It took a mere days for SoftBank to put together $100 million for Black founders following protests and demands for scrutiny from the Black tech community asking about how investors and the tech industry would support Black people within their companies and firms following a week of protests in response to the death of George Floyd.

In a story shared on TechCrunch last week, the firm announced its new Opportunity Growth Fund designated to invest in Black founders, carving out what amounts to just .01% percent of its popular $100 billion Vision Fund.

Andreessen Horowitz also capitalized on the moment, announcing a $2.2 million donor-advised Talent x Opportunity Fund aimed at underrepresented seed-stage founders provided by donations from the firm’s partners.

KEY TAKEAWAYS

- SoftBank Group and Andreessen Horowitz add new funding for Black founders.

- Some founders say new funds and outreach from VC firms feel inauthentic.

With the crop of new efforts to target more support for Black founders, is it too early to begin applauding the change of heart when dedication and support have been lacking across the industry thus far?

Harm and Foul

Funds focused on investing in minority founders are not new. We saw many of them come to life in and around 2015 when studies on the venture capital industry exposed the harsh truth that roughly 97 percent of all funding from this asset class has gone to mostly white male founders.

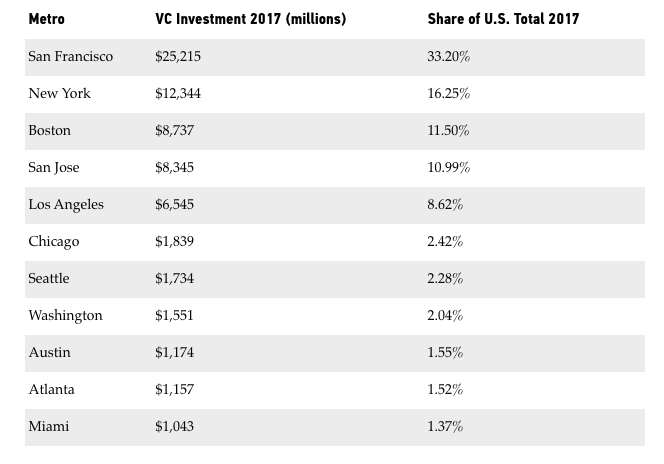

From a geographic perspective, traditional venture capital funding has been concentrated in just three states, California, New York, and Boston. And while Black majority cities like Atlanta and Chicago do see some venture capital activity within their respective cities, these dollars are less than 3% of total funding spend nationwide.

In the wake of a global pandemic and public support for racial justice, it would appear that firms like SoftBank and Andreessen Horowitz are capitalizing on the good public relations afforded them for the effort. And while something might be better than nothing, the fact that notable Black CEOs and investors like Shu Nyatta, partner at SoftBank Group, Stacy Brown-Phillpot, CEO of TaskRabbit, and Paul Judge, investor and chairman of PinDrop, have signed on as advisors to the SoftBank fund, some founders feel the move is pandering to the current climate, and won’t make up for the disparity gaps between white men and founders from underrepresented groups.

All these funds statements are just posturing. The problem is that VC’s are always looking for a unicorn. They overlook actual small businesses that are creating jobs in their communities, expressed D√©Von Christopher Johnson, founder and CEO of BleuLife Media Group, who mentioned that he has pitched twice to A16z to no avail.

Diversity and inclusion is not about the top 1% of startups. It’s about funding those that may not be marquee companies but are culturally relevant to people of color.

The $2.2 million Talent x Opportunity Fund (TxO) at Andreesen Horowitz led by Nait Jones, takes a different approach to its funding model, using denoted dollars from partners to fund businesses. This fund is separate from the VC firm’s Cultural Leadership Fund launched in 2018 by Chris Lyons with investors ranging from Hollywood and entertainment royalty like Jada Pinkett Smith, Serena Williams, Diddy, and others.

Baffling as it may be, one of the industry’s most famous VCs thought it was a good idea to do a press launch today for a $2.2M “fund” made up of charitable dollars. In other words, using funds normally earmarked for grants, to take equity from “underserved” founders. Given its charitable money, I’m guessing it’ll be invested using the IRS designation of a PRI (Program Related Investment) which means there’s a built-in expectation of lower returns, lamented investor Nathalie Molina Nino about the TxO fund in a post shared via LinkedIn. In Nino’s words, founders of color deserve more than charity.

Leave the Gimmicks At Home

Dawn Dickson, founder and CEO of intelligent vending machine software company PopCom, lamented on Twitter about the deluge of investors that are now reaching out to her with asks to invest. Dickson wrote: I personally don’t want any of the “I feel guilty and now I want to invest in Black founders” VC checks. If you weren’t talking to us before, don’t talk to us now. The community has our back. Dickson recently raised her second crowd-equity funding round of $1 million, meaning first-time investors were able to invest in PopCom for just $262 per share without needing accreditation.

My position is that if you are JUST realizing that Black founders are worth investing in you are not my type of person. You’re not authentic, Dickson wrote. Others recognize that the new funds are hardly an answer to decades of underinvestment in Black founders, but provide at least one more pathway to equity if the commitment is real.

Harold Hughes, founder and CEO of Bandwagon/Aura, a sports fan analytics company that helps teams identify and engage fans that show up on game day. said that since he started his company in 2015, he experienced first-hand how outrageous the funding gap was as he raised money for his company. He hopes that through more funding opportunities, equitable treatment through the venture capital funding process will ensue.

Is it opportunistic of them? Absolutely. Is it virtue signaling? Highly likely. But does it help solve the funding problems that we have all identified? Without a doubt – if they all keep their word. If the tradeoff is that these funds and VCs get a little temporary press and Black Founders finally get the capital that we need, I’m all for it.