In 1970, Helen Coleman left Los Angeles for Seattle, Washington and opened up Ms. Helen’s Soul Diner in the city’s predominantly-Black Central Area District neighborhood. She fed the community recipes she’d cultivated from her grandmother, whose Oklahoma roots served as the reux to the platters Coleman served up for athletes, politicians, celebrities and comedians stopped by for a plate.

Jesdarnel Henton, Coleman’s daughter who is also known as “Squirt,” helped in the kitchen and served customers as the duo made headlines for over a decade. Their second restaurant, Ms. Helen’s Soul Food Restaurant, picked up steam in the 90s and was forced to shutter following damage from a 2001 earthquake. Despite its city-wide success, there was little to continue forward. Shortly after, Coleman retired (though “Squirt” is planning a comeback through a grab-and-go concept).

Black-owned, family-run businesses like Coleman’s have long exemplified the underpinnings of the American Dream for Black families. Through entrepreneurship, many Black families have leveraged business ownership to build wealth, legacy and give back to their communities.

Prominent family-run companies like legacy brands Radio One, Black Enterprise and Sweetie Pie’s have earned millions, providing jobs to family members who take on leadership roles and manage the business, as well as jobs for thousands of Black employees.

But despite the opportunities family-owned and operated businesses have for long-term success, a 2019 report from the Family Business Alliance revealed fewer than 30 percent of said businesses reach third generation family ownership.

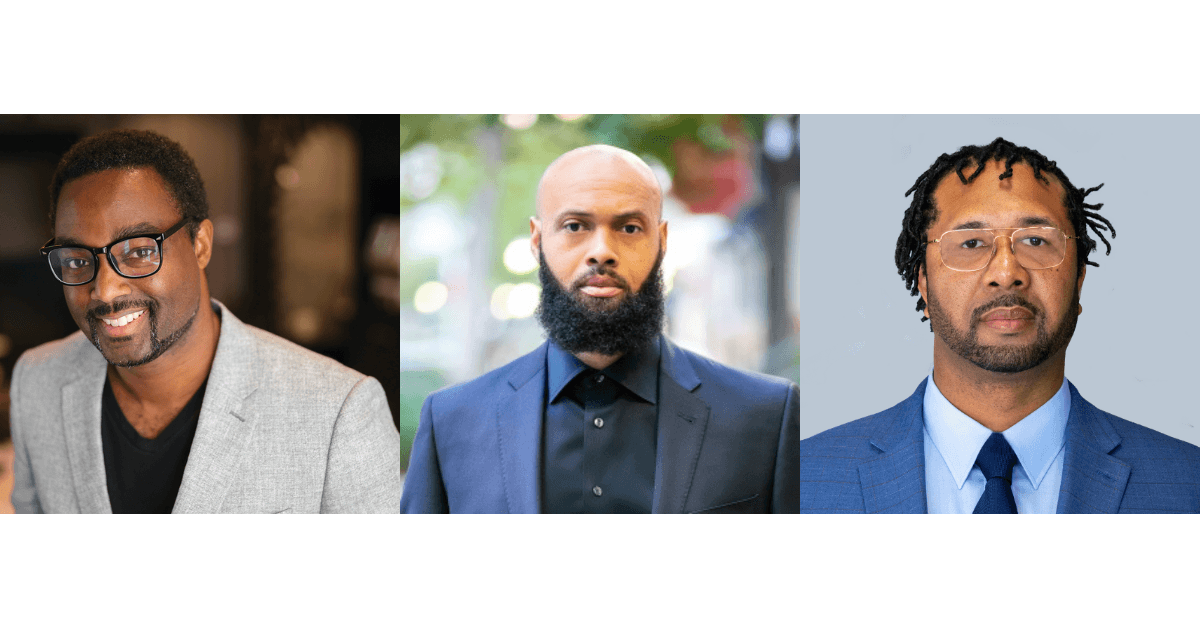

“A lot of business owners are great at running their business but get caught up in the day to day of management. I meet business owners that say they will get to their personal stuff but never do and think they can wait until their mid-to-late 50s and 60s but by then it’s too late ,” Jonathan Hodge, Financial Advisor, Senior Portfolio Manager and Certified Exit Planning Advisor at UBS Global Wealth Management, told The Plug.

While a variety of factors come into play as to why family-owned businesses don’t always make it to the next generation. When it comes to Black businesses and the opportunity for wealth creation, Hodge believes early succession planning and communication is important.

In a recent survey by PwC, 60 percent of business owners noted an increase in communication amongst family members during COVID, but many have still not begun planning for future risks.

The Federal Reserve estimates that over 200,000 small businesses have shut down as a result of the COVID-19 pandemic—early reports noted that between February and April of 2020, nearly 40 percent of Black-owned businesses closed.

For Black family-owned businesses, Hodge said that early planning can help to mitigate against future economic losses and the ability to preserve hard-earned wealth. Many of his clients were able to make pivots and healthy decisions for their family-owned business as a result of having a plan in place.

Hodge’s clients were also able to use resources from UBS to help guide the family along the fundamentals: structuring family business meetings, defining roles and responsibilities, retirement goals and how they will continue to give back to the community in a meaningful way.

“Business alignment with personal and family goals creates accountability. It’s important to codify the family and business mission statement and to begin assigning responsibilities for estate planning,” Hodge said.

A Note from Our Sponsor

This story is made possible by UBS Global Wealth Management. To connect with Jonathan, please find him on LinkedIn or visit his website advisors.ubs.com/affinitywealthpartners.

UBS Financial Services Inc. and its affiliates do not provide legal or tax advice. Clients should consult with their legal and tax advisors regarding their personal circumstances and before they invest or implement. This report is provided for informational and educational purposes only. Providing you with this information is not to be considered a solicitation on our part with respect to the purchase or sale of any securities, investments, strategies or products that may be mentioned, including estate planning strategies. In addition, the information is current as of the date indicated and is subject to change without notice.

As a firm providing wealth management services to clients, UBS Financial Services Inc. offers investment advisory services in its capacity as an SEC-registered investment adviser and brokerage services in its capacity as an SEC-registered broker-dealer. Investment advisory services and brokerage services are separate and distinct, differ in material ways and are governed by different laws and separate arrangements. It is important that clients understand the ways in which we conduct business, that they carefully read the agreements and disclosures that we provide to them about the products or services we offer. For more information, please review the PDF document at ubs.com/relationshipsummary.

The key symbol and UBS are among the registered and unregistered trademarks of UBS. UBS Financial Services Inc.is a subsidiary of UBS AG. Member FINRA/SIPC. IS2104595Expiration 8/31/2022