Key Insights:

- The Digital Commodity Exchange Act of 2022 would create a definition for digital commodities.

- Some experts say new crypto legislation is not inclusive because policymakers are not talking to Black and Hispanic Americans who own cryptocurrencies.

- Other policies in the works include the Stablecoin Transparency of Reserves and Uniform Safe Transactions Act and the Responsible Financial Innovation Act.

Pennsylvania representative Glenn Thompson recently co-introduced an act that would give the Commodity Futures Trading Commission (CFTC) a greater role in overseeing crypto spot markets.

The Digital Commodity Exchange Act of 2022 is an updated version of a bill originally introduced in 2020 aimed to bring crypto exchanges into a single federal framework. If passed, the act would create a definition for digital commodity, meaning any form of fungible intangible personal property that can be exclusively possessed and transferred from person to person without necessary reliance on an intermediary.

“[The] legislation is a culmination of years of work to define a framework that fosters innovation, protects consumers and reduces regulatory uncertainty,” Thompson said in a press release.

“Closing the spot-market gap is an essential piece of the regulatory puzzle, but more work remains. I look forward to working with my colleagues to bring greater clarity to crypto users and creators and I hope to see it move through the legislative process promptly,” he said.

The act would allow the CFTC to oversee companies issuing or letting people trade cryptocurrencies while having the Securities and Exchange Commission (SEC) continue to oversee tokens that fall under United States securities laws, according to CoinDesk.

Some experts argue creating a legislative framework around cryptocurrency is necessary for the growing industry, but others worry these new policies may not be inclusive.

The Black crypto community

Cryptocurrency has become an alternative financial system for Black and Hispanic Americans who have historically faced discriminatory banking practices, with 25 percent of Black Americans owning cryptocurrency compared to 15 percent of white Americans.

Although recent crypto legislation is sparking beneficial debate, policymakers are still missing the mark by using outdated frameworks and ignoring people of color who are leaders in crypto, Cleve Mesidor, the founder of the National Policy Network of Women of Color in Blockchain and executive director of The Blockchain Foundation, told The Plug.

“One of my biggest issues with Washington [D.C.], not just when it comes to crypto but also when it comes to economic growth, has been that Washington uses consumer protection as a tool, but doesn’t really focus on economic empowerment,” Mesidor said.

“I’ve been doing this work for a long time. I struggle to get members of Congress, whether they are Democrats or Republicans, to actually meet with Black and Latino innovators in fintech,” she said.

Rep. Thompson’s act is not the only policy at play right now aiming to regulate virtual currencies.

In April, Pennsylvania Senator Pat Toomey released his Stablecoin Transparency of Reserves and Uniform Safe Transactions Act. Stablecoin is a type of cryptocurrency that is designed to maintain a fixed value over time and the proposed legislation includes a regulatory framework for banks and state agencies regarding stablecoin.

The Responsible Financial Innovation Act introduced in June seeks to provide clarity on whether digital assets, such as cryptocurrencies, are considered commodities or securities. If it is a security, then companies using crypto must comply with SEC rules when registering and reporting.

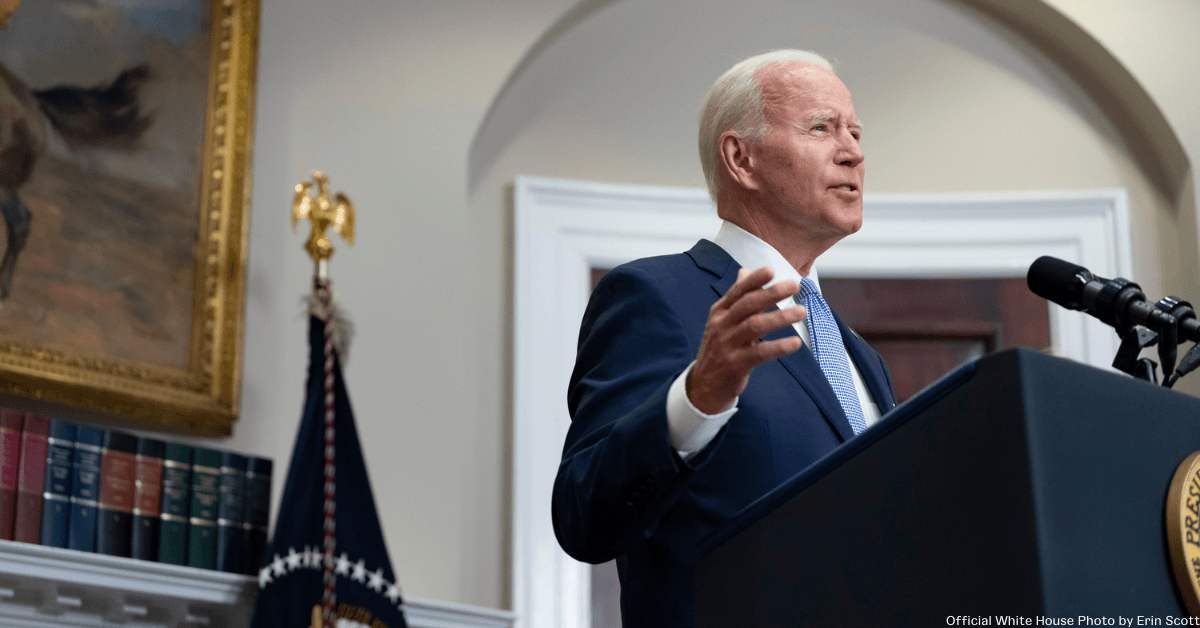

On a larger scale, President Biden signed an executive order in March for a review of the government’s approach to cryptocurrencies. It requires various agencies to produce reports relating to cryptocurrency regulation by September and October.

“Fundamentally, an American approach to digital assets is one that encourages innovation but mitigates the risks to consumers, investors, and businesses, broader financial stability and the environment,” National Economic Council Director Brian Deese and National Security Adviser Jake Sullivan said in a statement.

What’s the impact?

The lack of consumer privacy in the digital marketplace and money laundering has led to negative public sentiment around cryptocurrency. If the Digital Commodity Exchange Act of 2022 is passed, firms will have more clarity on navigating digital asset trading and the CFTC will have greater oversight on policing cryptocurrency.

Even so, Mesidor said until policymakers stop viewing crypto as a space that is by and for white men, legislation will not benefit the people actually using the technology.

“Right now Black and Latino communities are leading an economic revolution and are hidden figures in our own revolution. We’re not only in the blind spot of the media, we’re in the blind spot of policymakers and the industry,” Mesidor said. “How can you actually advance anything when no one is really paying attention to where the greatest adoption is happening?”

“Crypto functions differently than any financial instrument we’ve ever had, so the traditional rules of the game for policymaking do not apply here. The marketplace is not just browner, it’s also younger,” she said. “It is to their detriment that they’re not keeping up with the reality of where the industry is.”