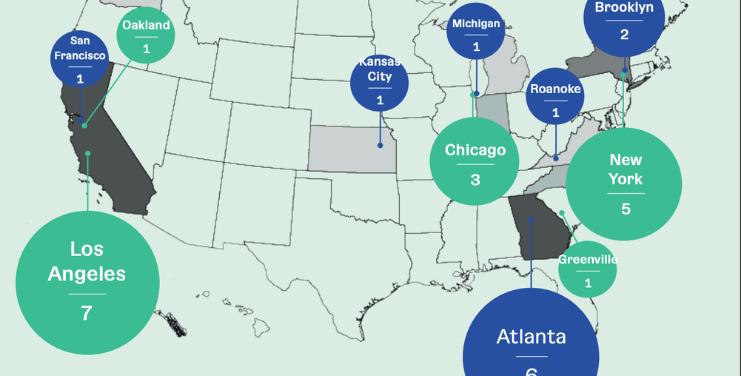

Businesses with paid employees are shown to increase wealth in communities, yet this opportunity is largely lost to Black entrepreneurs.

“For all of the 21st century, the average Black firm growth has been positive, but the average Black firm revenue has been negative. – that simply means, every recession or shake up Black folks start more businesses, but they’re fighting over the same amount of dollars,” McKoy said.

“The mainstream press says, ‘there’s no better time to be a Black or Brown entrepreneur’ but you have to look under the hood.”

McKoy coined the term ‘poveteering’, which he defines as the process of running a business but becoming poorer at the same time, to describe the cycle of Black business creation that fails to generate wealth for business owners and their community.

The Federal Reserve has tracked racial wealth through the decades and wealth in the U.S. remains overwhelmingly white even as the white population has decreased.

In 1989 white Americans owned 90.7 percent of the U.S.’s wealth and were 60 percent of the population. That same year, Black people were 12 percent of the U.S. population but held only 3.8 percent of the country’s wealth. As of Q1’20, white wealth has dipped slightly to 84 percent, while Black wealth has increased by 0.2 percent to four percent in 30 years. This could have dire consequences for all of the U.S.

“If Black businesses in the U.S. become functionally extinct, and no longer plays a significant role in the overall American ecosystem function, then there will be grave and negative consequences for the entire country,” McKoy said.

He cautions that ‘Blackout’ days to only spend with Black-led companies and buy Black campaigns are not enough to reverse the deep chasm of wealth inequity. Federal intervention, equity investment and removing barriers to entry can start to mend the gap.

“It’s a very high bar that a Black person [George Floyd] has to be murdered on national and international television to shop at your store so Blackout days aren’t enough,”McKoy said.“You can’t talk about this without reparative justice. There’s got to be work at the federal level to get capital into the Black ecosystem.”