A select list of companies and financial institutions funding Black investors indicates that the kinds of entities working with Black fund managers are becoming more diversified, especially as a result of last year’s racial equity movement. The white and male-dominated venture capital community is slowly making inroads for Black investors, who are also taking matters into their own hands by launching funds. These efforts could lead to the private equity industry becoming more inclusive.

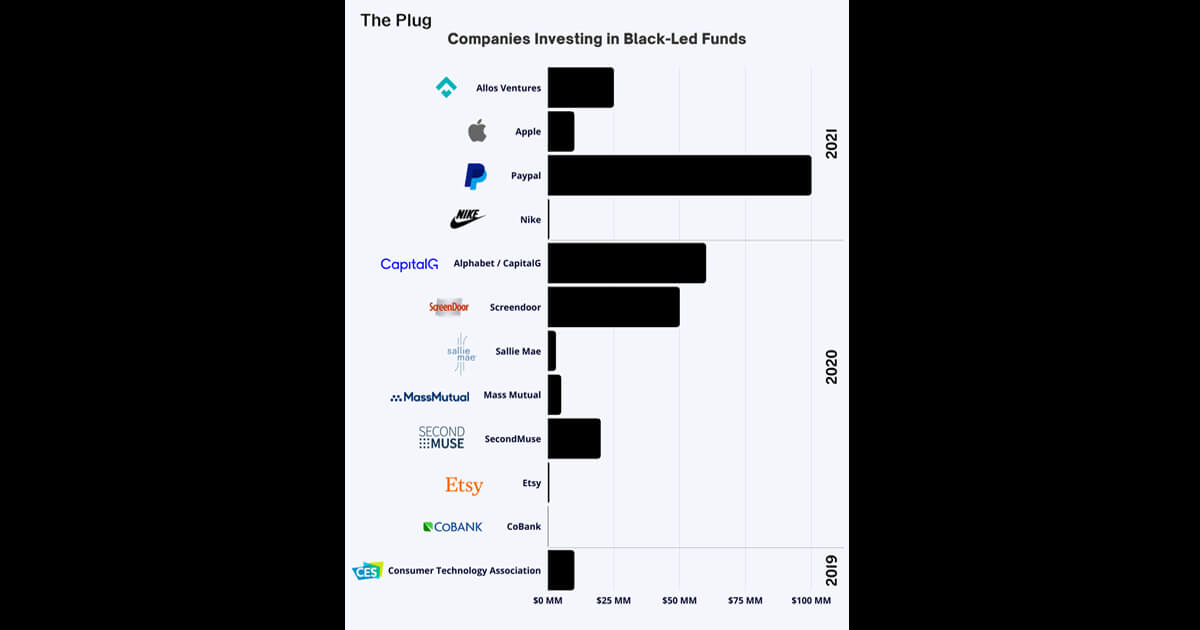

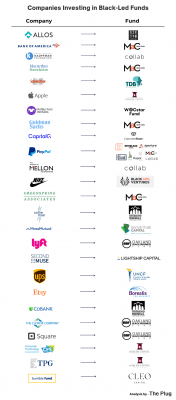

The Plug‘s database of companies publicly investing in Black-led funds reached a critical mass in 2020 and has sustained during the first half of 2021. Among the 25 companies and institutions on our list all but three of them (92 percent) invested in Black venture firms between 2020 and 2021, with disclosed funding totaling upwards of $284 million.

Capturing Momentum

Black fund managers having the know-how to capitalize on this moment of heightened interest and commitment to diversifying private equity and venture capital will also help drive better outcomes, according to Bahiyah Robinson, CEO of VC Include, an organization that provides resources to assist and diversify fund managers. Everything has turned on its head in the last 14+ months, and particularly in the year since George Floyd. Meeting the moment needed education on both sides of the marketplace on the limited partner side as well as the general partner side, Robinson told The Plug.

We’re seeing certain gaps of knowledge in how to build an institutional-grade asset management firm that can scale from a fund I to a fund IV or V, she said. Robinson’s work in social entrepreneurship and impact investing started in 2009 and led her to source tech talent in Africa. She went on to oversee co-investment deals with the World Bank in 2012 and the U.S. State Department to strategically invest in tech on the continent before moving on to work on supply chains of capital markets.

You can help a handful of people get a few million dollars, but how do you scale it? I started looking at the capital markets perspective and less about the ecosystem of founders and the supply chain of capital, she said. I thought about starting a fund myself in 2017, I canvased the world to find a woman of color with more than 10 years of VC experience and I found one in a year of searching.

The scarcity of experienced Black investors led Robinson to create VC Include. Now, the problem the organization hopes to solve is increasingly being taken up by investors within predominantly white institutions that do not have a history of developing diverse investors. Finding fund managers is similar to finding startups, there’s some basic pattern matching. In order to get funding it asks, ‘what’s your track record?, who do you know?’ all of these pieces tend to create a homogenous, circular product of who gets to run a fund and who gets funded, Liz Roberts, director of MassMutual’s newly formed Catalyst Fund and Emerging Managers Fund, told The Plug. We’re looking at how to innovate these things so we’re not filtering out great opportunities.MassMutual has established two $50 million funds focused on diverse founders and emerging fund managers.

The financial institution’s impact fund invests with a strategy that the best talent can come from anywhere if given the opportunity. Data shows that diverse teams create higher profitability, which suggests providing resources to Black fund managers is a financial imperative. When people hear impact investing, they hear ‘submarket.’ When you add race to that, they hear charity, which is so frustrating as an impact investor, Roberts said. If you look across your portfolio of fund managers and they don’t reflect the population you simply are not getting the best talent, it’s just math.

Making A Difference While Making A Profit

Historically the effort to get more funding to Black investors existed through public and private partnerships.It was important for our fund which is focused exclusively on founders of color to demonstrate that we could create a competitive return and that we could also have these impacts, but at the time we called it making a difference while making a profit, Edward Dugger, President Reinventure Capital told The Plug. Dugger said the history of the federal government moving away from block grants for community reinvestment to the Minority Enterprise Small Business Investment Corporations (MESBIC), a minority startup funding program with the SBA matching private investor dollars 3X, became an important investment vehicle for Black-led startups in the 1970s and ’80s rather than Black investors.

LPs were interested initially in what we [Black fund managers] did with our money, in other words, it wasn’t good enough for them to invest in us as managers of color; they wanted us to invest in businesses of color. We were seen as an important intermediary, Dugger said. As LPs got less interested the focus defaulted back to investing in managers of color without much regard for what they did with the money.

Reinventure Capital secured $5 million in funding from MassMutual in April, largely due to Duggar’s track record of successful returns at a previous fund, Boston-based UNC Ventures in the 1990s. The fund generated a 32 percent return and $2 billion in equity financing with Dugger at the helm. While there are notable examples of success, Black fund managers are perceived very differently than their peers of other races contributing to a lack of diversity. Organizations are applying a consultative lens to correcting the homogeneity of investor circles, but also using data.

Mitigating Risks

There is this perception that Black fund managers are riskier, that they have to have more hooks in the way that their capital is deployed that you don’t see with fund managers that aren’t of color, Tynesia Boyea-Robinson, CEO of CapEQ, an investment advisory firm focused on social impact, told The Plug. I have a private equity person I worked with and he said ‘by the time the capital gets to me. it’s got so many levers on it to ‘de-risk this investment that it’s not even useful.

Boyea-Robinson helps investment firms evaluate for biases, which can present missed opportunities and profit, creating a guide for investors on how to make capital more useful for diverse investors. CapEQ, along with PolicyLink, is trying to identify standardized processes and collect data around what is driving inequity in investing.

The missing ingredient is accountability for the entire private sector, our work is to establish that accountability. We need standards, we’ve come together to spell out exactly what it means to shift power and allocate risk in a very different way, Mahlet Getachew PolicyLink, managing director of corporate racial equity and legal, told The Plug.

PolicyLink, CapEQ, Global Impact Investing Network (GIIN) and others are working in tandem to come up with a set of standards around equitable investing. The development of these standards will help set a baseline for what is an antiracist investment strategy. An intentional strategy is fundamental for a sustained effort to diversify venture capital and must outline very specific goals in order to be successful. As The Plug’s recent list of investors shows, the last 16 months have created a push for investments to Black VCs, but much like the racial equity movement that spawned much of this deal flow, a longer-term view is needed to bring real change to private equity.

Just saying that PayPal, Netflix or Google has made investments doesn’t really speak to any kind of long-term strategy, Robinson said. There’s a lot of desire and an upcoming wave of folks coming upfront and continuing to invest and others are going to retreat. They might have invested in 2020 or 2021 but you might not see a whole bunch of dollars flowing after that.