The Coalition to Back Black Businesses, a four-year grant-making initiative designed to provide financial assistance and long-term support for Black-owned small businesses, has selected its first cohort of recipients. $5,000 grants to 600 Black-owned small businesses have been awarded, 59% of which are woman-owned, across 33 states. Among the grantees are three Philadelphia-based businesses owners. The Plug spoke with each owner to understand what challenges the pandemic has posed and how the grant has impacted their ability to continue business operations.

The initiative, which consists of $5,000 to meet business owners’ immediate needs, $25,000 enhancement grants to select grantees to further assist business operations, mentorship, and online resources, comes as 60% of Black small business owners report experiencing a decrease in sales in the past six months, according to an online survey conducted by the U.S. Chamber of Commerce Foundation. The survey, which examined 592 Black small business owners, 416 of which were grantees, highlighted that business owners’ top needs were access to capital (60.1%), education/training (19%), and marketing (19%). Other needs include mentorship/coaching, vaccines and other pandemic-related assistance, and networks.

“Small businesses are in real trouble,” U.S. Chamber of Commerce Foundation spokesperson and Senior Director of Research and Issue Networks Lawrence Bowdish told The Plug. “My colleagues are looking to make sure that the small business ecosystem is strong and thriving, and [I’m] so happy to be a part of that, and make sure that not only are we helping individual small businesses, but that the system in which they are trying to succeed is as strong as possible.”

For David Simms, owner of Eatible Delights Catering, business has been down 45-55 percent because of the pandemic. Pre-pandemic, the business catered 200-300 events per year, and now it does six-eight events a month.

Though Simms was one of few minority business owners who successfully received paycheck protection program (PPP) loans, through which he was able to bring back three employees he had laid off, he noted that it ran out quickly.

“It’s a challenge,” he said. “People look at it like ‘oh, I’ve got this amount of money, I’ve got that amount of money,’ but when I purchased this building in the end of 2019, it was based upon the sales that I had for 2019 … and how I wanted to grow this business. Unfortunately, because of the pandemic, this has not happened.”

In April 2020, the Center for Responsible Lending found that 95 percent of Black-owned businesses were shut out of the Paycheck Protection Program, most commonly due to their size and lack of preexisting borrowing relationship with a bank. Notably, the second round of PPP loans, passed in January 2021, was designed to focus on minority- and female-owned small businesses.

Simms, who altered his business to include curbside pickup and delivery in light of the pandemic, expressed that the value of the grant, which he allocated toward operating costs, goes beyond the money itself, extending to networking and building relationships.

“In this relationship, it’s not just me taking the grant and not doing the interview or not answering emails, it’s all of those things for me to be able to tell you all that the program works, so that they can give it to somebody else and they can be motivated to continually do these things for small businesses,” he said.

Bowdish voiced a similar observation.

“There were a number of emails we got where the $5,000 meant a lot more than its monetary value,” he said. “For a lot of these companies, it meant that there was someone out there that took a look at what their company was doing and said, ‘we want to make sure this company has $5,000 to keep going.’”

Shakina Rush, president and owner of Kingdom Builders & Industrial Maintenance, LLC, a 100% minority woman-owned business, echoed Simms’ appreciation for the grant.

“When I found out that I received it, I thought, ‘oh my god, now I can pay my office lease, I won’t feel like I’m suffocating,’ which is the day-to-day costs of running a business,” she said.

Rush, who used her grant primarily to cover operating expenses and payroll, said that her business, as a small minority business, was already disadvantaged before the pandemic hit, causing COVID-19’s onset to put everything at a standstill.

“Being a small business, person-to-person networking was very vital because businesses are built on relationships, and that was completely done when the pandemic hit,” she said. “Whatever you had going on before the pandemic was something that you really had to cherish and hold on to, and try to maintain as much as possible, so it definitely affected the growth of my business.”

Were it not for the loyalty and dedication of her staff, the business might not have stayed alive, Rush added.

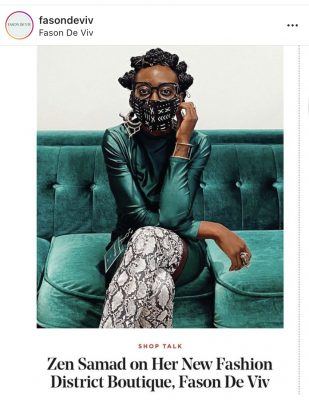

Zen Samad, owner of Fason De Viv, a curated marketplace specializing in clothing, home decor, and beauty products, also spoke to the pandemic’s impact on business growth.

“Being in business for eight years, the goal is growth and to be recognized, and for us to get to that point where [people are] looking at us as a six-figure company, because when it comes down to benefits, when it comes to capital, … we get judged by that as a minority-owned business,” she said.

Samad, whose platform promotes around 30 percent of minority brands, used her grant toward purchasing merchandise from other minority brands, which helped support their companies as well. She also stressed the importance of online marketing, especially as the pandemic catapults society further into a digital era.

“This pandemic made the government realize how much minority-owned businesses need help when it comes down to funding and being able to afford marketing and digital needs, because everything changed,” she said. “Everybody has a website, everybody needs their presence online, and you need to put money behind it.”

Now that mentoring and coaching platforms are up and running and grants have been distributed, the Coalition’s next steps include rolling out applications for $25,000 enhancement grants in the late spring/early summer, and gearing up for next year’s batch of applicants, who will be able to apply in late August/early September.

While the program is a four-year initiative, Rush said she hopes it, and other related grant-making programs, will continue well beyond the pandemic.

“This is something that has long been anticipated and needed within the African American community because, at the end of the day, it takes certain finances to build a certain level of financial stability and wealth,” she said. “I really commend [the Coalition] for what it’s doing for the Black community and Black businesses, and it should never stop.”

This story is part of a partnership with WURD radio covering technology, business, and innovation in Philadelphia. This vital work is possible with support from the Philadelphia COVID-19 Community Information Fund, an effort by Independence Public Media Foundation (IPMF) and the Knight-Lenfest Local News Transformation Fund (Knight-Lenfest Fund).