Key Insights:

- A report by DEI company Blendoor published last month documents a ‘tapering-off’ phenomenon among Black talent in leadership roles in financial services.

- Key data points evaluated across 160 financial services companies reveals disparities in representation, compensation, retention and companies making good on racial equity commitments.

- DEI is changing across companies as talent determines where to work based on values.

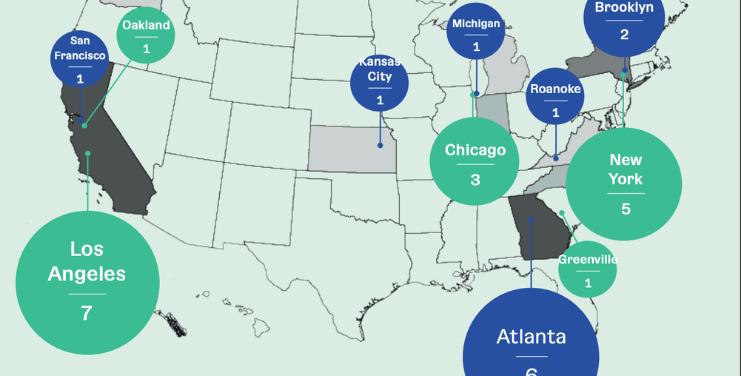

Blendoor, a diversity, equity and inclusion metrics software company published a report last month that evaluated 160 finance companies on their diversity, equity and inclusion (DEI) performance and pledges from 2015 to 2021. In 2015, many companies began offering more transparency into their DEI through annual company-wide reports. Blendoor’s new analysis tracks the progress, or lack thereof, over time.

As a whole, representation among women and minorities in financial services has stagnated. The number of Black employees in financial services has increased from 11 percent to 12 percent from 2015 to 2021. The number of women in financial services that represent companies like Aflac and Jones Lang LaSalle has decreased slightly from 53 percent in 2015 to 50 percent in 2021.

When it came to intersectionality, employees belonging to more than one underrepresented group, like women of color, continue to be left out of leadership roles, occupying just four percent of leadership roles in financial services.

Blendoor CEO Stephanie Lampkin used the report as a way to measure companies’ public commitment against their actions.

“This report was our first foray into understanding the extent to which financial services companies made very big pledges related to DEI, specifically after the murder of George Floyd, and comparing those pledges to their actual performance across leadership, recruitment, retention and impact,” Lampkin told The Plug during a live discussion.

The report indicated that there continues to be a disconnect between what companies have pledged and their actions towards fulfilling DEI commitments.

Women and people of color, and especially Black finance professionals, continue to be underrepresented, and perhaps unsurprisingly there doesn’t seem to be a pipeline problem for onboarding new talent. In fact, in entry-level positions, there is a substantial number of Black employees being recruited but the number of Black employees thins out among executive-level roles.

As an industry, diversity issues in the financial services sector are not unique and can parallel the problems seen in the tech industry. Lampkin notes that this thinning-out phenomenon, however, is unique to financial services in a key way.

“I was surprised to find that there’s actually quite a bit of diversity at the entry-level stage for a lot of these companies but the tapering off as you get higher and higher up into management and board representation is really astonishing,” Lampkin said. “The pattern that we found to be more significant in finance is the drop-off. Tech, unfortunately, is underrepresented from entry to executive in a lot of categories, but that’s not the case in finance,” she continued.

“The pipeline problem myth is far more prevalent in finance because clearly the talent is there, they’re just not being promoted and compensated throughout their trajectories.”

Black employees are effectively capped at how far they can go within their companies, with their growth being stifled not only in the rate at which they are promoted but how much they’re compensated.

White men, for instance, remain unmatched in their level of representation, promotion and compensation. The highest-level finance executive makes $7.6 million on average, both while and Black male executives are compensated at around the same rate according to the report. Where this is a stark disparity is in how many executives are Black.

Seventy percent of finance executives are white men, while a mere 1.9 percent of finance executives are Black men. When gender is factored in the disparities become even starker, with only 1.5 percent of finance execs identifying as Black women earning on average $2.4 million as finance execs, the lowest pay among any group to occupy the role.

Blendoor also assigns a score to companies based on four criteria of DEI measures including leadership, retention, recruiting and impact. Some companies are excelling in some of these areas, like All State and Progressive who are retaining underrepresented minorities, and CBRE Group for having a proportionate number of people of color in leadership positions. Lampkin said these strengths will increasingly become a part of how prospect talent evaluates companies and whom they choose to work for.

“We’re headed in that direction, once we get to that point people can start choosing companies not just based on how much money they can make, but whether it aligns with their core values and visions for the future,” Lampkin said.