A new venture capital firm focused on historically Black colleges and universities has just launched. HBCU Impact Capital is aiming to help develop the innovation and research coming from HBCUs by investing in businesses started by alums and people in the HBCU ecosystem.

“We’re not just approaching this by saying, ‘We’re going to go to Black colleges to try to figure out how to make money,'” Isaac Addae, one of the managing partners of HBCU Impact Capital, told The Plug. “We’re going to go to Black colleges to figure out how to scale more Black businesses, in technology specifically, that make an impact.”

Addae received his bachelor’s and master’s from Tennessee State University, where he now teaches as an assistant professor in the College of Business, and got a doctorate from Morgan State University. His partner in the fund, Tré Baker, brings a different experience having gone to Vanderbilt University and Harvard Business School.

“We see an opportunity to bridge those two worlds, to bridge the HBCU world and bridge the Ivy League world for the benefit of all of our communities,” Addae said.

“The HBCU community has sent a lot of our people to Ivy League schools, but for whatever reason we still have this gap that exists around innovation when it comes to the Black colleges and commercializing innovation, so we’re hoping that we’re the missing piece of that puzzle,” he added.

Developing the Black economy

Venture capital is an overwhelmingly white industry, both in the funders and the founders. Only three percent of investment partners at VCs are Black according to the 2021 VC Human Capital Survey.

An August 2020 Crunchbase report found that Black and Latinx founders had raised $2.3 billion collectively, but represented just 2.6 percent of overall funding ($87.3 billion) invested that year into private firms.

But HBCUs can play an outsized role in developing Black entrepreneurs. In 2015, HBCUs made up just three percent of the nation’s four-year colleges but accounted for 15 percent of all bachelor’s degrees earned by Black students.

Among business schools, Howard University is also outperforming its peers. In 2018, Bloomberg found that more than half of surveyed Howard B-school graduates had gone on to found their own companies, the highest share of any of the 126 schools in their best B-Schools ranking.

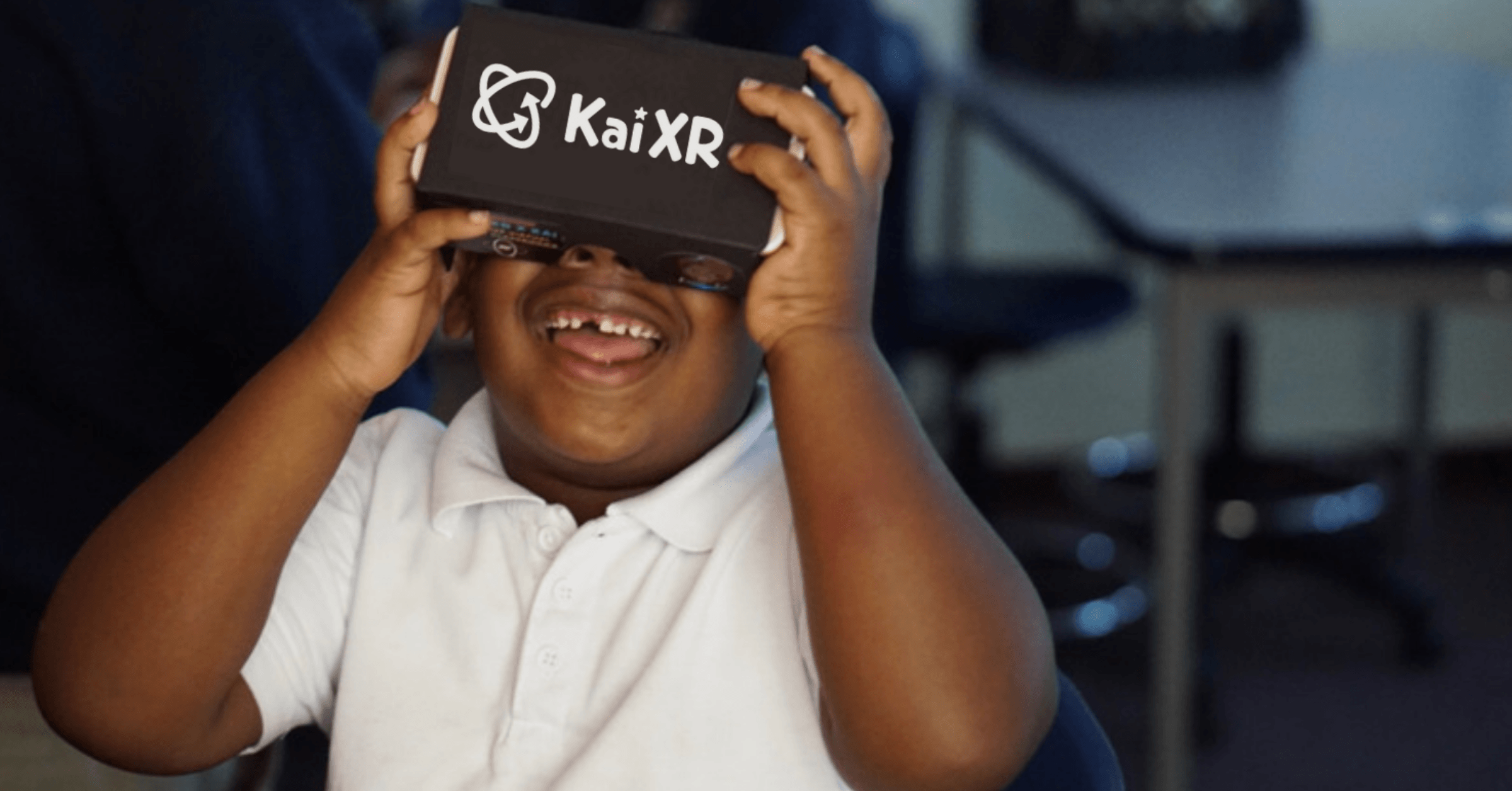

HBCU Impact Capital is taking a hybrid approach to Black economic development and is starting its work with four HBCUs across Nashville and Atlanta — Tennessee State, Meharry Medical College, Clark Atlanta University and Morehouse College. They hope to expand to the DC region next and then on to other HBCU hubs.

It is half venture studio, half micro private equity firm that will focus on investing in commercializing university research and helping startups in the neighborhoods around those schools, North Nashville and Atlanta’s West End.

“We are essentially going to support businesses that are within the HBCU ecosystem,” Addae explained. “Either led by HBCUs, the founders are HBCU grads or the business itself operates within the vicinity of the Black colleges that we’re focused on, because we want to grow more Black businesses in the community surrounding the HBCU.”

On the firm’s private equity side, HBCU Impact Capital has been established as a rolling fund, with a goal of raising $20 million. The minimum investment is $20,000, which Addae said was to make investing in the fund more accessible, but he did not disclose how much has been raised so far.

They are industry and stage agnostic and their average investment will range between $50,000 and $250,000. They are aiming to make their first investment in the first quarter of 2022.

On the venture studio side, Baker and Addae will serve as advisors for the startups they invest in, helping businesses with everything from fully developing fledgling ideas to creating a go-to-market strategy for innovations that have already been patented.

Over the past two years, HBCUs have produced nearly 100 patents, an analysis by The Plug found. However, that is far fewer patents than larger, more well-funded primarily white institutions and university systems. In 2020 alone, the University of California system and Stanford University were granted 597 patents and 229 patents, respectively.

This disparity affects HBCUs ability to secure revenue from their research. Stanford was the largest single producer of patents of any university or college last year, receiving $114 million just in gross royalty revenue and equity from its technologies.

HBCUs have increased efforts to turn these inventions into businesses. Morehouse School of Medicine, Hampton University, Benedict College, North Carolina A&T State University, Florida A&M University and Jackson State University are some of the schools establishing offices dedicated to helping their faculty and staff license and commercialize their research.

Addae said HBCU Impact Capital will develop partnerships with school officials to help innovation get from campuses to businesses that can scale.

This is not the first private equity firm to focus on HBCUs and their students, although other initiatives are more focused on increasing institutions’ endowments and preparing students for investment careers.

Base10 Partners announced in May it had raised a $250 million fund and would donate half the fund’s carried interest to HBCUs to support their endowments. Another firm, Lowercarbon Capital, has offered HBCUs some fund allocations on a no-fee/no-carry basis.

In June, three multibillion-dollar asset management firms announced a joint 10-year, $90 million initiative at Clark Atlanta University, Howard University, Morehouse College and Spelman College to open more pathways for students to pursue jobs in private equity.

“The VC community, from what we understand, right now hasn’t placed a lot of attention on [HBCU innovation] but we see that there’s potential there,” Addae said. “We want to see more Black businesses scale, and that’s our whole approach.”