A small but growing group of black investors are raising big dollars in a venture capital community that traditionally lacks diversity. They are an eclectic mix of professional athletes, C-suite level executives, and former Wall Street bankers. To date, their funds range from $5 million to $100 million.

But do these new black-owned venture capital firms behave differently than their counterparts?

So far, the answer is no.

The track record of these firms is relatively short. A great deal of them opened shop as recent as a year ago with the average firm launching in 2012. However, early data suggests that most of the 33 black-owned and led firms we sourced, using CB Insights data and documents from the Security and Exchange Commission, follow similar patterns as their industry category predecessors.

A look at 21 black-owned venture firms, with historical investment data in the CB Insights platform, reveals a few key behaviors that parallel traditional (read white and male) venture capital firms.

Black Venture Firms Operate from Tried-and-True Markets

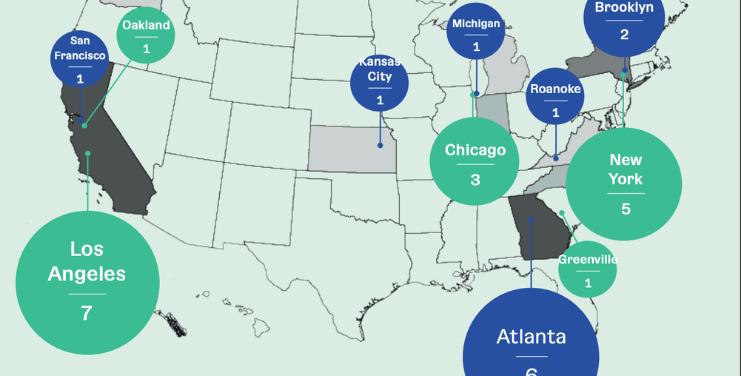

Nearly half of the 21 identified firms are headquartered in cities teeming with extensive startup ecosystems apt for entrepreneurial growth and access to plentiful investment opportunities. In these cities, there is an abundance of accelerator and incubator programs, pitch competitions, a slew of high-quality co-working spaces, and close proximity to individual and corporate investment dollars.

Of the represented black-owned firms, nine are based in California, four in New York, and two are in Atlanta. Similar to their counterparts, black-owned venture capital firms are sticking close to larger markets with greater access to deal flow.

For the outliers that head up their operations in cities outside of key markets, their investments are tied solely to the communities in which they are headquartered. For instance, the Wolverine Venture Fund is led by a diverse team of current and former students at the University of Michigan in Ann Arbor, Michigan. The majority of their investments were made in companies within the Michigan region.

Cleveland Avenue focuses its seed capital investments within the Chicago entrepreneurship community and also pairs their investments with access to incubator, accelerator, and technical assistance programming in support of the local entrepreneurship ecosystem.

Investments Outside of Key Innovation Hubs Are Minimal

Minority-owned firms are also sidestepping small and mid-sized cities and going after the big wins in bigger cities. At least for now. A cursory overview of recent investments from public records, online articles, and historical data spanning two to five years from 9 out of the 21 firms reveal that on average 30 percent of black-owned venture capital firms make their investments in companies within the Silicon Valley region. New York City comes in next at an average of just over 21 percent, and Southern California company investment at just over 17 percent.

This data isn’t surprising. The top investment hubs for all venture capital are specifically within these major markets. For black-owned firms, they’re on par with the rest of venture capital’s geographic constraints.

However, reaching a more diverse group of entrepreneurs in emerging markets, a focus on majority-minority cities with access to educated populations and market-specific expertise could be on the horizon.

Backstage Capital, launched in 2016 by Arlan Hamilton, is one of the more recent firms, based in Los Angeles, that has stepped outside of the proverbial box. Hamilton has tasked her fund to invest in women, minorities, and founders from the LGBTQI community. In a short period of time, she has invested in companies in Reno, Nevada, McKinney, Texas, and a few cities in Florida.

The Men v. Women in Senior Partner Roles

When it comes to representation across the board, early black-owned firms followed their market leaders by having an all-male presence in lead investing roles. Four of the firms with three or more partners had no senior female leadership on their teams.

Others, mostly teams of two, appear to have both male and female representation balanced.

In comparison, traditional venture capital firms have been called out for mostly homogeneous teams with only eight percent of women represented at the top 100 venture capital firms. As black-owned firms grow, leadership representation will be another opportunity to break the mold.

The Future Isn’t Finished

It is still early in the data to determine how black-owned firms will perform over time and how their growth and expansion will increase investments in other minority founders across the country and within nontraditional markets.

One thing is certain, black venture capital firms and how they behave in the market can translate into real-time data on the future of the innovation economy and who gets to lead it.