Black founders are bringing financial tech enablement to the forefront of the growing system sitting at the intersection of economics, social value, creativity and intellectual capital.

The creative economy contributes about six percent to the global gross domestic product, with an estimated 200 million people globally making money by taking part in it.

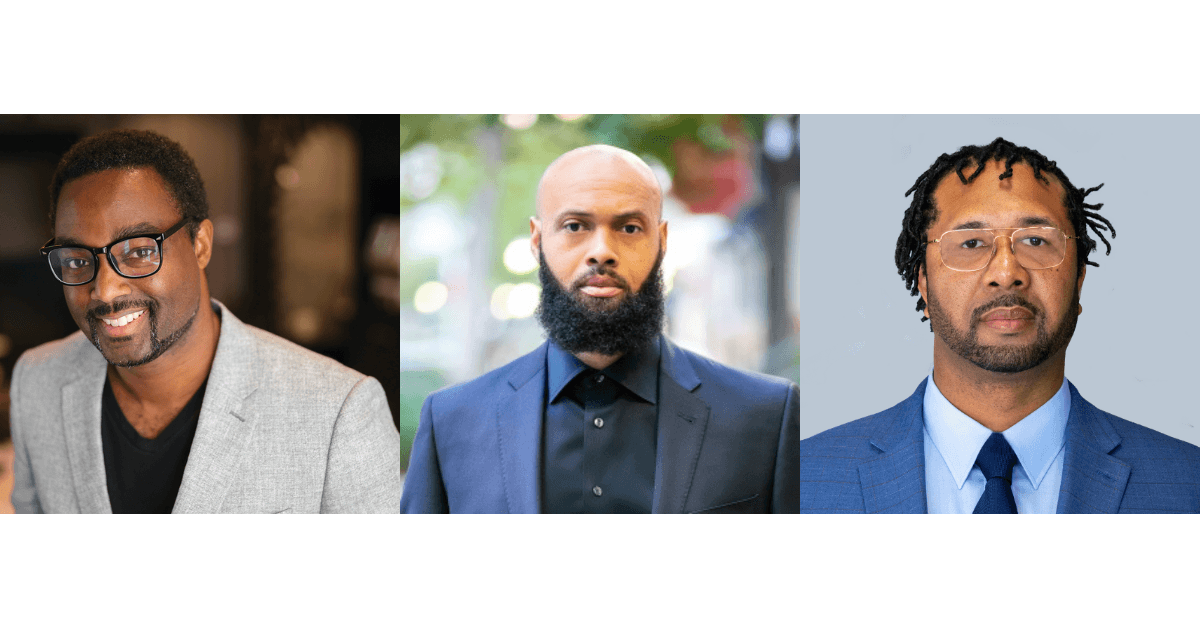

Three fintech startups in the Mastercard Start Path In Solidarity program are focused on addressing pain points experienced by the creator economy. They offer innovative solutions for content creators, game developers, musicians, athletes, and more around data insights, revenue management and fan engagement.

Bump

As a child, James Jones would join his father — a musician, business owner and software engineer — on “Christian church tours,” traveling to perform and teach music to different churches around the U.S. Even as a child, Jones noticed how his father struggled to collect and track revenue from the churches he visited. Inspired by this experience, Jones later co-founded and is the CEO of Bump, a financial services platform for creators.

Jones, who worked for years as an entertainment lawyer, witnessed his clients experiencing similar financial barriers to his father as they struggled to understand their income streams and feared they would lose ownership of their creations due to industry practice.

“If you are a creator or influencer making six figures annually, you can’t walk into a bank and expect to get approved for a business loan or any other type of financial product. The bank doesn’t understand what an influencer is and doesn’t understand the ebbs and flows of an influencer’s revenue sources,” Jones told The Plug.

Content creators face many challenges, including managing revenue from royalty payouts from social media platforms and accessing “creator-friendly” funding sources, Jones said.

But Bump recently partnered with Highnote and Mastercard after participating in Start Path’s Spring 2022 cohort to create a credit card exclusively to support creators. Bump accounts for non-traditional financial assets including cryptocurrencies and NFTs when determining credit limits for its card.

Bump has over 100,000 creators in its pipeline, and since launching in 2021, has raised $2.5 million from investors including Plug and Play Ventures, Sixty8 Capital and Snap Inc. Bump has also been able to gain traction outside of the U.S. with a global launch in Dubai, Egypt and other markets in the Middle East and North Africa. The platform anticipates continued growth as content creators dominate the global labor force.

“Simply stated, the creator economy is becoming massive. For this reason, data-driven neobanking that specifically caters to creators, freelancers and the broader creator economy will play a huge role in ensuring that creators and their businesses have the tools and financial products to grow their businesses,” Jones said.

Tatum Games

Tatum Games helps game studios and independent developers improve monetization through data analytics. Since launching eight months ago, over 1,400 developers have used the platform and it has raised $600,000 in pre-seed funding.

Apple and Google take 30 percent of app revenue and gathering data is costly, which is a difficult pull for small companies. That is why Tatum Games made its SaaS product, MIKROS, free.

“The whole process of advertising and marketing and getting enough analytic data to where you can do something meaningful is extremely costly and a majority of small to medium-sized companies can’t afford it,” founder and CEO Leonard Tatum told The Plug. The platform provides side-by-side comparisons of users’ KPIs vs. their competitors’ KPIs as well as information on hacking and trolling.

Large game developers like Tencent and King can produce games at much higher rates than small companies and independent developers, and even gaining exposure through advertising is a challenge, Tatum explained.

“In this particular sector, it’s just very, very skewed. There’s a need for innovation and change and we’re up for that challenge to try and even the playing field a little bit more,” Tatum said.

XR Sports

While working in the investment space for gaming and esports, Kedreon Cole learned about the challenges facing the entertainment industry, which led to the development of XR Sports, a social commerce website builder for creators. The platform has “fan engagement hubs,” which are owned by the creators and allows them to build an independent digital economy.

XR Sports aims to solve the need for more cohesiveness among creators managing their fan base on different social platforms. Third-party platforms limit creators’ ability to monetize their fan relationships because they do not have ownership of those records, Cole explained.

The backend of XR Sports is similar to an e-commerce platform with creators serving as merchants.

“They are engaging with their fans through unique storytelling, immersive experiences, and interactive solutions,” Kedreon Cole, founder and CEO of XR Sports, told The Plug. “Websites are essentially informational places, very transactional, not super experiential, and so we bring a lot of those elements to our platform, which are tied to the influencers or the creator’s domain itself.”

Simply put, fans would still go to a creator’s website but XR Sports is facilitating interactions behind the scenes. One of the platform’s measures of success is the rate at which fans are returning and participating in creator experiences.

XR Sports has worked with two college conferences and more than 25 universities, including the Southwestern Athletic Conference, to build gaming-based fan solutions. They plan to partner with individual creators like athletes and musicians in the future as they continue to grow the platform. XR Sports is hoping its experience and the relationships built through the Mastercard Start Path program will connect it to additional funding.

This story was sponsored by our partners at Mastercard. For more information about the Start Path In Solidarity Program, visit here.