KEY INSIGHTS:

- As HBCUs have recently seen a surge in corporate interest and support, the question is whether it is just a moment or a movement.

- Billionaire investor and philanthropist Robert Smith and Cisco VP Saidah Grayson Dill discussed this question at last week’s National HBCU Week Conference.

- Smith and Dill have two overarching pieces of advice for companies interested in engaging with HBCUs — be innovative and offer more than just a check.

Public-private partnerships are an important and enduring facet of higher education, serving to help create invaluable work experiences for students and pipelines of new talent for businesses. But creating successful and lasting partnerships can be a challenge, particularly for HBCUs.

“The best return on investment are HBCUs, without question,” Tony Allen, president of Delaware State University and chair of President Biden’s Board of Advisors on HBCUs, told a room filled with HBCU presidents, students and supporters last week during the National HBCU Week Conference.

“So if we can do what others can’t, we need to make sure that we are creating unique partnerships in the private and public sector,” he continued.

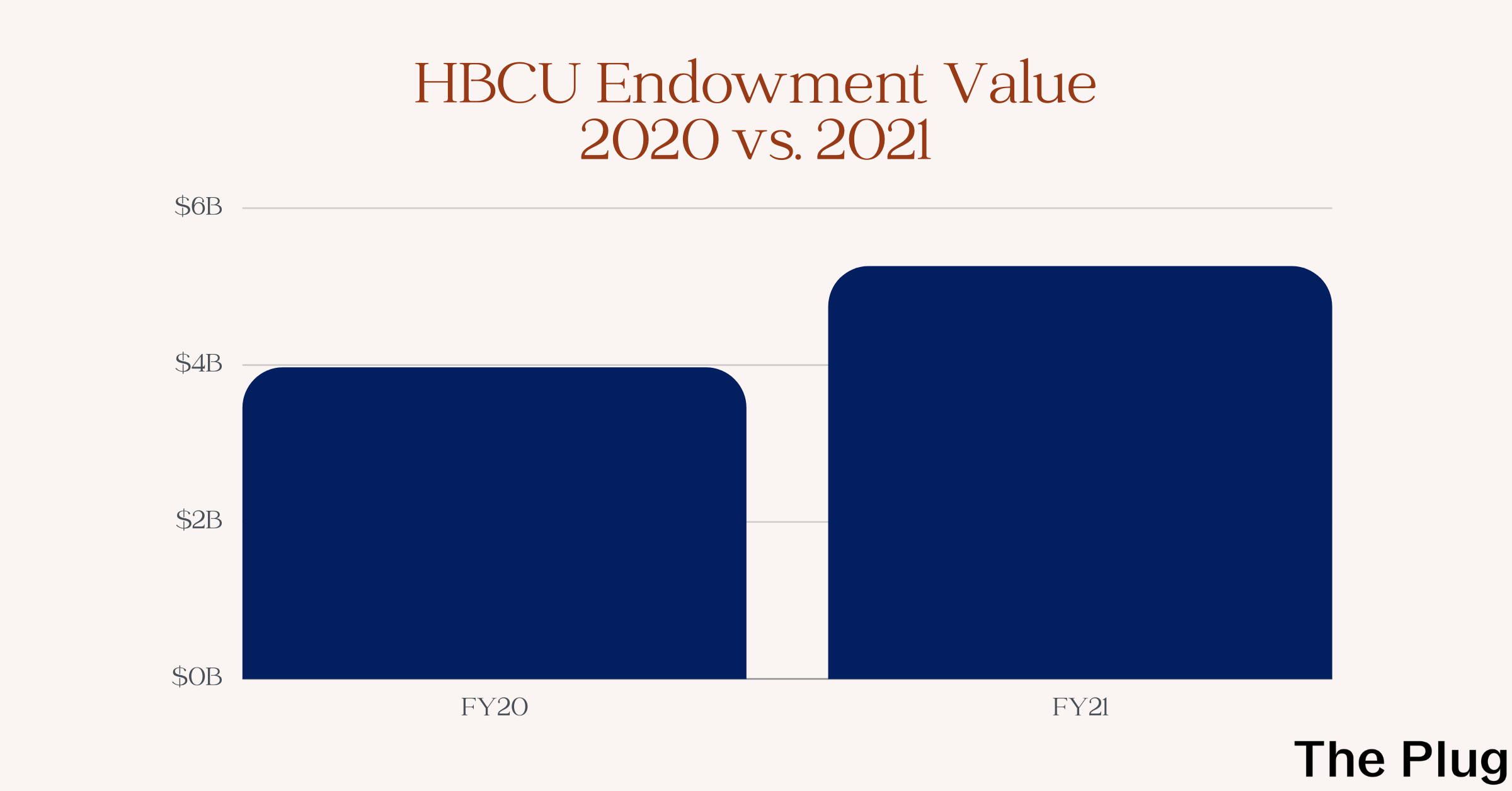

Over the past two years, HBCUs have had a renaissance, seeing increased enrollment, philanthropy, funding and corporate partnerships. But the question now, as it was in 2020 when the murder of George Floyd caused a flood of corporate pledges, is whether this support is just a moment or a movement.

At the National HBCU Week Conference, one of the biggest HBCU-focused conferences of the year, President Allen discussed this question with Saidah Grayson Dill, Vice President of Legal and Deputy General Counsel for telecoms giant Cisco, and Robert Smith, billionaire investor and philanthropist who famously paid off the student loans of the entire 2019 Morehouse College graduating class.

In paying off the loans, Smith realized the oppressive burden the debt was, not just on Morehouse students, but across the HBCU ecosystem, so he launched the Student Freedom Initiative (SFI) to liberate students of this burden. Among other things, SFI has alternative income-based financing for HBCU students and aims to improve HBCUs’ capacity to teach, do research and raise money by upgrading their IT infrastructure at no cost to the school.

Cisco has committed $150 million to SFI — $50 million to the alternative financing program and $100 million in labor, expertise, materials and supplies to upgrade all HBCUs’ technology infrastructure.

From their vantage point of being part of organizations that have created deep and meaningful partnerships with HBCUs, Smith and Dill have two overarching pieces of advice for companies interested in engaging with HBCUs: take an innovative approach and build relationships beyond signing a check.

Take an innovative approach

Too often, industry recruiters blame a lack of diversity on not being able to find it, instead of not looking in the right places.

“There’s a very, very large private equity firm out there that up until 2015, recruited at only nine schools,” Smith recounted at the conference. “They have over $1 trillion of assets — that’s with a ‘t’ — in assets under management, and they went to nine schools so they can hire people who look like them.”

Establishing a partnership with HBCUs may take a different approach than how companies have worked with colleges before, Dill said.

“You might have to think about that differently in terms of how you engage HBCUs versus predominantly white institutions,” she explained. If there are employees in the organization who are HBCU graduates, have them reach out to their alma mater to bring students as interns for the company, and get to know the HBCU individually, she suggested.

HBCUs are an incredibly diverse group of institutions, encompassing nearly every type of college or university there is in the U.S.: two-year and four-year colleges, private schools, public universities, land-grant institutions and graduate schools.

“Individually, get to know each institution, as many as you can,” Dill said.

Build a relationship beyond just signing a check

For an HBCU-industry partnership to be a lasting one, Dill and Smith said it has to go beyond money.

“Are you providing internships? Are you contributing to the endowment? Are you having discussions at the top of the university? Are you asking the university president, ‘What do you need and how can I help you?’” Dill explained.

Corporate money can also be a fickle friend, which is why it is important for HBCUs to get something more than just a check from a partnership as they also need to create opportunities for students.

“I would require some capacity of interns at a minimum that are taken annually and get, at a minimum, 10-year commitments to those levels of interns,” Smith advocated. “It is the exposure that our children need that will liberate their creativity, their genius and their opportunity to participate in the economy.”

But not all opportunities are positive, especially if it is a company that does not have a track record of supporting Black interns or employees. As such, HBCU leaders need to be judicious and do their due diligence.

“Ask questions about what mechanisms the companies have in place to support interns,” Dill cautioned. “I think it’s relatively easy and safe to get people in the door, but to keep them and to retain people, and to promote people and get them in the upper echelons of corporate leadership requires an infrastructure.”

Ultimately, creating successful and lasting HBCU-industry partnerships requires thoughtfulness and intentionality to yield good and fruitful results for both sides.