A Note from Our Sponsor: This story is made possible by UBS Global Wealth Management. To connect with Jonathan, please find him on LinkedIn or visit his website advisors.ubs.com/affinitywealthpartners.

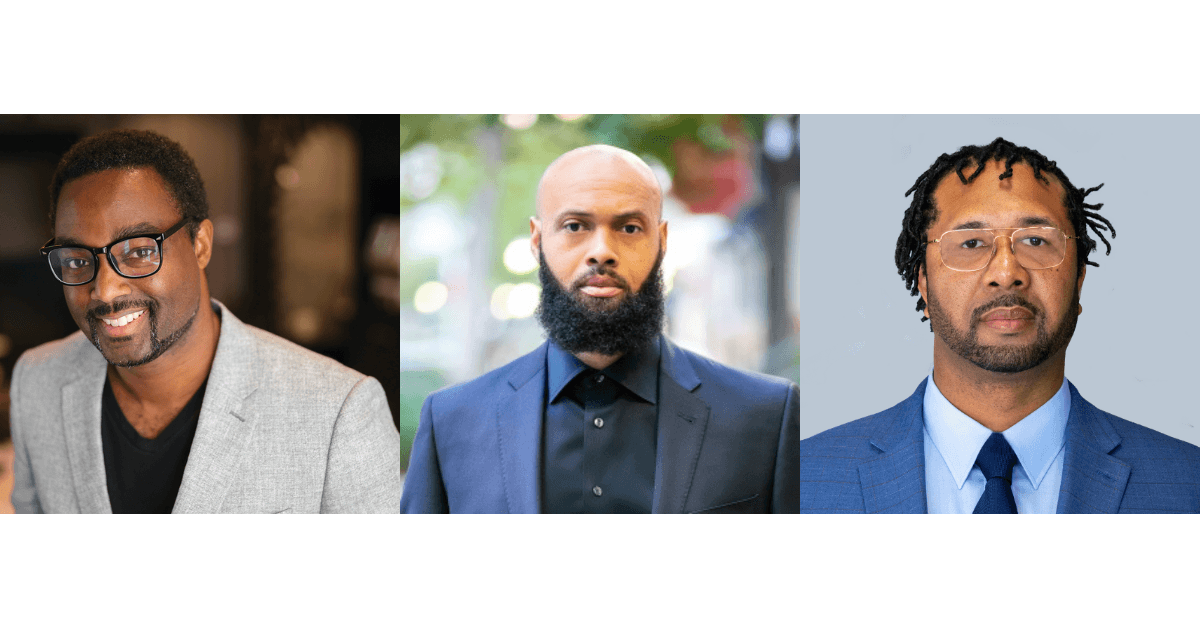

Jonathan Hodge wakes up every morning with a mission. The financial advisor at UBS with designations for endowments, foundations, athletes, and entertainers is working to help the Black community grow its wealth.

“That’s my North Star,” Hodge told The Plug.

The racial wealth gap in America is staggering. The median wealth of white families is $188,000 while for Black families it is $24,000, according to a 2019 survey by the Federal Reserve. The Federal Reserve indicates that the gap is the result of key factors such as intergenerational wealth transfers and home ownership, both of which have been stymied from centuries of discrimination and racism through government policies and backlash that denied Black Americans the chance to build wealth.

“You’ve had riots from white communities that destroyed Black commercial districts in places all over the country and most notably Tulsa, in the Greenwood district — Black Wall Street,” Dr. Andre Perry, senior fellow at the Brookings Institution and author of “Know Your Price: Valuing Black Lives and Property in America’s Black Cities,” told The Plug.

Hodge understands that there is a lot of history to reverse when it comes to creating Black wealth today, but he also sees plenty of opportunity.

“Reading our history of great things in the Black community and how they’ve been burned down, literally; that to me is motivation,” Hodge said. “If they could do it back then, imagine what we are capable of doing now.”

His work focuses primarily on families and individuals and the entities created by them.

“For me, a lot of it has to do with aligning the institutional resources of the largest global wealth management firm in the world, UBS, to these business owners,” he said.

One of those resources is capital, both in assets and the more intangible human capital. As an advisor, Hodge wants to be a conduit for his clients of UBS’s knowledge about different approaches and frameworks to building wealth based on a myriad of experiences.

Over the past year, there has been a wave of renewed attention and funding for Black wealth building. From new technologies like crypto and NFTs being leveraged for Black Americans to create wealth to a growing trend of investment funds and venture capital firms investing exclusively in Black founders, it seems there has never been as much support for Black entrepreneurs as now.

For example, 100 years after the Tulsa Massacre, a new 10-year, $200 million plan that roots itself in strategic partnerships, youth programming, and scalable entrepreneurship support services for Black Tulsans is setting up in the city. The initiative will also incorporate a few of the dozens of accelerators focused on Black tech founders.

Ultimately, wealth is not just a certain amount in a bank account.

“Wealth isn’t about a number,” Hodge explained. “When you’re truly wealthy, the barrier to entry to things like capital, education, and health care is zero or very, very low.”

Having wealth provides a powerful network and it also leads to more scalability. The wealthier you are, the easier it is to become more wealthy because you have more capital to invest in your business, Hodge believes.

Scalable wealth can provide for multiple generations and across multiple families in those generations. The work is happening now to help Black Americans create that lasting legacy.

A Note from Our Sponsor

This story is made possible by UBS Global Wealth Management. To connect with Jonathan, please find him on LinkedIn or visit his website advisors.ubs.com/affinitywealthpartners.

UBS Financial Services Inc. and its affiliates do not provide legal or tax advice. Clients should consult with their legal and tax advisors regarding their personal circumstances and before they invest or implement. This report is provided for informational and educational purposes only. Providing you with this information is not to be considered a solicitation on our part with respect to the purchase or sale of any securities, investments, strategies or products that may be mentioned, including estate planning strategies. In addition, the information is current as of the date indicated and is subject to change without notice.

As a firm providing wealth management services to clients, UBS Financial Services Inc. offers investment advisory services in its capacity as an SEC-registered investment adviser and brokerage services in its capacity as an SEC-registered broker-dealer. Investment advisory services and brokerage services are separate and distinct, differ in material ways and are governed by different laws and separate arrangements. It is important that clients understand the ways in which we conduct business, that they carefully read the agreements and disclosures that we provide to them about the products or services we offer. For more information, please review the PDF document at ubs.com/relationshipsummary.

The key symbol and UBS are among the registered and unregistered trademarks of UBS. UBS Financial Services Inc.is a subsidiary of UBS AG. Member FINRA/SIPC. IS2104441 Expiration 8/31/2022