Running a small business is difficult, point blank. From building a customer base to figuring out social media algorithms that change on a dime. Adding to that, with the economic disruptions of the last two years, now more than ever small businesses need to streamline their operations.

In 2020, around 10 percent of businesses that employed less than 20 people closed, according to The Plug’s analysis of Census Bureau data. These closures impact not just small business owners and their employees, but the community as a whole.

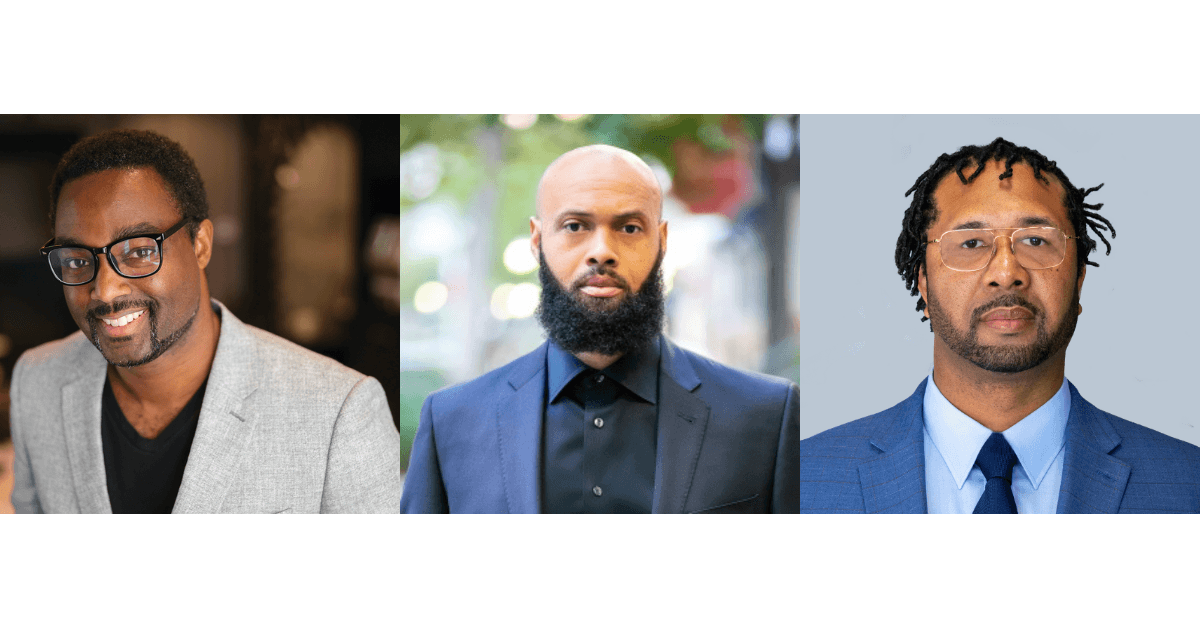

Underrepresented fintech founders from the Mastercard startup engagement program, Start Path, are stepping up to the plate to address pain points and create tools that help small business owners grow their companies and run more efficiently.

These tools range from an app that synchronizes the entire customer journey and provides a live shopping experience to a platform that essentially automates the financial planning process.

oneKIN

Many small businesses starting out today are more likely to have an online storefront than one on Main Street. But by being just online, owners often struggle with getting enough visibility to build a customer base.

“E-commerce was really designed to solve for the limitations of brick and mortar by providing kind of this seamless connectivity, but the reality is, unless you have a multimillion-dollar marketing budget to feed the algorithm, you’re never going to get prioritized in the search queries,” Marvin Francois, co-founder and CEO of oneKin, an AI-powered live shopping platform, told The Plug.

That is why Francois and his co-founder Jennifer Gomez created oneKin Live, an app that works as a sort of modern-day QVC where customers can find new products and services, chat with founders and purchase through live shopping events all at once. This streamlines the customer discovery process for business owners into one platform instead of multiple marketing touchpoints.

“That often looks like email marketing, social media, spending several hours kind of figuring out an Instagram Reel, building audiences across all these platforms only for an algorithm to say ‘Just kidding!’” Gomez, chief marketing officer of oneKIN, told The Plug. “What oneKin Live does is shortens and flattens it so that it’s a full-funnel shopping experience.”

And it is not just CPG brands that can use oneKin Live, but artists and creatives as well. Gomez said that during Art Basel in early December, some artists used the platform to do live painting via the app.

After launching on Black Friday this year, oneKin is now also partnering with pop-up market organizers, malls and book publishers

“We’re excited about what next year looks like because we’re going to really triple down on this bringing in some really big partners,” Francois said.

Finpro

Another pain point small business owners often face is having a full, clear picture of their business’s financial situation.

That is where tools like Finpro come in, which uses AI and machine learning to essentially automate the entire financial planning process.

“For people who don’t know how to use spreadsheets to forecast financials, we make it easier for them,” Serge Amouzou, founder and CEO of Finpro, told The Plug.

“So, marketing teams can log into our software and get recommendations for next steps, such as ‘Spend $50,000 on Facebook ads to increase sales 20 percent this week,’” Amouzou said. “Then they can go ahead and forecast their budgets. Sales teams can do the same thing, product teams can do the same thing. And all this data can inflow to the finance team that can approve or give feedback on those budgets.”

With Finpro, having a centralized platform for financial planning analysis streamlines the decision-making process. Having a clear picture of this data can help businesses get loans from the bank faster, collaborate across remote teams better and make informed decisions to grow the business.

This year, Finpro has signed a mid-five-figure deal with an accounting firm and is in conversation with a few CDFIs. The company is also raising a $2 million seed round that it aims to close in Q1 2023.

Goodfynd

Finding the right software and tech tools for small businesses can be hard. Many tech solutions for entrepreneurs tend to be enterprise-focused, and are therefore overweight, pricey, and do not fit the specific needs of a small business.

But Goodfynd, a point-of-sale platform for food trucks and vendors without a permanent brick-and-mortar, is trying to change that. Their technology increases a business’s visibility and profitability and allows vendors to manage their business, from payments to operations, in a single platform.

“Saving both time and money are key to having a thriving small business,” Sofiat Abdulrazaaq, co-founder and CEO of Goodfynd, told The Plug. “The more efficiently a business runs the greater its potential profit.”

Streamlining business operations and utilizing technology to increase efficiency is what will help a small business grow and flourish. And ultimately, the work that oneKin, Finpro, and Goodfynd are doing is about more than just building a product — it is about helping small businesses be around for the long haul.

“Communities thrive when small businesses thrive,” Francois said.

This story was sponsored by our partners at Mastercard. For more information about the Start Path In Solidarity program, visit here.