Software is indeed eating the world and every industry will have its own unique aftertaste. Just like E-commerce has fundamentally changed the face of retail for small and large brick and mortar stores, financial technologies (“fintech”) have matured to do the same for large financial institutions, Jamie Dimon head of America’s largest bank, JP Morgan, acknowledged as much in his recent shareholder letter. Neobanks/Challenger Banks are the epitome of fintech, operating as branchless banks providing services entirely online, like Revolut, Chime or N26. Those pure-play Neobanks are also joined by lending and payment fintechs that have expanded to provide banking offerings, like SoFi and Square.

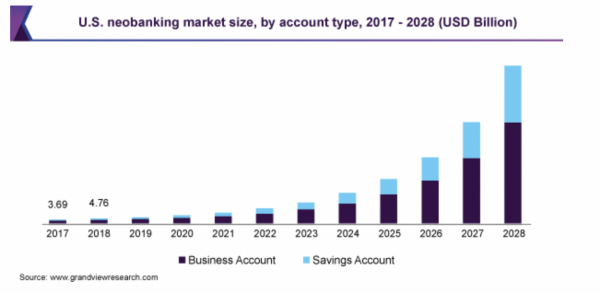

Overall Neobanks have matured to a significant scale, with a global market size of $34.4B in 2020 and estimated to rapidly expand to $377B by 2028. In the US, once the leader in financial technology and infrastructure, these Neobanks have grown to millions in consumer adoption, revenue and, of late, regulatory maturity, and dominated the IPO window of new and upcoming public market issuances. In the backdrop, the U.S. small community banks without the resources to invest in technology or the scale of their national bank counterparts have taken a beating along with national bank branches closing at a record rate of 3 a day.

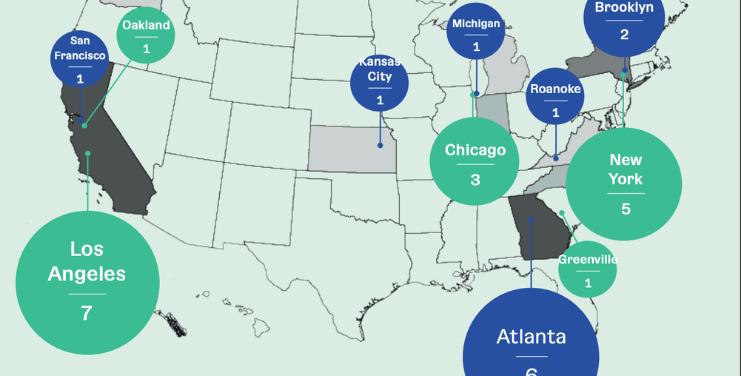

However, ambitious founders targeting this community segment of banked, unbanked and underbanked 40 percent of Americans have emerged within the record-breaking quarter of growth in the fintech sector as an investment in the space reached a record $23 billion alone during the first quarter this year. However, just as assets in national banks vs community banks and credit unions were 50:50, how the community-first financial technologies will fare in asset accumulation, profitability and consumer adoption at scale against large fintechs is yet to be seen.

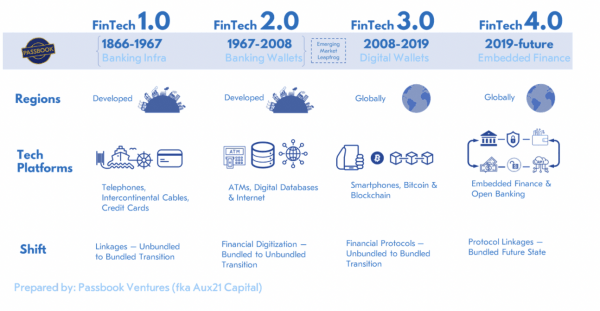

Age of Fintech Maturity

Technology has always played a key role in the financial sector, from the abacus to the printing press and banknotes to the blockchain of today. Key periods in the timeline of fintech are:

The promise of Neobanks’ branchless operations are lower cost structures, customized consumer experiences and the ability to deliver solutions to un- and underbanked populations, while sharing many similarities with legacy antecedents, such as the categorization into consumer and business banking. Neobanks such as Revolut, Fidor and Simple are consumer centric, while Novo, Brex, Anytime, Counting Up, Bunq, Fire.com and Holvi serve business accounts. Chime chameleons as both.

Customer-centric neobanks such as Dave, target specific pain points of specific demographics. Dave for instance creates features of great appeal to low-income groups who are frequently targeted by traditional banks with overdraft fees. This has resonated quickly among investors and customers; Dave is going public through a deal valuing the firm at $4B, after the company, launched in 2017 raised over $176M in venture capital with 10 million customers for its financial platform and 1.3M clients for its banking product.

Despite all the venture capital, SPAC and hungry retail investor dollars chasing these startups, traditional banks are converting their customers to digital banking 180 percent faster than Neobanks are signing up customers on their platforms. Establishment giants have responded in kind, with institutions such as JP Morgan, Bank of America, Capital One, PNC, U.S. Bank, BB&T, and Wells Fargo buying out fintech platforms such as Zelle through collective ownership of holding companies. On its face, Neobanks may seem to compete with traditional banks and in the future it’s likely they will increasingly do so, however, at the moment their meteoric rise has come at the expense of community banks and credit unions.

A 2018 study by the Federal Reserve, released in 2019, found that 40 percent of Americans would struggle to come up with $400 to cover an unexpected expense. This financially vulnerable population has become tremendously valuable to Neobanks due to the ability to make money off their spending power, through interchange fees.Interchange is how the vast majority of challenger banks make money.

Banks collect interchange fees from merchants when customers spend their money using a bank’s debit card. The percentage challengers can collect on interchange is small, but larger than what their megabank competitors are allowed. Under the Durbin Amendment, part of the Dodd-Frank Act, banks with less than $10 billion in assets are able to charge merchants up to 1.5 percent on debit card swipes.

That’s seven times more than what incumbents like Wells Fargo or Citi can charge, an analysis by Fortune found.However, without making money on deposits they have, like a traditional bank, the Neobanking model only works if the startups are subsidized by venture capital dollars to achieve tremendous scale, then turning on the spigot of lending and other high margin businesses. Several startups have embarked upon a different path to make revenue and financial products by offering targeted solutions for specific segments of the U.S. population.

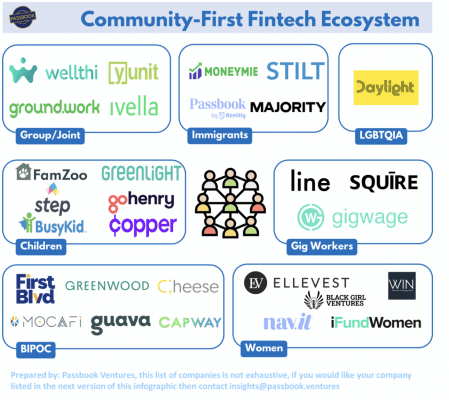

Many of these “Community-First” Neobanks are at their early stages but their approach is markedly unique in their bundling of financial products at the outset and often offering subscription tiers to provide transparency around banking fees and interests.

Why Communities Matter?

One may initially question if targeting once overlooked communities, commonly considered ‘minorities,” would be able to be valuable enough to create billion-dollar opportunities sufficient to warrant the $1.7B of capital currently invested in the space. The communities and the spending that occurs within them are tremendous market opportunities all to themselves, with populations ranging from 18.5 million LGBTQIA in the U.S. to 168.3 million women in the U.S. with $1 trillion to $6.4 trillion of spending power annually. The potential for many billion-dollar outcomes exists for Community-First fintechs in the U.S. if they achieve scale monetizing through the interchange fee derived only from the spending of members within their respective communities. However, an extremely encouraging trend is that these companies have chosen to look beyond spending/interchange fees for revenues, due primarily to lack of VC funding appetite to subsidize scale in targeting communities rather than the general population. This capital scarcity has driven founders to the forefront of fintech innovation, with deeper integrations and earlier product life cycle adoption of open banking and embedded finance principles and tools to deepen the financial platform’s offerings and touchpoints with customers.

What’s Driving the Community-First Approach?

Beyond the recognition of the fintech opportunity within standalone U.S. communities, the growth of Community-First fintechs is being driven by three distinct and timely factors.

- The evolution of the fintech ecosystem to mirror offline financial services

Neobanks are currently at an inflection point with the march to the public market and the scrutiny on their bottom line required to satisfy investors. We expect a similar and rapid evolution like rideshare and delivery companies that initially provided subsidized rides and deliveries to consumers, funded by venture capital dollars, and have since pivoted to cost-reflective pricing and bundling of service offerings to deepen their relationship with their consumers. Indeed, we are in the early innings of this transition with players like Cash App/Square, Revolut, Robinhood, Dave and Sofi with approaches aiming to be the financial one-stop-shop for their customers. In SoFi’s case, their acquisition of Galileo, which powers the backend infrastructure for 95 percent of all Neobanks very much akin to Amazon AWS for the web, and Galileo’s new CEO, Derek White’s, ambition to extend their open banking capabilities, Neobanks are primed for a sea change that enables seamless bundled financial services that mirror traditional banks digital offerings. These large fintech players fostering the economies of scale to support the viability of open banking rails provides Community-First players the ability to build business models that focus on customized solutions and bundles that serve their specific populations with low hanging fruit entry point products and take advantage of high-profit margin financial products, similar to local community banks and credit unions.

- Founders building solutions are diverse and reflect the communities being targeted

Another force driving the Community-First approach we’ve recognized is that the founders building these solutions are proximate to the problems experienced by the communities they are targeting. Beyond who’s doing the building – these builders are also receiving VC funding to operationalize their vision to provide financial solutions that target their own often overlooked communities. This tracks with the overall increase in VC funding and a¬†corresponding increase in funding toward founders emerging from overlooked communities which has grown four fold. Financial problems are uniquely tied to people and their communities around them, which is why we believe market-leading global financial innovations from Ant Financial, NuBank, PayTM and M-Pesa emerged from local players. The United States is a uniquely diverse country with a population of distinct yet intermingled and vibrant communities, so its leadership in ‘Community-First’ fintechs by tapping into founders in those communities is leveraging the market’s inherent advantage that presents national and global expansion opportunities.

- U.S. consumer expectations for ‘financial wholeness’

Prior to the rise of fintechs and Neobanks, “most consumers relationships with financial institutions has been defined by friction” says Akshay Krishnaiah, founder of Line Financial and former Global Product Head of Paypal Labs. This could be considered an understatement for people from overlooked communities, which have experienced centuries-long discrimination, overcharging and other predatory practices by U.S. financial institutions. The proliferation of smartphones, online banking and e-commerce has caused consumers to expect seamless financial services for payments at the very least. Community-First Neobanks have emerged as a seamless solution within the vacuum of traditional financial services which resulted in those communities having higher percentages of underbanked. Payments and digital wallets alone, present underbanked communities more of the same, however, Neobank’s branchless and banker-less lending and other financial services evens the playing field. Moreover, the reduction in branches of national banks and the closure of brick and mortar small financial institutions propel consumers to seek targeted solutions that serve their needs. Understanding this desire for financial wholeness (full participation in the financial system) has propelled founders to build companies to fill that gap.

Why we are excited about this trend

Wider Open-banking adoption:

Customer centric approach leads to greater use of open banking infrastructure similar to Revolut’s product expansion, this customer and Community-First approach will spur more digital financial product innovation similar to Ant Financial marketplace.

Financial Product Innovation and Deepening Financial Inclusion:

Targeted financial interventions based on a Community-First approach promotes the creation of unique financial products and distribution models for customers outside of the traditional financial ecosystem, like Susu or Fleri’s diaspora insurance membership. Globally, microfinance institutions’ micro-lending risk scoring, largely targeting underbanked women, led to digital and mobile lending innovations that have been on the bleeding edge of fintech. The trend also provides an opportunity for Community-First SaaS fintech tools to emerge that partner with existing MDI and CDFIs to allow them to compete with larger institutions well into the future. Overall, we believe that the ‘Community-First’ approach will lead to U.S. financial innovation and renewed leadership.

One step ahead of regulators:

The Community-First approach is also one step ahead of the eventual leveling of the regulatory playing field between fintechs and traditional financial players when they will likely have to comply with traditional banking regulations like the Community Reinvest

ent Act.

Conclusion

Finance and banking is in a constant state of innovation. Currently, the evolution of financial technology in the U.S. and globally has reached a scale that has outpaced the ability of small community banks and credit unions to compete. However, as the Neobanks chasing scale continue to evolve to mirror their traditional bank rivals and target upmarket users for their new financial products. The bedrock of Community-First Neobanks will be to leverage embedded finance and targeted or personalized suites of financial products that re-establish the community linkage small and medium brick and mortar financial institutions occupied.

Contributed by Chinedu Enekwe Partner Aux21 Capital and Olivia Osuala Analyst Aux21 Capital