KEY INSIGHTS:

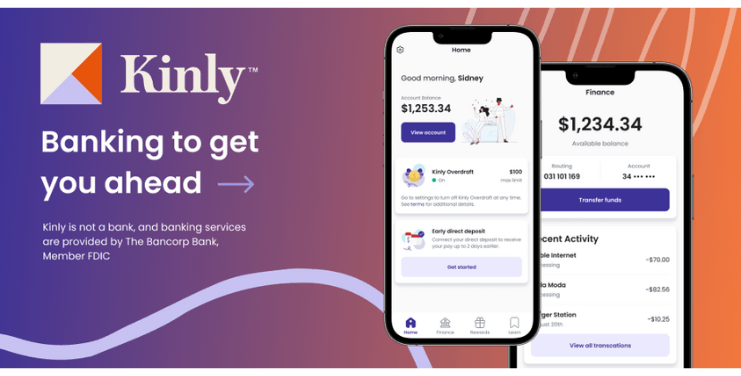

- Neobank Kinly targets Black consumers similar to Greenwood and CapWay.

- The company raised a $5 million seed round in November 2020 and a $15 million Series A in August 2021.

- Kinly’s launch marks the continued growth in “for us, by us” fintechs aimed at serving Black Americans through financial literacy and basic banking products.

Kinly, a new banking platform aimed at serving Black customers, has launched after raising $20 million in venture capital over two fundraising rounds. The company is the latest Black-founded neobank to come on the scene, rivaling more established financial technology start-ups like Greenwood, CapWay and Guava.

Kinly was founded in late 2020, raising a $5 million seed round in November that year and attracting big-name investors like Gabrielle Union. Last August, Kinly raised a $15 million Series A round that was led by Forerunner Ventures, according to Crunchbase, and included Kapor Capital, Anthemis Group, Point 72 as well as high-profile sports figures Marshawn Lynch and Kevin Durant.

Like other neobanks, Kinly has no brick-and-mortar branches, but offers account holders fee-free access to Allpoint ATMs, up to two day-early access to their paycheck and no overdraft fees. The company’s banking services, like Greenwood and CapWay, are provided by an established FDIC member bank. In Kinly’s case, services are through The Bancorp Bank.

There is also a financial education component to the neobank. Through short audio pieces (on average around eight minutes), money experts break down topics from budgeting and setting goals to specifics around car finance like vehicle valuation and maintenance.

Kinly plans to expand the platform’s offerings later this year to give its users the ability to trade stocks and offer a full cryptocurrency exchange.

The rise of digital-only banks

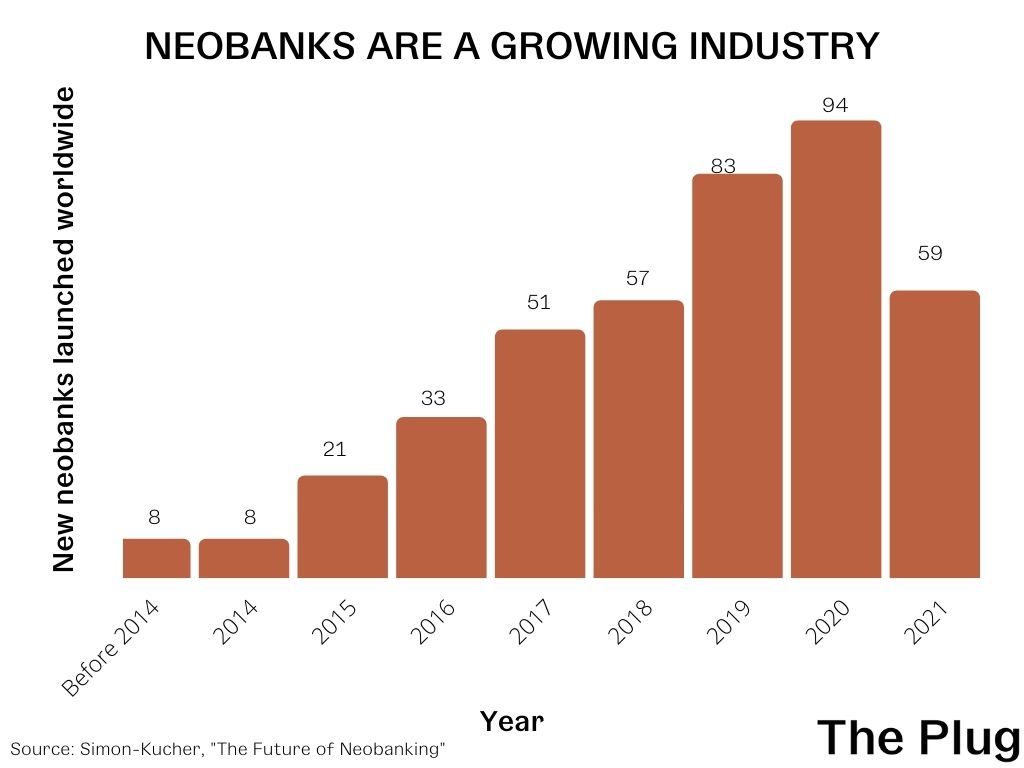

In the last 12 months alone, 19 new neobanks have launched in the U.S., according to a new report from strategy and marketing consulting firm Simon-Kucher. Neobanks now serve more than 100 million clients in America, the report detailed.

That still pales in comparison to traditional U.S. banks. Just three of the largest banks — Bank of America, Wells Fargo and JPMorgan Chase — have more than 120 million active digital users combined, according to an analysis by The Plug of their Q1 2022 reports.

But for consumers who do use new fintechs, they are drawn to them often because they are fast, easy-to-use and low-cost products, according to the World Retail Banking Report 2022.

Banking while Black

Kinly’s launch marks the continued growth in “for us, by us” fintechs aimed at serving Black Americans.

“There’s a lot of distrust in the Black community and a lot of other underestimated communities when it comes to the financial industry and rightfully so,” Donald Hawkins, CEO and founder of Kinly, told The Plug.

Hawkins watched in 2020 as that distrust and general frustration around the way Black people are treated in the U.S. came to a head. It was in the midst of that summer’s protests that the idea for Kinly was born.

“I realized that the only solutions that Black America could use that would create lasting change would have to be developed by us,” Hawkins said. “No longer can we wait on hopes, wishes and prayers that the powers that be will hear our cries and help us out. We’re going to have to create our own solutions.”

Similarly, Greenwood, the neobank that bills itself as “the digital banking platform for Black and Latino individuals and business owners,” was co-founded by Ryan Glover, Andrew Young and Michael “Killer Mike” Render in the wake of the 2020 protests. The company has since expanded beyond financial services; in the past two months, Greenwood has made waves with its acquisitions of Black-owned companies The Gathering Spot and Valence.

Kinly is also following in the footsteps of CapWay, founded in 2016 by Sheena Allen, which has a similar mission of bringing trustworthy banking experiences to underbanked and unbanked populations and promote financial literacy to communities that have been unsupported by traditional banks.

“Whenever I hear those names, I always smile because I’m so excited for all the things that they’re building too,” Hawkins said about Greenwood and CapWay.

“A lot of people don’t realize that there’s 15,000 community banks and credit unions out there that all tend to do pretty well. There’s 45 million Black folks in the U.S., and not enough of us. There need to be 15,000 Greenwoods, CapWays, and Kinlys in the U.S. as well,” he said.