KEY INSIGHTS

- A new Brookings Institute report maps consumer data rights but shows it’s a slow process that lacks demographic considerations.

- Fifty-four percent of Black participants in the Brookings study said their bank or credit union should be required to disclose when their personal data has been shared.

- Black U.S. consumers are expected to spend $300 billion.

After a five-year hiatus, policy action issues related to consumer financial data are getting attention, according to a new Brookings report. Last year, The Consumer Financial Protection Bureau (CFPB) released an advance notice of policymaking and a start date of law processing Spring 2022. The decision is long overdue as more consumer data laws help Black consumers choose financial assistance and offer better alternatives.

Data portability in financial services can assist consumers with choosing a financial service provider and enable innovation among new entrants seeking to offer a better deal or a novel product or service, the report said. However, there is less support among Black Americans for policymaking that affects consumer finances.

A McKinsey study that looked at Black and white households with similar incomes found that Black households tend to spend less. Financial support would go to extended family, higher student debt burdens and higher interest rates on various consumer loans.

Banking facilities have been closing down in recent years, according to Federal Deposit Insurance Corporation (FDIC) data. Almost half of all Black households were unbanked or underbanked in 2017, compared to 20 percent of white households that same year. This impact puts an outsized constraint on small businesses and individuals who turn to payday lenders as an alternative to banks.

In 2019, consumer expenditures among Black households totaled approximately $835 billion. The combined spending of Black households was raised five percent in the past two decades. This surpassed white household spending (three percent), which was attributed to an increase in the number of Black households.

Black Americans are already wary about data privacy but have less support for financial consumer protection policies even though people of color are more likely to use fintech apps.

A Financial Health Network report found that 62 percent of consumers support data portability, noting that their bank or credit union should have to notify them when their personal data has been shared with another company (such as a fintech provider). Fifty-four percent of Black participants in the study support data portability compared to 59 percent of Hispanic participants and 65 percent of white respondents.

Forty-one percent of fintech apps users believe that the software only accesses the information it needs while 25 percent believe that the system could access all of their data. Unlike data portability, there is more support for data minimization. However, 78 percent of Black respondents have the lowest support of data minimization next to Hispanics (82 percent) and whites (91 percent).

The report also explores current legislation questions on consumer data such as Gramm-Leach-Bliley Act, a law requiring financial institutions to explain their information-sharing practices. The Electronic Fund Transfer Act (EFTA) governs many types of electronic transactions from consumer accounts. There is more concern about the law as transactions become more diverse and account data is shared in credit underwriting and financial advice.

The report explores policy issues of data portability related to Section 1033 of the Dodd-Frank Wall Street Reform and Consumer Protection Act, rules prescribed by the Bureau of Consumer Financial Protection that require consumer financial services providers to reveal any consumer information available in control or possession of the provider.

Unless answered these questions could add more stress to other areas. There are already issues of privacy in Fintech firms accusing banks of blocking their access to customers’ account information.

Black U.S. consumers are expected to spend $300 billion on unmet demands, but there needs to be a stark change to better serve Black consumers, according to a McKinsey report.

Mckinsey’s survey found that Black consumers are willing to shift approximately $260 billion, 30 percent of aggregate spending, to companies that fit their needs. They can pay 1.2 times more on products that fit their preferences which adds another estimated $25 to $45 billion in net spreading. The increased spending has the potential to motivate innovative companies to compete for Black consumer needs across industries.

Building an inclusive economy is one way to ensure economic equity and opportunity, according to the Mckinsey survey. The survey recommends tackling diverse challenges by improving hiring and promotion practices within companies. On a local level, place-based transformation can be used to enhance local housing policies for housing security, broadband access and other resources. For example, A US-focused development bank could be the foundation to support transformations in underserved communities.

Collecting more granular data can help companies in the inclusive economy as well. Stakeholders across public, private and social sectors can locate and use key metrics to break down large demographics to identify trends and challenges. Ongoing data collection could increase accountability.

Sponsored Series: This reporting is made possible by the The Ewing Marion Kauffman Foundation

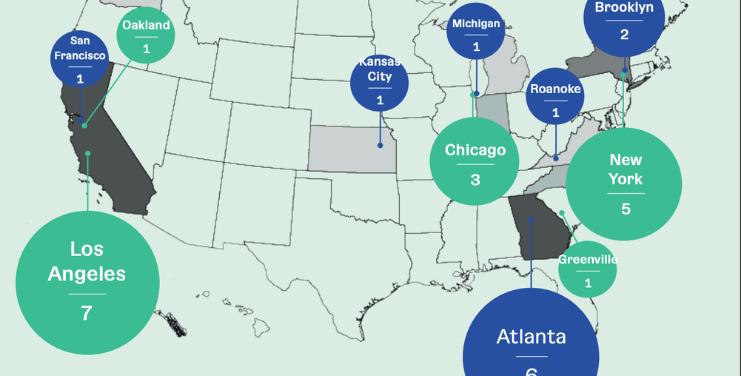

The Ewing Marion Kauffman Foundation is a private, nonpartisan foundation based in Kansas City, Mo., that seeks to build inclusive prosperity through a prepared workforce and entrepreneur-focused economic development. The Foundation uses its $3 billion in assets to change conditions, address root causes, and break down systemic barriers so that all people – regardless of race, gender, or geography – have the opportunity to achieve economic stability, mobility, and prosperity. For more information, visit www.kauffman.org and connect with us at www.twitter.com/kauffmanfdn and www.facebook.com/kauffmanfdn.