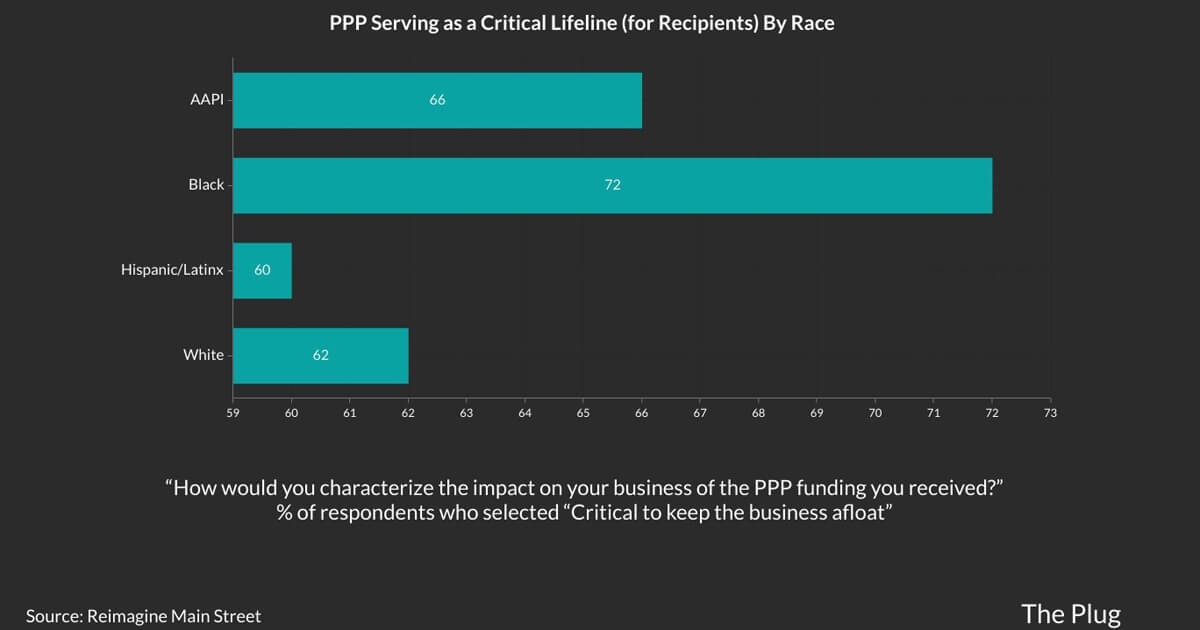

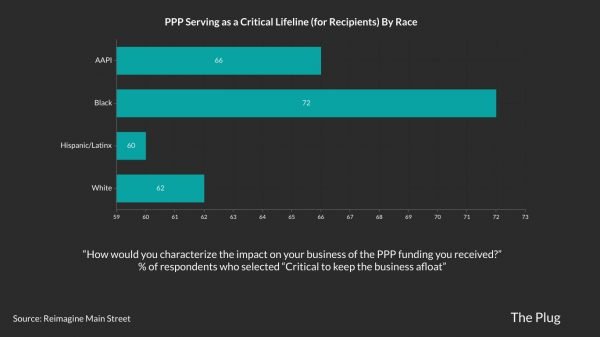

Black-owned businesses have yet to reap the full benefits of the paycheck protection program (PPP) meant to provide financial relief from the pandemic, which is set to close Monday, according to data by Reimagine Main Street. Data found that Black-owned businesses were the least likely to be approved for a PPP loan, with only 37 percent of small Black-owned businesses with $250,000 or less in 2020 revenue applying for and receiving a PPP loan. White business owners, at the same level of revenue, had the highest rate of success with 52 percent receiving a PPP loan. While applicants of all races applied for PPP at similar rates, with Native American applicants skewing slightly lower, Black business owners were the most likely to say the loan was critical to keep the business afloat, the study found.

Having been denied this lifeline afforded to other races at higher rates has contributed to the 41 percent of Black-owned businesses that closed due to the pandemic according to the National Bureau of Economic Research. When our country faces a crisis, the most vulnerable are hit the hardest, especially in the Black community, Ron Busby, president and CEO of the U.S. Black Chambers, said during a panel discussion.

Sixty-eight percent of the businesses that we found among 2.6 million Black firms owned in the country said that they didn’t get PPP, not because they didn’t have the acumen or that they didn’t have a good business, it was the relationship they didn’t have with banks, he said.

Business owners of color, women business owners and those age 50 and older don’t anticipate recovering at the same rate as white male business owners. Black business owners expect the longest road to recovery, not surprisingly they were generally among the hardest hit businesses, Tammy Halevy, co-lead of the Reimagine Main Street initiative, said during the panel. When we disaggregate the data further than just by race and ethnicity alone, women business owners generally expect a longer road to recovery, on average white men expect the shortest time to recovery.

The survey defined a long recovery as six months before reaching pre-pandemic revenue. Sixty-seven percent of Black business owners expect a slow recovery, while Native American business owners were even less optimistic about fast recovery, 75 percent expect a long recovery ahead. However, 43 percent of Black respondents were confident that their business could access financing to meet working capital and growth needs, compared to 37 percent of respondents overall. The federal government, which initiated the PPP loan program through the 2020 Coronavirus Aid, Relief, and Economic Security (CARES) Act, is calling for continued investment in minority-owned businesses.

For the millions of main street small businesses, especially Black and Brown-owned, we know that they had to struggle through the health aspects of the pandemic but also the economic struggles of the pandemic, Cedric Richmond, senior advisor to the President and director of the White House Office of Public Engagement, said during the panel.

We have to invest and make sure that those businesses thrive because those businesses more than any are the canary in the coal mine, as they succeed and flourish. We know the economy and the country will do the same, he said. The application to apply for a PPP loan closes on May 31.