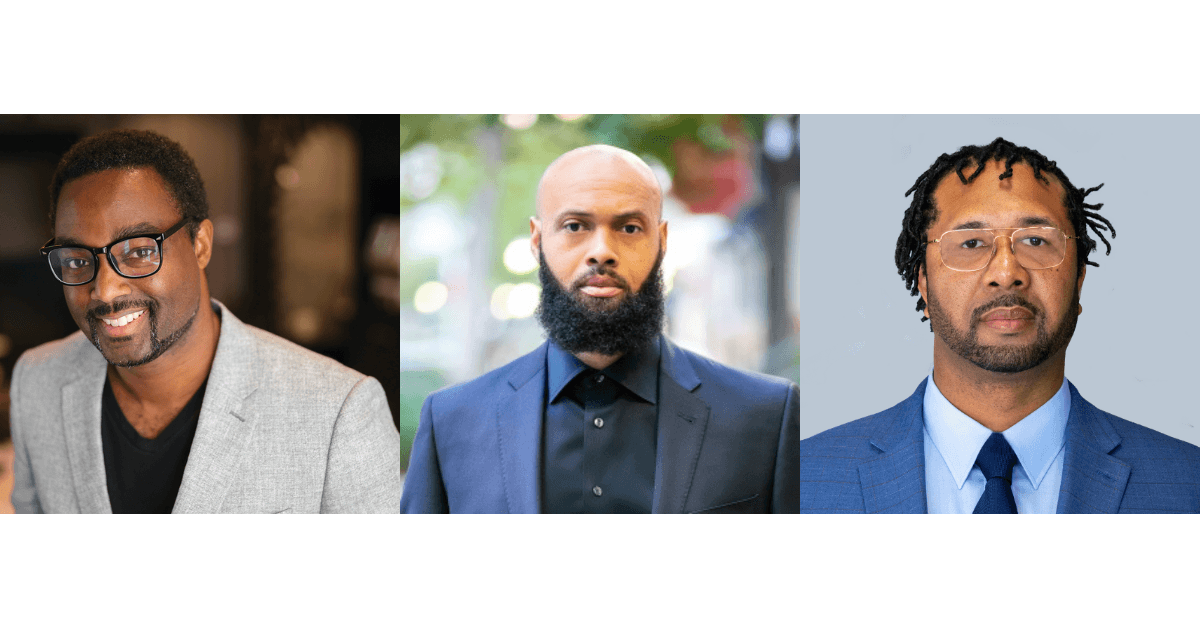

Black founders at the forefront of the financial technology revolution are proving to be indispensable to the financial industry and beyond. The Plug caught up with founders from the Mastercard Start Path In Solidarity program to find out what they think is hot in fintech in the year ahead.

Increased cybersecurity

In a world that is more digital than ever before, James Jones Jr., co-founder and CEO of Bump, a financial service platform for creators, predicts tools around payment fraud prevention will see a rise in 2023.

“The world is increasingly mobile, and peer-to-peer payment transfers as well as B2B payments should become more popular. And of course, a larger volume of payments and users of other fintech products and services creates a higher risk for fraud,” Jones told The Plug.

Alloys State of Fraud Report found that 27 percent of respondents lost over $1 million to fraud and 91 percent of respondents said fraud rates have increased at their organization year over year. Consequently, in 2022, 71 percent also said they increased spending on fraud mitigation.

According to RiskRecon, a Mastercard company, an organization is 40 times less likely to be a victim of ransomware when it has good cybersecurity hygiene.

Strengthening trust

Trust is paramount to the fintech customer base, Kelly Ifill, founder and CEO of Guava, explained. In 2023 she believes customers will have even higher expectations for the fintech platforms they partner with.

“This means that the successful ones will be serving the underserved, banking the unbanked, and filling voids that need to be filled,” Ilfill told The Plug. “The benefit here is that the more people that are brought into our financial system through fintechs, the more businesses, communities, and the economy thrive. But unless you’re doing something truly additive, your customer might choose to live without you.”

The creator economy will continue to expand

Bump, which operates at the intersection of the creator economy and fintech, has seen an increase in creators selling the rights to their creations to reach liquidity.

“Navigating the complexities of stakeholders and creators’ rights to the proceeds stemming from these sales should keep fintech companies building solutions for these issues very busy and in high demand for the foreseeable future,” Jones said.

Similarly, Kedreon Cole, the founder and CEO of XR Sports, a social commerce website builder for creators, believes that the growth of the fintech industry and the creator economy move hand in hand.

“Many entrepreneurs from the next generation of digital merchants will be storytellers and they will need access to intuitive fintech tools to help them capture more value through the stories and business lines they develop,” Cole told The Plug.

In 2023 Cole predicts creators will leverage fintech tools to build independent digital economies, such as the one he built.

“I do not believe creators will be leaving social media any time soon, but a realignment of the value stream between this new generation of online merchants and the third-party platforms that host their fan communities is on the horizon,” Cole said.

Payments will continue to go digital

Leonard Tatum, CEO and founder of Tatum Games, a data analytic SaaS product for game studios and independent developers, believes that there will be continued growth among AI, machine learning, blockchain and decentralized finance.

That’s why Tatum’s platform is built around collaborative ecosystems.

“Mobile game developers can know if their users are big spenders before they spend any money in their app based on our spending score,” Tatum told The Plug.

“Think of a spending score like a credit score. Based on someone’s spending score, you have a baseline understanding of how often and how much that person generally spends. This allows game developers to better monetize, save costs and ultimately create better gaming experiences,” he said.

Serge Amouzou, founder and CEO of AI financial planning platform Datatrixs, pivoted and rebranded during the last quarter of 2022 to serve accounting firms and banks.

Amazou believes that automating the financial planning process to serve financial service firms will be transformed by fintech — accountants, loan officers, and financial analysts will become “automation experts” instead of “data crunchers.”

Although notable companies such as Credit Karma are consumer-focused, new fintech companies are pivoting to business-to-business models.

Overall, Amouzou believes business owners will continue paying attention to the importance of financial planning and analysis.

“We’re in a recession, layoffs are happening all around, it’s much more critical for businesses to have insight into their financials and making sure that data is streamlined and organized across business functions so that they can make it through this essentially tremulous time,” Amouzou told The Plug.

This story was sponsored by our partners at Mastercard. The Start Path In Solidarity program is part of Mastercard’s In Solidarity commitment of $500 million in products, services, technology and financial support to help close the racial wealth and opportunity gap. For more information about the Start Path In Solidarity program visit here.