To get a meeting with venture capital investor McKeever Mac Conwell, one is only a Tweet away. Since June, Conwell has taken over 1100 meetings with entrepreneurs and investors alike, sharing time to discover, even in the middle of a pandemic, exactly what’s happening on the ground as he sources a bevy of new deals for his latest endeavor.

Conwell left his post at the Maryland Technology Development Council (TedCo) in August after a four-year track record of pulling minority founders into the institution’s investing pipeline. Now, he’s building out Rarebreed Ventures. The firm aims to build its first $10 million dollar fund with a targeted check size of $250,000 to founders at the pre-seed stage in their business.

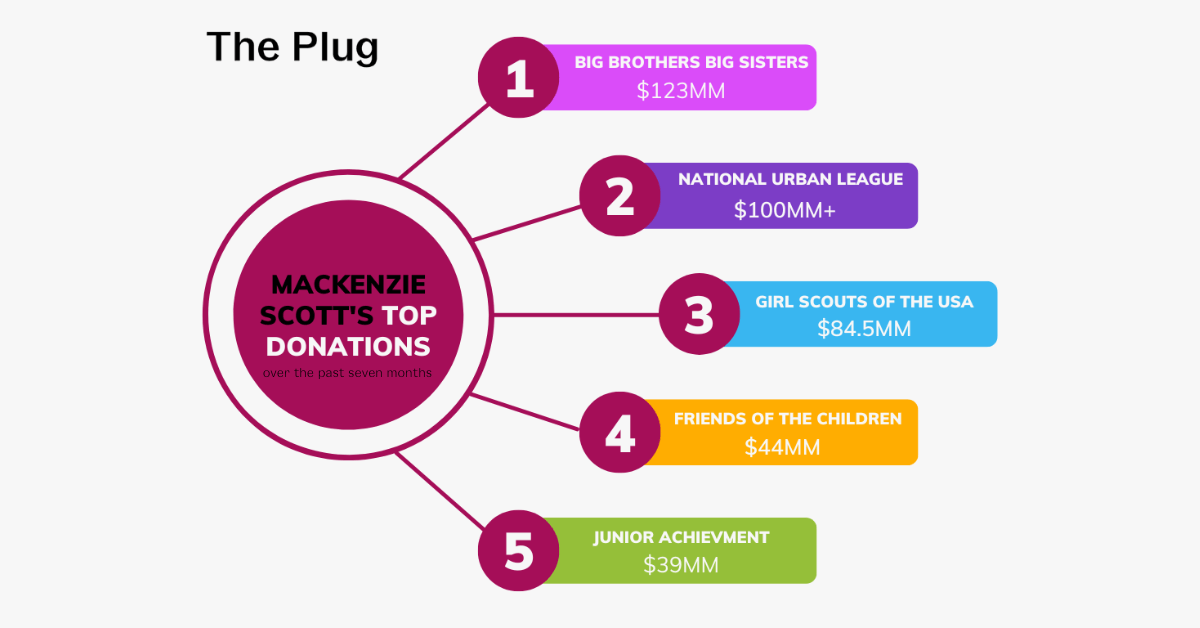

The longstanding discussion of the lack of funding for Black startup founders has amplified in recent months as legacy firms like Softbank, Andreessen Horowitz and others redirect their attention to adding diversity to their portfolios through offering microcosms of their total assets under management to minority founders. Last week, education conferencing platform Hallo, released a Q3 Black Founder Report.

Their research found that out of the 1,383 startups who received funding, only 31 had Black founders. And out of the over $5 billion dollars invested, just $114.8 million went to black founders. According to Conwell, RareBreed Ventures will focus on drawing its portfolio of diverse founders from outside of the box away from the saturated markets of Silicon Valley, Washington, D.C, New York, and Massachusetts.

During his stint at TedCo, Conwell helped to shape lending, with notable courting of companies across a variety of industries, like Osmosis, ScholarMe, Remodelmate, Elite Gaming Live, and others. But his power to do even greater deals for minority founders outside of Maryland there, Conwell says, was limited. “I was meeting founders with exceptional skillsets but who lacked the resources to move their companies forward and I didn’t have any way to support them properly. I needed the autonomy without the red tape.” Conwell is joined by venture partner Jonathan Kroll, investor Amani Phipps, and Ime Essien, a former HBCU.vc student.

While Conwell says he and his team are committed to finding unique deals nationwide, sourcing has also looked like connecting with small business owners who have much more knowledge of what’s happening on the ground in their communities and who is building what, come at the hands of RareBreed ‘s relationships with local chambers of commerce, the Urban League, Latin economic development corporations, and other legacy business institutions that provide a gateway into less established innovation markets.

“A typical VCs might look at these places and not think there are many investable businesses in some of these markets, but the companies are amazing and ripe with innovation,” says Conwell. In addition to looking for tech-enabled businesses that showcase a repeatable customer acquisition strategy, Conwell says Rarebreed is highly interested in entrepreneurs transforming physical product distribution in legacy industries that have traditionally not seen innovation over the last decade. Things like hair care, beauty, and personal care are examples of environments traditional VC has overlooked but appeals both culturally and opportunistically as areas where founders are finding ways to overall myopic spaces. Conwell is still raising the fund and no current investments have been made.