KEY INSIGHTS:

- Acquisition of two Black-led publicly traded companies were completed in the third quarter of 2022: Ping Identity Holding for $2.8 billion and Global Blood Therapeutics for $5.4 billion.

- Six of the seven companies reported an increase in net revenue from the same three-month period in 2021.

- Compass, a tech-enabled real estate brokerage, reported a 14 percent loss in revenue from last year due to the destabilizing of the real estate market.

Seven companies that are publicly traded and Black-founded or Black-led recently announced their earnings for the third quarter of 2022. They make up a handful of the over 2,000 domestic companies to report on their financials for the period ending September 30.

In the second quarter of 2022, The Plug reported that two Black publicly traded companies were set to be acquired. Pfizer completed the acquisition of biopharmaceutical company Global Blood Therapeutics in early October for $5.4 billion at $68.50 per share. Thoma Bravo completed the acquisition of software company Ping Identity Holding shortly after in an all-cash transaction at $28.50 per share for a total of $2.8 billion.

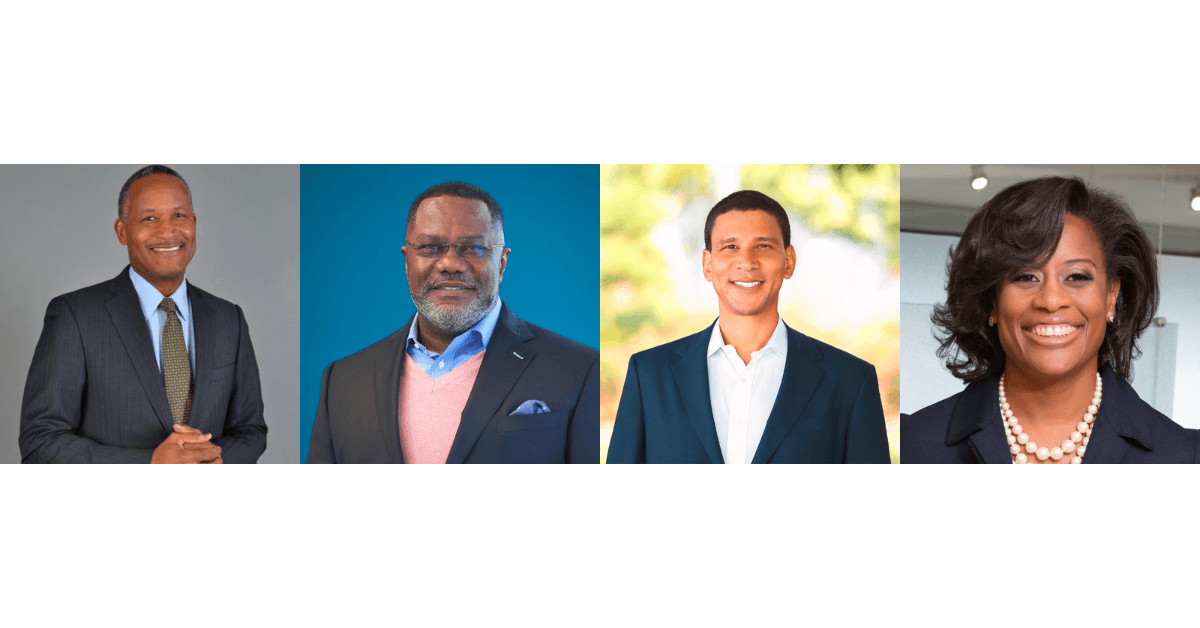

American Shared Hospital Services

Radiation therapy equipment company founded by Dr. Ernest A. Bates, American Shared Hospital Services reported a 17.8 percent increase in third-quarter revenue compared to the same period in 2021, with a total revenue of $4.8 million.

“AMS has accomplished much in the last few years and we believe the Company is now poised for continued growth, backed by our significant cash balances and $7 million unused credit line,” CEO Ray Stachowiak said in a press release.

In September, the company appointed Peter Gaccione as Chief Operating Officer. The previous COO Craig Tagawa remains as American Shared Hospital Services’ president and Chief Financial Officer.

Axsome Therapeutics

A biopharmaceutical company founded and led by Herriot Tabuteau, Axsome Therapeutics reported a total revenue of $16.8 million for the third quarter of 2022, compared to none for the same period in 2021.

In May, Axsome completed the acquisition of Sunosi, a medication to treat sleepiness due to narcolepsy or obstructive sleep apnea, from Jazz Pharmaceuticals. The company generated approximately $16.8 million in U.S. net sales of the drug in the third quarter.

This quarter, the company announced the launch of Auvelity, a medication for the treatment of major depressive disorders in adults which is now available in U.S. pharmacies.

“While it is still extremely early days in the Auvelity launch, we are very encouraged by the interest and reception from the prescriber community thus far,” Tabuteau said in a press release.

Broadway Financial Corporation

A bank holding company led by Brian Argrett, Broadway Financial Corporation reported consolidated net earnings of $1.3 million for the third quarter of 2022, compared to $182,000 for the same period in 2021.

The company attributed its increase to higher average balances of investment securities, primarily from Broadway Financial Corporation’s $150 million sale of Series C Preferred Stock to the U.S. Treasury in June as part of the Emergency Capital Investment Program (ECIP). The ECIP was created to support low- and moderate-income community financial institutions’ efforts to support local small businesses and consumers.

“I am pleased to report that during the third quarter we continued our record of improving results and further demonstrated the scalability of our business model,” Argrett said in a press release.

“With the addition of $150 million of new equity capital in June this year, we are poised to continue growing our business, improving the Company’s returns on assets and average equity, and expanding the positive impact of City First Broadway in the low-to-moderate income communities that we serve.”

Carver Bancorp

Bank holding company Carver Bancorp, led by Michael T. Pugh, held cash and cash equivalents of $95.5 million as of September 30 — more than double from the previous quarter.

This quarter continued to see business challenges as banks “continue to absorb heightened regulatory costs and compete for limited loan demand” due to the sharp increase in food and energy costs as a result of inflation, the company said in an SEC filing. The Federal Reserve will likely continue to increase interest rates to bring down inflation, which reached a 40-year high in June.

Carver Bancorp is particularly impacted by the economic climate in New York City where it has seven full-service branches. The city has lagged behind the state of New York and the nation in restoring jobs lost due to COVID-19 and decreasing unemployment rates to pre-pandemic levels. New York City’s unemployment rate is currently 5.9 percent compared to 3.7 percent nationally.

Compass, Inc.

Compass, a tech-enabled real estate brokerage founded and led by Robert Reffkin, reported a revenue of $1.49 billion, down from $2 billion from the previous quarter and a 14 percent loss in revenue from the same period last year.

In an earnings call, Reffkin said 2022 has been a “generationally bad” year in the residential real estate industry. He attributes the historic decline to high mortgage rates and home prices, a lack of inventory and stock market declines, making it an unattractive market for buyers.

Still, Reffkin remains optimistic.

“Against a backdrop of significant challenges for the housing industry, Compass continued to make progress in a number of important areas during the third quarter,” he said in a press release.

“As we look ahead, we believe the housing market will remain challenged during 2023 before returning to stability and growth in the future. The Compass team remains laser focused on providing our agents with technology, workflow tools and marketing support to be successful in the market.”

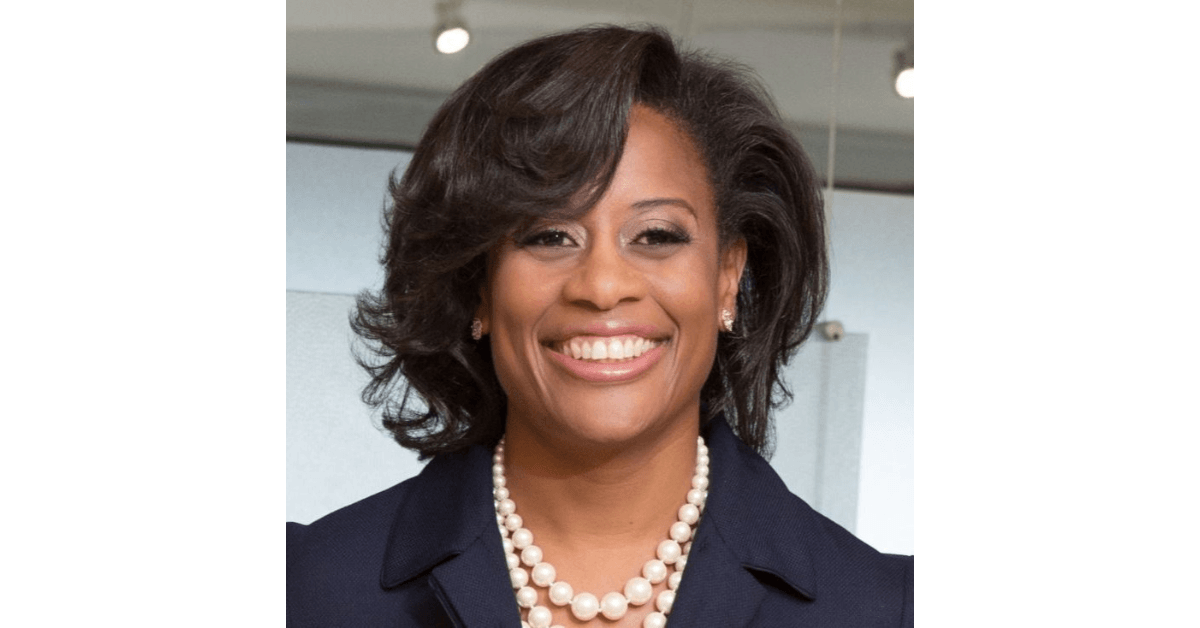

RLJ Lodging Trust

RLJ Lodging Trust, a real estate investment trust company led by Leslie D. Hale, reported a total revenue of $318.1 million, a slight decrease from the previous quarter. The company saw an increase in RevPAR, revenue per available room, from Q2 though, reaching a new high since the pandemic.

“Our third-quarter results exceeded our expectations, led by strong group production, continued recovery in business transient and leisure remaining strong while returning to normal seasonality,” Hale said in a press release.

One of RLJ Lodging Trust’s quarterly highlights is the conversion of two hotels in October: the Mills House Hotel in Charleston and the Zachari Dunes at Mandalay Beach, which Hale said are “outperforming our expectations.”

Urban One

Urban One, a media company led by Alfred C. Liggins III, reported net revenue of $121.4 million, an increase of 8.9 percent from the same period in 2021 and a slight increase from the previous quarter.

In August, Urban One acquired four radio stations in Indianapolis for $25 million from Emmis Corp., which Liggins anticipates will increase radio revenue to a “double-digit percentage” for Q4.

Urban One also reported the pandemic may impact revenue sources on a “going forward basis,” noting that its larger markets including Atlanta, Baltimore, Charlotte and Dallas may face particular operating challenges due to COVID-19.

“We do not carry business interruption insurance to compensate us for losses and such losses may continue to occur as a result of the ongoing and fluctuating nature of the COVID-19 pandemic,” the company said in a press release.