KEY INSIGHTS:

- Greenwood’s valuation is now $325 million after the company closed a “Series A2” round.

- The latest funding comes just months after the company acquired The Gathering Spot and Valence.

- Greenwood is also launching a monthly membership program that gives customers access to all the companies in its portfolio.

Greenwood, a fintech company geared towards providing banking opportunities for Black and Latino customers, has secured a $45 million funding round led by Black-founded investment firm Pendulum.

“This funding really accelerates our ability to deliver banking products, premium experiences, community, job advancement and wealth creation opportunities for the Black and brown community,” Ryan Glover, co-founder, chairman and CEO of Greenwood, told The Plug. He added that internally they are calling the raise a “Series A2,” essentially an extension of the $40 million Series A Greenwood closed in February 2021.

With this latest investment, Greenwood is now valued at $325 million, Glover said, and Pendulum becomes the company’s largest investor on a dollar basis. New investors in the round include Cercano Management, Cohen Circle and The George Kaiser Family Foundation. Previous investors include Bank of America, Citi Ventures, PNC, Truist Ventures and Wells Fargo, who also participated in this round.

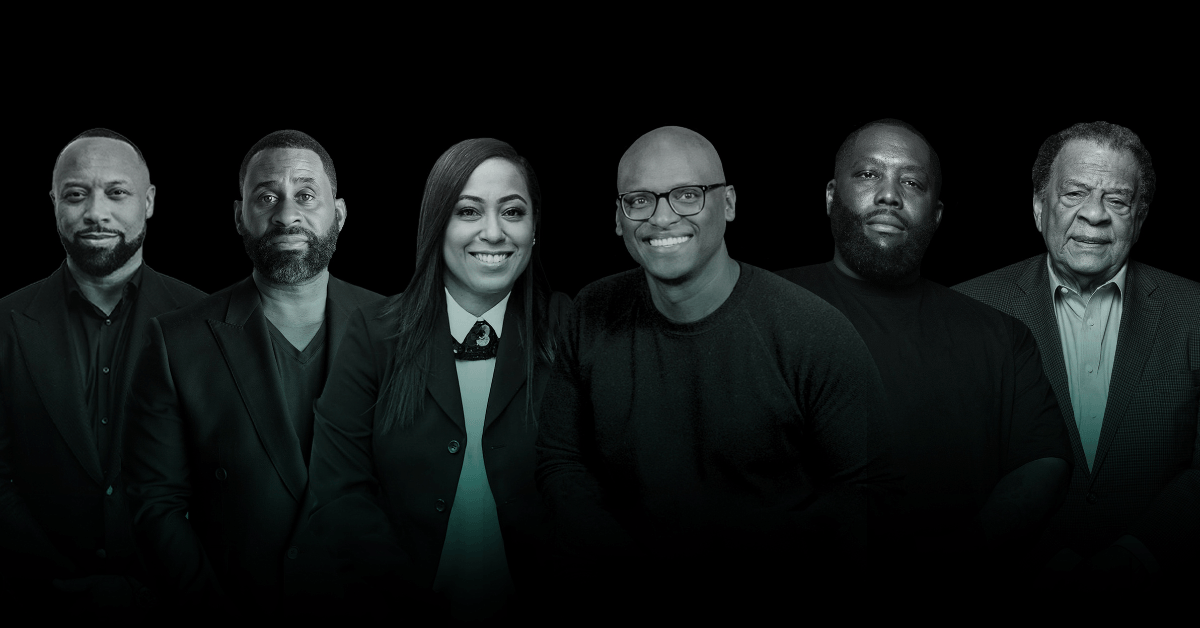

Greenwood was publicly launched in the fall of 2020 and named after the historic “Black Wall Street” district in Tulsa that was destroyed in the 1921 race riots. The company was founded by Glover, former U.N. ambassador and Atlanta mayor Andrew Young and rapper Killer Mike.

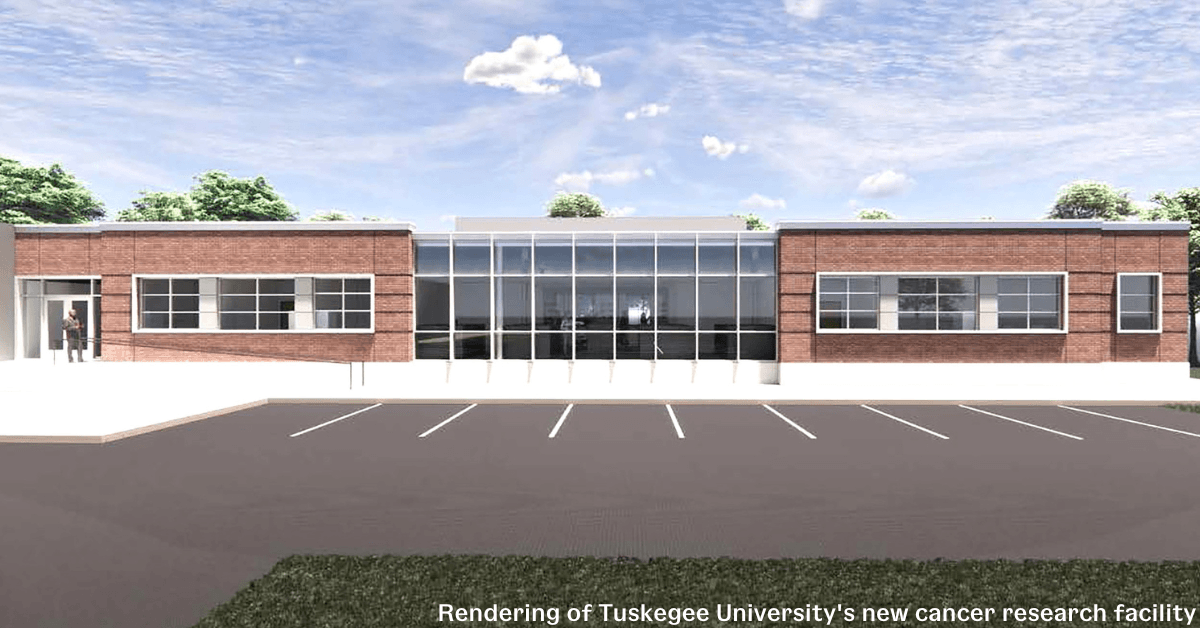

This year, Greenwood has expanded by making high-profile acquisitions of two other Black-founded businesses — professional networking platform Valence and The Gathering Spot, a coworking space with locations in Atlanta, Washington and Los Angeles..

“We believe that in order to build true wealth that there are other components that are necessary to build wealth and that’s building community, which The Gathering Spot does a wonderful job of doing, and also through the acquisition of Valence, we now have the ability to find our community members jobs and/or improve their job standing,” Glover said about the acquisitions. “It’s about who you know, just as much as what you know.”

Uniting Greenwood companies and looking to the future

Over the past two years, Greenwood has morphed from just a neobank to a full portfolio of companies whose missions center around supporting the Black community. To date, Greenwood has more than 100,000 customers, The Gathering Spot has more than 11,000 active members and Valence has over 25,000 members.

At the same time Greenwood announced its $45 million raise, the company also announced a new membership program, Elevate, billed as an “all-access pass to take your career and lifestyle to the next level.”

For $200 a month, customers get access to all three companies under the Greenwood umbrella. They can receive an Elevate card that is issued by Mastercard and provides travel, events and experiences perks, visit any of the three Gathering Spot locations around the country and use Valence’s networking and job placement platform.

“We created a wraparound experience offering products, services and moments that, no pun intended, elevate key facets of Black professionals lifestyles,” Glover said.

Looking to 2023, Glover said investment and credit products will be released, but ultimately Greenwood will continue to work to provide access to capital, access to people and access to opportunity for its users.

“Our overarching goal is to help our community get their money right and that comes in many different ways and forms,” Glover said. “So those three metrics are how we’re going to continue to build the brand and serve the members of our overarching community.”