Adapted from last week’s HBCU newsletter. Subscribe now to make sure you don’t miss the next issue.

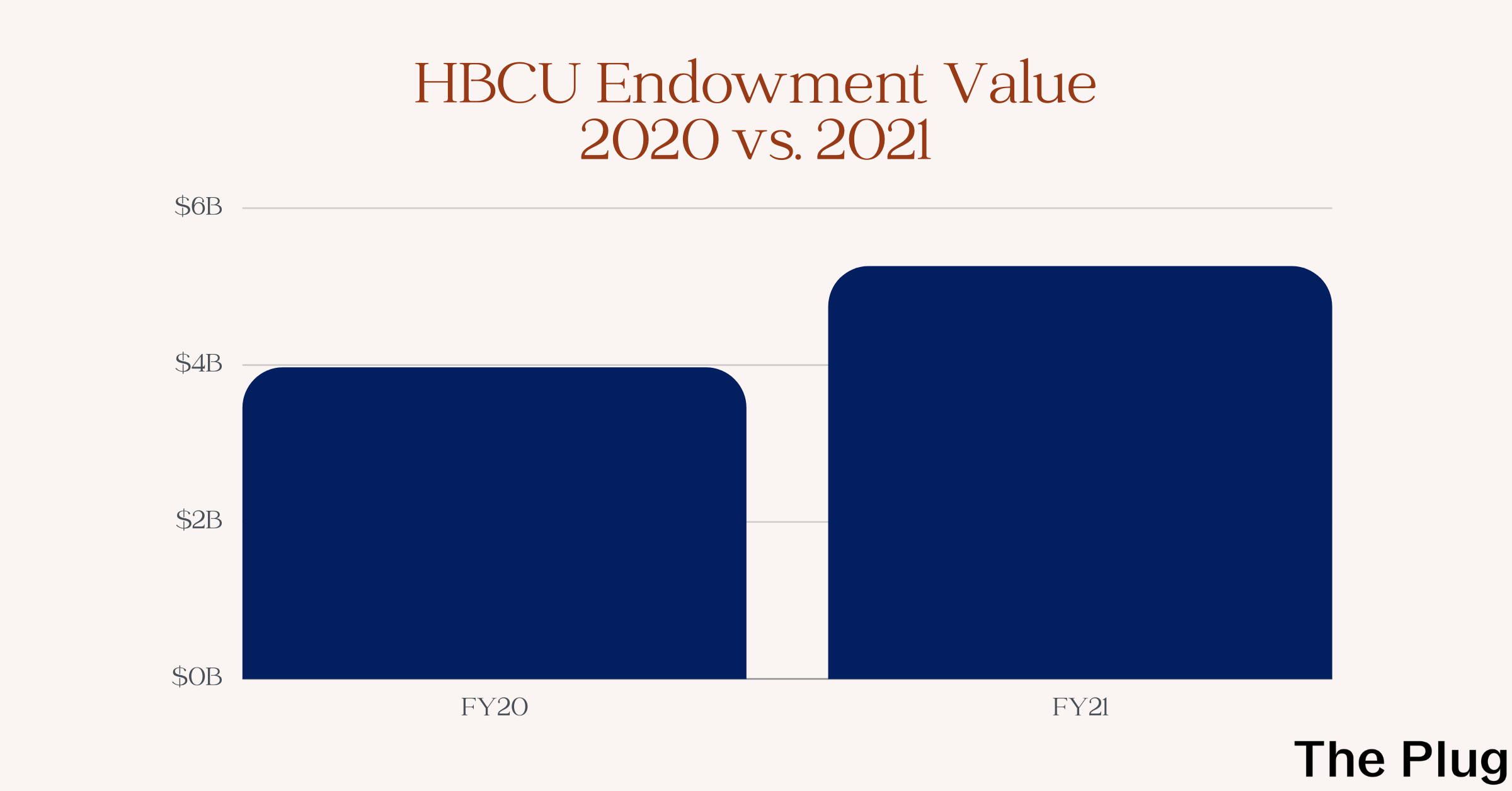

After George Floyd’s murder, corporations all over the U.S pledged over $50 billion towards racial equity. Over the past two years, millions of those dollars have been distributed, and while it’s not nearly enough to undo centuries of institutionalized oppression, we can already see positive ripple effects of the money.

Two nonprofits dedicated to helping HBCU students have received and/or been pledged nearly $100 million, and are putting it to good use:

The AltFinance Initiative

Last summer, three multibillion-dollar asset management firms made a splash when they announced they were giving $90 million over the next 10 years to open more pathways for HBCU students to enter the alternative investment industry.

Apollo Global Management, Ares Management and Oaktree Capital Management are each donating $3 million a year for the next decade to help fund paid fellowships, scholarships, internships and a virtual institute administered by the University of Pennsylvania Wharton School of Business.

In the past year, they spun up a nonprofit to run the initiative, installed Marcus Shaw as the nonprofit’s CEO, donated $2 million for the business schools at the initial four HBCU partners and welcomed their inaugural class of 31 fellows. More than two-thirds of the fellows are spending this summer interning in alternative investment firms, and the others are interning at tech, consulting and wealth management firms.

“We’ve got students now that weren’t aware of these companies and weren’t thinking about this industry in January, that are now working in the industry building networks, building capabilities to be the next great investors,” Shaw told The Plug.

Students enter the fellowship either as rising sophomores or rising juniors, and they continue with it until they graduate, meaning their access to trainings, classes, mentorship and networking is continuous.

The inaugural class of fellows came from Clark Atlanta University, Howard University, Morehouse College and Spelman College, but the second cohort that will launch this fall will expand to also include Hampton University, Florida A&M University, Morgan State University, and North Carolina A&T State University.

The CodeHouse Scholars Initiative

Another initiative that has been made possible by corporate funding over the last two years is the CodeHouse Scholars Initiative (CHSI), aimed at supporting HBCU students in their burgeoning tech careers.

“We knew that there’s a lot of work that needed to be done when it came to students transitioning into college and getting them early exposure and access to skill building to be prepared for the tech industry,” Ernest Holmes, President and Co-Founder of the nonprofit CodeHouse, told The Plug.

Through CodeHouse, students attend a month-long program the summer before their freshman year to help bridge the transition from high school to college, receive up to $20,000 in scholarships over their undergraduate career, one-on-one mentorship, professional development and internship opportunities from the tech companies that partner with the initiative.

The nonprofit has received at least $3.4 million from its partners PayPal and Google as well as Microsoft, UKG, Twitter and LiveRamp for the initiative.

In 2021, CodeHouse hosted its first cohort of more than 25 students from the schools at the Atlanta University Center — Clark Atlanta University, Morehouse and Spelman College. This year, they have also expanded to Howard University and North Carolina A&T State University after Google gave CodeHouse a $1 million grant.

And yet, this funding is still just pennies compared to corporate revenues

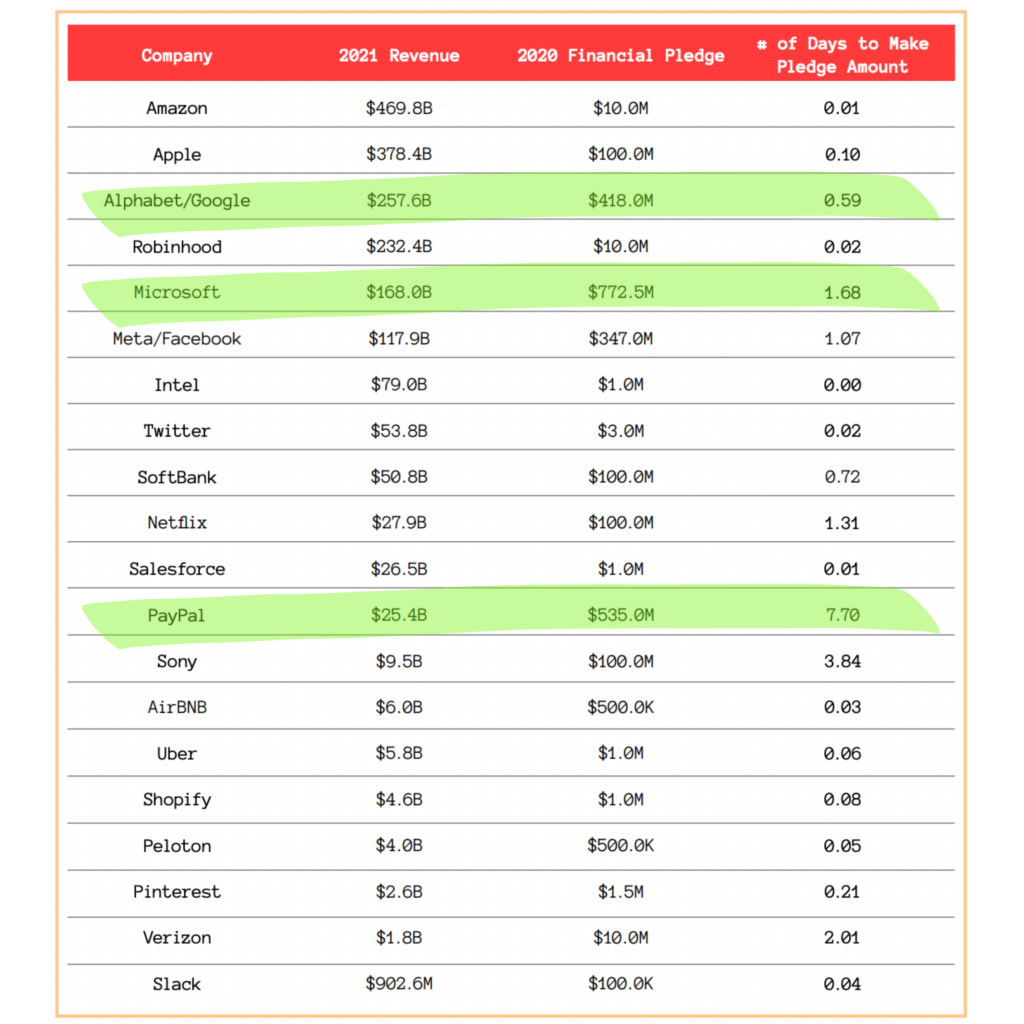

When Apollo, Ares and Oaktree announced they would each give $3 million a year to AltFinance, the contribution was roughly just 0.001 percent of their $461 billion, $227 billion and $153 billion assets in 2021, respectively.

For three of the main supporters of the CHSI — Google, PayPal and Microsoft — the hundreds of millions they pledged to racial equity causes would take them about a week or less to recoup.

While there are fruits of these initiatives supported by corporate gifts, the fact is that companies have the potential to be giving more and helping impact even more lives.