KEY INSIGHTS

- The Consumer Financial Protection Bureau approved new rules that allow debt collection to contact debtors via social media platforms.

- In the U.S., 39 percent of people of color have debt compared to 24 percent of white Americans.

- The Federal Trade Commission (FTC) fraud service is one recourse for targeting rogue debt collectors.

While Congress is prolonging the federal borrowing limit debt deadline to 2023, the everyday person does not have that luxury. New rules approved by the Consumer Financial Protection Bureau (CFPB) took effect earlier this month to allow collection agencies to email, text and message people on social media to seek repayment for unpaid debts. Black Americans already have more debt than the average white American, but these new rules add to the online discrimination for Black Americans.

“If consumers don’t want to deal with their debt, they can opt-out and then the debt collector has the option of litigation,” Dean Kaplan, CEO and president of The Kaplan Group, a commercial collection company, told The Plug. “But many people do want to deal with their problems and social media is often the best way to communicate.”

The rules are an updated version of the 1977 Fair Debt Collection Practices Act (FDCPA) for the digital age. Under the Federal Trade Commission (FTC), the past rules focused on communication with connection of debt collection, unfair practices and validation of debts among other policies.

The new rules were devised during the Trump administration when the CFPB became more business-friendly than it had been in the past. Kathy Kraninger, former CFPB director, resigned in January at the request of President Biden, who nominated Rohit Chopra to be CFPB’s new director. The laws set a limit on how often debt collectors can call debtors. Agencies will be restricted to seven calls per week per account in collection.

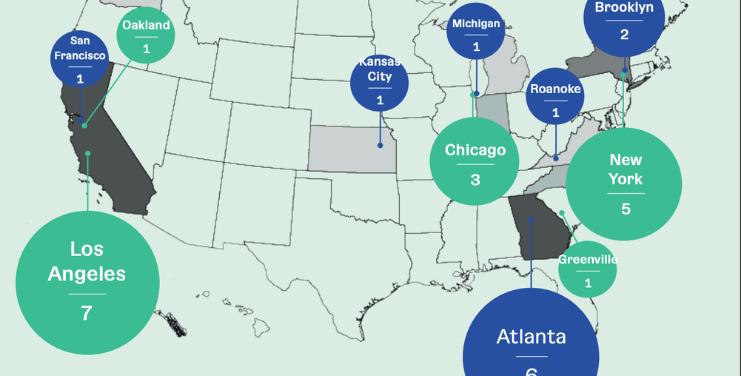

In the U.S. 39 percent of people of color have debt, compared to 24 percent of white Americans, according to an Urban Institute report. The median debt for communities of color is $1,887, slightly above the national average of $1,835.

Black Americans are more targeted by debt collectors with few options to relieve the matter, according to a 2015 Financial Industry Regulatory Authority (FINRA) Investor Education Foundation survey, which found that borrowers of color were called nearly twice as often as white borrowers despite similar rates of default and late payments. Debt collectors estimate contacting consumers more than a billion times a year.

Black Americans also have trouble filing for bankruptcy to settle debts. According to a National bankruptcy study, debtors in majority Black areas were twice as likely to have their bankruptcy case dismissed as debtors living in majority-white areas. The majority of Black Americans who file bankruptcy file under Chapter 13 instead of Chapter 7 at much higher rates. Chapter 13 is a risky choice because it requires five years of payments before any debt is wiped out, compared to Chapter 7 which requires around $1,000, either in one lump sum or over a few weeks.

Between 2008 through 2010, only 39 percent of Chapter 13 cases filed by debtors from majority-black zip codes ultimately resulted in a discharge of debts. In contrast, 58 percent of cases filed by debtors from majority-white zip codes were discharged.

There are some ways to look out for debt collectors as social media opens the communication hub.

“If they feel pressured or feel like they’re being threatened in any way, that’s an opportunity to stop having any kind of conversations,” Leslie Tayne, Founder and Head Attorney at Tayne Law Group told The Plug. “Just because they call up with a little bit of information doesn’t mean that you should provide them with your information.”

There are several federal services and programs to flag unlawful debt collector behavior. The Federal Trade Commission (FTC) created the Operation Corrupt Collector initiative that protects citizens and cracks down on unethical practices. The initiative collaborates between the FTC and more than 70 law enforcement partners to take action against deceptive and abusive debt collection practices.

Suspected fraudulent activity can be reported to the FTC Report Fraud service. Individuals can file a complaint explaining the situation, obtain information for future protection and share the report with FCT’s law enforcement partners for investigation.

Americans can file with the FTC, CFPB, or even in some cases, the state, a jury, attorney general or the local consumer affairs division. However, that person may not get a direct response, but that agencies will potentially use the data to investigate those types of practices.

Depending on the area, a simple search can display many private sector agencies that deal with rogue debt collectors. The American Bar Association is another place to file complaints with a consumer-based attorney. Nonprofits can aid with debt repayment for financially challenging times.

Sponsored Series: This reporting is made possible by the The Ewing Marion Kauffman Foundation

The Ewing Marion Kauffman Foundation is a private, nonpartisan foundation based in Kansas City, Mo., that seeks to build inclusive prosperity through a prepared workforce and entrepreneur-focused economic development. The Foundation uses its $3 billion in assets to change conditions, address root causes, and break down systemic barriers so that all people – regardless of race, gender, or geography – have the opportunity to achieve economic stability, mobility, and prosperity. For more information, visit www.kauffman.org and connect with us at www.twitter.com/kauffmanfdn and www.facebook.com/kauffmanfdn.