KEY INSIGHTS

- Adoption of fintech among Black Americans has reached 82 percent.

- Twenty-two percent of Black Americans reported that before fintech became widely available, they rarely kept track of their financial information.

- A host of new fintech startups like Novae and ZMBIZI provide personal finance management tools that aim to educate consumers about money and grow their wealth.

Financial technology (fintech) adoption is growing like never before. Black-led fintechs are paving the way to improved financial tools and education among Black Americans.

Black-led fintechs are experiencing rapid growth in giving and meeting the met needs of consumers.

“We are extremely proud of the success we’ve gained and feel tremendously blessed to be in this position,” Reco M. McCambry founder of Novae, told The Plug. “I come from humble beginnings, it is very important to provide low barriers of entry to inspiration, education and opportunity; which is what the foundation of Novae is all about.”

Novae, a financial consulting and training company, has quickly gained notoriety for being the first Black-owned fintech company to offer ‘Buy Now Pay Later’ services for small businesses nationwide. The company has also released services in consumer financing and entrepreneurship opportunities to help customers to financial freedom.

This year Novae will continue to create solutions for individual consumers and small business owners nationwide. The company will also expand its White Label Partner Program to leverage the marketing prowess of other financial services entrepreneurs to help businesses and customers.

Other companies are suppling quick solutions to unforeseen financial issues. Solofunds has also paved the way for providing emergency loans for unexpected financial situations. Through its peer-to-peer program, investors and borrowers can access $50-$1000 in minutes. The company’s borrowing system efficiently grows responsible borrower’s ability to access loans after each transaction.

“Historically, we’ve had better success at payback. Our default rate is 11 percent compared to the industry average, which is 33 percent,” Travis Holloway, co-founder of Solofunds, told The Plug. “We wanted to take the stress out of asking, so we asked, ‘how do you figure out how to unlock discretionary income? And prevent people from taking out predatory loans’.”

The company recently acquired a B Corporation (B Corp) certification solidifying its dedication to underrepresented communities. This certification comes as the company is expanding its services to help customers manage and grow their finances. Out of more than 4,000 B Corp-certified companies in the U.S. and Canada, only 13 are Black-led.

Black-owned companies and workers are creating resources to help future fintech companies. Consumers will have financial tech options such as mobile transactions to free data access for creating more fintech projects.

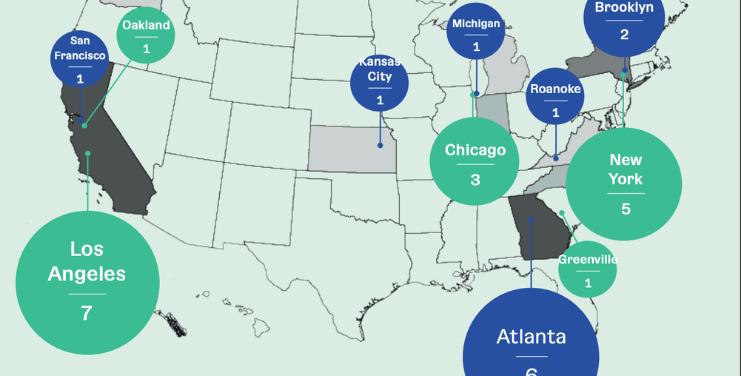

Benjamin Aubin, the former manager of the hip-hop trio The Fugees, is the founder and CEO of ZmBIZI, a smartphone and fintech software company. The company launched a pilot program with VISA to provide minority-owned businesses in Los Angeles the opportunity to use the phone and its tap-to-pay features.

The phone was recently released in select retail stores and a few pop shops. Businesses can use the pre-loaded finance features like mobile invoicing, tap and pay for contactless transactions and earn money for sharing opinions.

Other black professionals are leading in fintech innovation. FinTech Sandbox, a data residency program, assists over 230 fintech startups. Kelly Fryer, the Executive Director of nonprofit FinTech Sandbox, helps guide fintech startups to build innovative products by providing critical data access and development resources at no cost.

As a nonprofit, Fintech Sandbox does not profit solely off of financial returns. Kelly explains to Markets Media that Fintech’s six-month program room and free data access, which are expensive for early-stage fintech startups.

Fryer later explains to Markets Media that the next stage for Fintech Sandbox is financial inclusion and access and sustainability. Fryer plans to increase representation of race and gender in Fintech Sandbox’s portfolio.

Since joining the organization in September 2020, Fryer has been vocal about financial inclusion, sustainability and evaluating many early-stage start-ups through this lens.

These businesses will stack up to the growing demand for fintech projects and services.

According to a November 2021 study conducted by Plaid, a fintech company that provides APIs for fintech applications, the use of financial technology has reached mass adoption in the. U.S. consumers using technology to manage their finances increased from 52 percent to 88 percent. Americans more frequently use fintech than video streaming at 78 percent and social media at 72 percent making fintech the most used consumer technology next to the internet.

The study explains that 86 percent of Black U.S. households have access to banking tools while 81 percent of those surveyed use technology to manage their finances. The Plaid report notes that in the U.S. p people of color turn to fintech more than white Americans when facing financial challenges.

Financial problems stem from demographics, fees budgeting and finance maintenance. Attitudes towards fees vary by demographic but 20 percent of Black Americans and 31 percent of Hispanic Americans report being the most concerned about fees. To combat the issue, 37 percent of Black people and 31 percent of Hispanics use online banking that tends to have lower or no fees accounts.

Twenty-two percent of Black and Hispanic Americans did not keep track of their credit scores before using fintech. Keeping written lists is a strategy 22 percent of Black Americans and 28 percent of Hispanic Americans use to keep track of financial information like accounts and credit scores.

Fintech is also breaking taboos as 61 percent of Black Americans regularly chat about finances, which is above the national average of 51 percent.

Financial services are honing in on listening to the needs of minority businesses to more effectively support their financial needs.

Sponsored Series: This reporting is made possible by the The Ewing Marion Kauffman Foundation

The Ewing Marion Kauffman Foundation is a private, nonpartisan foundation based in Kansas City, Mo., that seeks to build inclusive prosperity through a prepared workforce and entrepreneur-focused economic development. The Foundation uses its $3 billion in assets to change conditions, address root causes, and break down systemic barriers so that all people – regardless of race, gender, or geography – have the opportunity to achieve economic stability, mobility, and prosperity. For more information, visit www.kauffman.org and connect with us at www.twitter.com/kauffmanfdn and www.facebook.com/kauffmanfdn.