Amid a racial reckoning and civil unrest across the United States over the summer, many businesses, including several venture capital firms, publicly pledged to interrogate their own structures and address the systematic biases that have prevented marginalized workers and minority founders from achieving the same level of success as their white counterparts. However, as the year draws to a close, some experts say that while they are optimistic about the future of venture capital, it could take a while to see if the industry has truly changed for the better.

According to The Ewing Marion Kauffman Foundation, on average about 17 percent of funding for white-owned start-ups came from investors, while they only contributed 1.5 percent to Black founders. It is the firms that were already supporting Black and Latinx founders, however, that are continuing to lead the way.

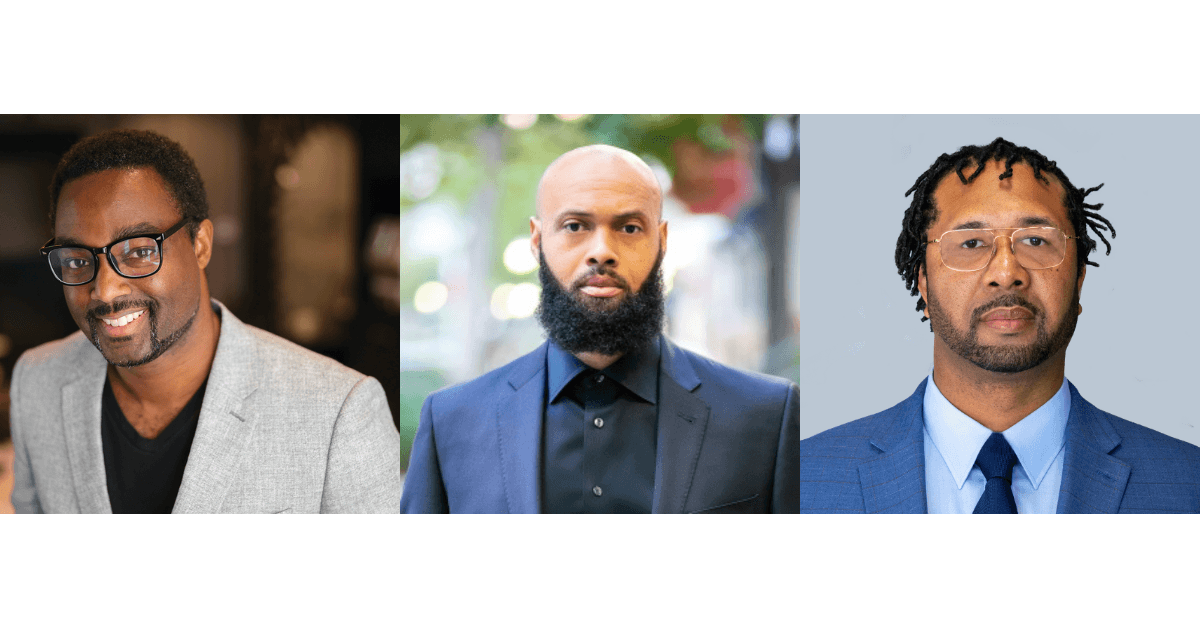

“This year seemed like an awakening,” said Ulili Onovakpuri, partner at Kapor Capital, a firm focused on closing equity gaps for communities of color in the United States. “The industry realized how bad it had been not only in not funding Black entrepreneurs but also not having that representation on their teams,”

Onovakpuri says the firm, which has long been recognized for prioritizing diversity and inclusion in its portfolio, has been contacted by traditional venture capital firms this year for insight into how they can improve.

“There was excitement because people started acknowledging the work that we’ve worked so hard on for so many years.” Onovakpuri said. It’s great to get that acknowledgement from the rest of the world for something that we’ve already been doing. With that acknowledgement came more attention so more people wanted to partner with us.”

Still, Onovakpuri says Kapor Capital has stressed that making fundamental change will take more than incorporating bias training or other one-off efforts.

“When people say ‘I’m trying to learn a language,’ you don’t just listen to the language once. You have to practice it. You have to talk to other people who know the language. It is really a muscle that you have to build.” Onovakpuri said. “I think the same way in terms of, if you truly want to create more diverse organizations and more inclusive organizations, it is something that has to be integrated into every aspect in every decision that you make as an organization.”

Jewel Burks Solomon, managing partner of Collab Capital, an Atlanta-based firm that focuses on Black founders, agrees that this year has shed light on funds that were already committed to supporting Black founders.

“We invest exclusively in Black founders and, in a year where it’s a lot of talk about supporting black founders, I’m really proud of the fact that we were doing this before 2020,” Burks Solomon said, noting the firm’s model seeks to help founders preserve ownership in their businesses. The firm has a fund life for the next decade.

Burks Solomon says she’s been pleased to see a number of funds with a similar mission come into existence this year, too. “There are a lot more funds that have come to be over the last year that have some type of focus, or at least inclusion of black founders, in their thesis,” she said.

“I am pretty optimistic that there will be more capital distributed to Black founders in 2021,” she adds. “From there we will see more success stories and that will just continue to make sure that it’s not just something that got kicked out, and maybe into 2021 and then it’s over.”

Still, Burks Solomon believes that access to the right customer base and networks are also important. This is something she works on both at the venture firm and as the head of Google for Startups.

This year, Google launched a $5 million Black Founders Fund to support more than 70 entrepreneurs. Burks says the tech company will continue to support the group of founders in 2021 by providing mentorship in specific product areas. Founders within the healthcare industry, for example, will be connected with mentors at Google Health.

Reign Ventures, a New York and Miami-based firm that aims to have at least half of the companies in its portfolio be led by minorities, currently has a portfolio of about 80% female or minority founders. Co-founder Erica Duignan Minnihan says that, while the firm is often labeled as a fund that exclusively supports marginalized founders, they are open to founders from all backgrounds.

“One thing that myself and my partner Monique [Idlett‐Mosley] consider important to us is that there shouldn’t be segregation of capital,” Duignan Minnihan said. “Although I applaud all these funds that are created to specifically invest in women, or specifically invest in minorities, I think just like bathrooms, capital should be available to everyone [and] to the best people.”

Still, Duignan Minnihan recognizes why funds catering to marginalized founders were created and hopes that venture capital will diversify to solve this problem.

“I think the only reason minority and female founders have not had the type of access to capital that would make sense in a fully functioning society is because there are so few people who are investment managers and venture capital funds that are either women or minorities.” she said. “Once we address that problem and we remove a decent amount of this unconscious bias, our capital system can operate much more efficiently.”

This story is possible thanks to support from the Ewing Marion Kauffman Foundation, a private, nonpartisan foundation that works together with communities in education and entrepreneurship to increase opportunities that allow all people to learn, to take risks, and to own their success. For more information, visit www.kauffman.org and connect at www.twitter.com/kauffmanfdn and www.facebook.com/kauffmanfdn.