Village Capital’s latest report, “Beyond the Friends and Family Round: How to Help Diverse Founders Build Social Capital,” provides an overview of its VC Pathways pilot program in conjunction with UBS. VC Pathways supports African American, Latinx, and women entrepreneurs by helping them gain access to seed-stage venture funds and vital resources to elevate their companies. Out of 144 applicants, 30 early-stage companies in Atlanta, Chicago, and Philadelphia were paired with over 200 mentors over the course of three months. Ben Franklin Technology Partners, Goodie Nation, ImBlackInTech and Blue 1647 partnered with Village Capital in their respective cities to support local entrepreneurs. The report is divided into three sections, or lessons, from the program; Build social capital for Entrepreneurs — early and often, Create a common language for investors and entrepreneurs, and Empower local organizations to create meaningful connections for entrepreneurs in their communities.

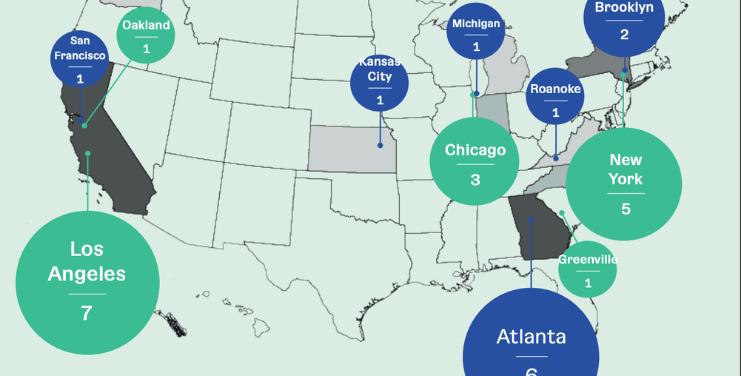

The findings serve as a model for policymakers, business leaders, and economic development heads to better serve underrepresented early-stage founders across the country. Ebony Pope, Director of US Ventures at Village Capital, is a major force behind the initiative from early conception, securing local partners, and overseeing the curriculum and investment readiness programs. “We as a firm are interested in overlooked places for entrepreneurs. Ninety percent of our investments are outside of Silicon Valley, Boston, and New York. Over 40 percent of our portfolio has women-led founders and over 25 percent minority-led founders.” In her development of the VC Pathways program, Pope says participants are trained to think like investors and receive tools on building social capital. “We want to take a lot of the bias out of the traditional investment decisions by bringing in companies that are solving similar problems in the sector and able to catch blind spots that we might miss because we don’t work in that space every day.”

The entrepreneurs received framework divided into milestones that investors use to assess companies. According to the report, participants in the inaugural cohort reached 80% of their milestones. Christian Zimmerman, co-founder and CEO of Qoins, along with CTO Nate Washington, participated in the Atlanta program. The company helps consumers achieve financial freedom by paying off debt through everyday purchases. “We started Qoins after graduating from college. Our initial pain point was student loans but quickly found that credit card debt was more stressful,” Zimmerman said. “What made me realize this was an issue was my unwillingness to set aside money to not only save but make additional payments towards my debts. I just kept making the minimums every month.” To date, Zimmerman says Qoins has successfully helped users pay off over $3 million in debt and is aiming for $10 million by the close of 2018. In an email, Zimmerman shared a new funding milestone for Qoins rounding out at just under a $1MM. Zimmerman remembers getting over 100 rejections from investors and having to borrow from friends and family. “We’ve also faced times where we almost had to take a bad deal just to stay alive. The biggest challenge we saw time and time again, was the issue of the finish line being pushed farther and farther away,” he said. “We would grow then would be told, ‘you need to hit X users.’ Then we would hit that number and would be told we need to hit another X number. Luckily, we’ve stayed true to our goal and because of this, after a year and a half we finally secured funding.” Zimmerman says his team’s VC Pathways mentor invested in Qoins and helped the company gain more exposure throughout Atlanta. “VC Pathways’ structure was different and more unique than other accelerators we’ve been in.

First being, no equity is taken,” Zimmerman said. “VC focuses on really shedding light on minority led founders in cities that are growing but still underrepresented. The hands-off approach of the program allows for companies to really focus on the business while still having meetings throughout the month to catch up and see progress.” Qoins has partnered with a financial wellness nonprofit to further the company’s mission of “helping people pay off debt.” Next month, the team is hosting a charity event to raise money to support a family in need. Rayford Davis, founder and CEO of Exception-ALLY, an edtech startup that delivers personalized recommendations to parents of students with special needs, also participated in the Atlanta cohort of the VC Pathways program. Known as the TurboTax for special education, Exception-ALLY simplifies the special education process with a customized action plan for families. Davis says his key takeaways from the program were seeking out investors, particularly ones with early-stage companies, who are familiar and interested in the problem you’re trying to solve. “There’s a chicken and egg situation. Investors often want to see a built-out product and predictable traction, but that often comes once you have some investment to build a product and get users. A company can definitely make progress on both with limited funds, but it is significantly tougher.” The team at Exception-ALLY recently launched a free Starter Kit for parentswith special needs children as a guide to navigating special ed programs. “[The] VC Pathways was most helpful in introducing us to people that generated press coverage. We did get introduced to some investors but none of them were really interested in our industry,” Davis said, “The investment preparedness frame that VC Pathways provides is very helpful. It helps entrepreneurs understand the stages of their business should be in for what stage of investment. I also think investors would benefit from this framework as well.” Click here to read the full report.