KEY INSIGHTS

- Thirty-five percent of Americans answered correctly on financial questions used in interest rates and investment diversification, the average number of correct answers was 1.8 out of 3.

- Black-led banks like Greenwood are increasingly starting financial education programs.

- The Financial Literacy and Education Commission (FLEC) has led federal member agencies in providing information and guidance for consumers on timely financial topics.

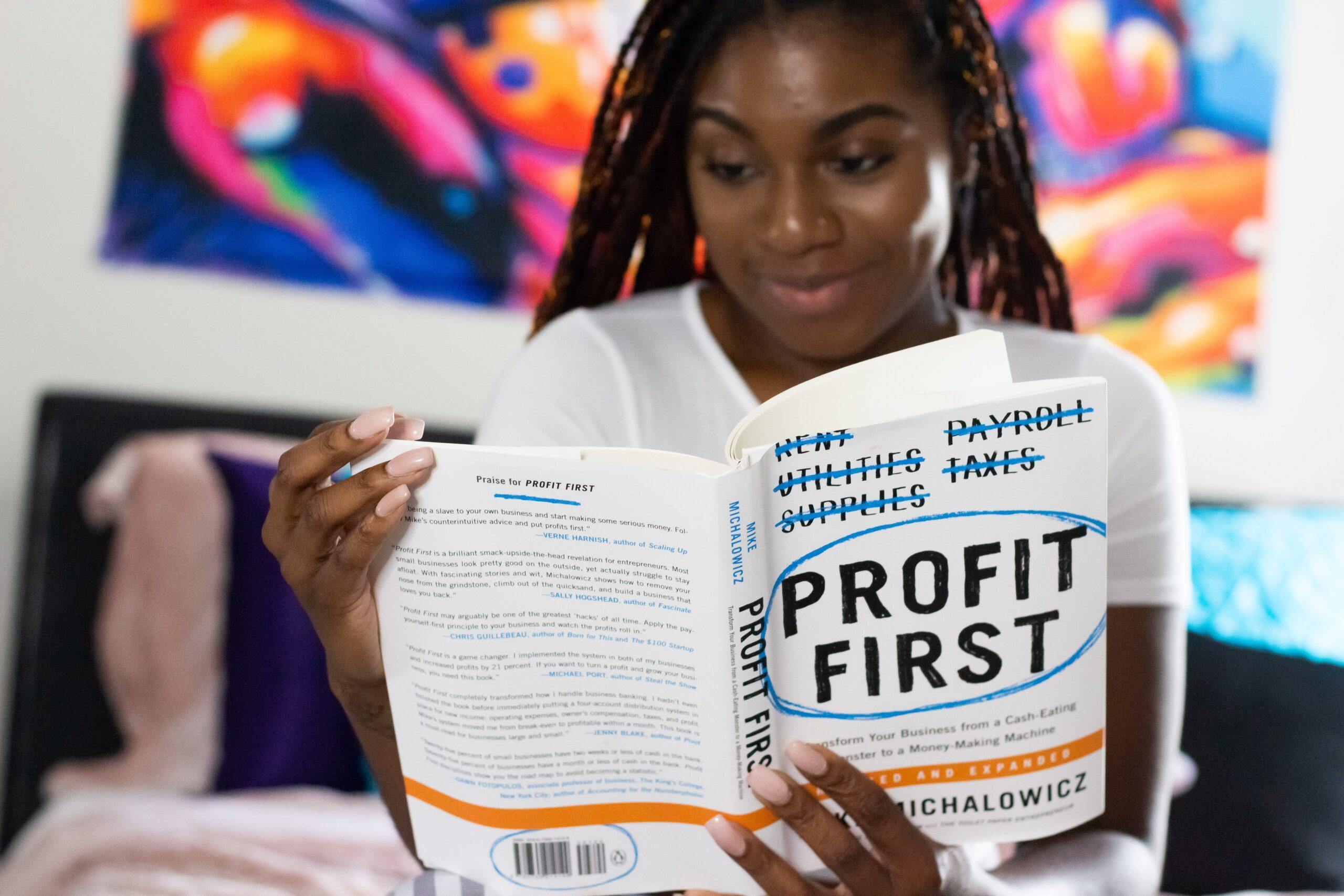

Black wealth is being analyzed and restructured like never before. Black legislators and banks are coming out with financial programs to grow and sustain the wealth of Black families. The roots to wealth building start in learning financial management, budgeting and savings which contribute to financial literacy.

“The key to America getting out of this problem is that we find ourselves beset with whether we speak of the pandemic and health impact will have to do with the economy,” New York State Sen. James Sanders, Jr., said at the National Black Caucus State of Legislators conference (NBCSL) policy panel.

According to a 2019 Federal Reserve survey, 35 percent of Americans got a higher share of answers correct on a survey that asked questions around interest rates, inflations and investment diversification to gauge financial literacy. A 2018 National Financial Capability study had similar results using a six-question scale, seven percent of respondents answered all six questions correctly, and 40 percent answered at least four of the six questions correctly.

A 2021 Congressional Research Service report, found that African American adults, lower-income women, informally educated adults and younger adults are less likely to be financially literate relative to the rest of the population.

Several online banking and federal agencies have resources and programs to educate Black people on investment opportunities to create and sustain Black generational wealth.

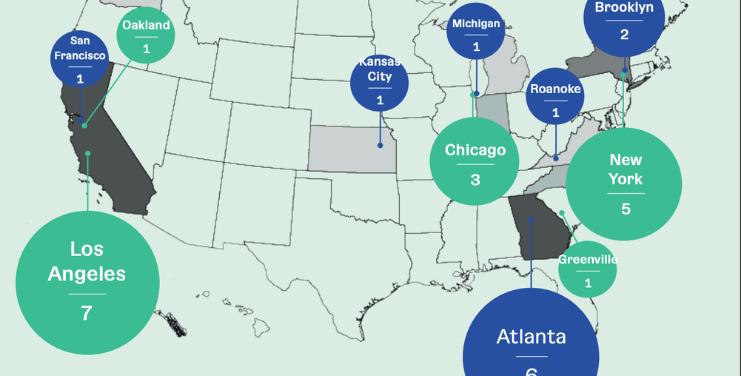

Greenwood, an online Banking service for Black and Hispanic users, recently opened a content studio designed to improve financial education under the guidance of co-founder Michael Render, known artistically as Killer Mike. Additionally, Greenwood’s studio is partnering with the podcast Earn Your Leisure to produce new programming aimed at Black and Latinx audiences.

Other programs are a daily podcast called Money Moves hosted by Tanya Sam of The Real Housewives of Atlanta, a documentary about Black Wall Street and “Greenwood’s Greenbook,” an online resource of Black and Latinx-owned businesses across the U.S.

Another resource is Black Bitcoin Billionaire, an organization for Bitcoin, cryptocurrency, and generational wealth building from all angles. The lessons cover things like Bitcoin literacy and how cryptocurrency can advance Black wealth.

“This (Black Bitcoin Billionaire) organization is available and is using some of the funds that we provide to educate and travel the country to make sure that African Americans in underserved communities understand the importance of Bitcoin how it works, and how it can be installed within their financial lives.” Chelsi H. Bennett, State Policy lead of Square/CashApp/Tidal, said during an NBCSL policy session.

Square One has a financial literacy program that offers a monthly guide to help users learn basic financial tasks such as saving, document writing and more according to a BusinessWest report. The program uses the SMART, specific, measurable, achievable, relevant, and timely goal technique that helps users set financial goals.

The program helps users understand the numbers and handle the stress that comes with grasping finances. Users are encouraged to save $10 a month or at least think about setting goals to save regularly.

Federal government agencies are implementing more resources to provide better education and economic opportunities for Black communities.

The White House recently released an executive order to increase economic opportunities for Black Americans. The plan is to understand systematic educational challenges many Black students face, improve Black families’ access to high-level pre-k education and connect education to labor market needs through programs such as dual enrollment.

Congress created the Financial Literacy and Education Commission (FLEC) to coordinate financial literacy activities throughout the federal government. FLEC comprises 22 federal agencies and The White House Domestic Policy Council. In recent years, FLEC has created national strategies for financial literacy and led federal member agencies to give information and guidance for consumers on topical financial issues.

The Federal Deposit Insurance Corporation (FDIC) recently updated its Money Smart finance program that enhances monetary management. Users have resource options of self-learning or traditional engagement among peers. People can learn everyday financial tips, play 14 economic games designed to test financial knowledge.

A growing bevy of tools ensures Black Americans have many financial resources to understand and build monetary wealth no matter the circumstance.