KEY INSIGHTS:

- Axsome Therapeutics and Broadway Financial Corporation report an increase in net revenue in the fourth quarter of 2022 from the previous quarter.

- Carver Bancorp, Compass, Inc. and RLJ Lodging Trust report a decrease in net revenue from the third quarter of 2022, but a positive outlook for 2023.

- Urban One, Inc. and American Shared Hospital Services will share their Q4 earnings and 2022 total earnings in the month ahead.

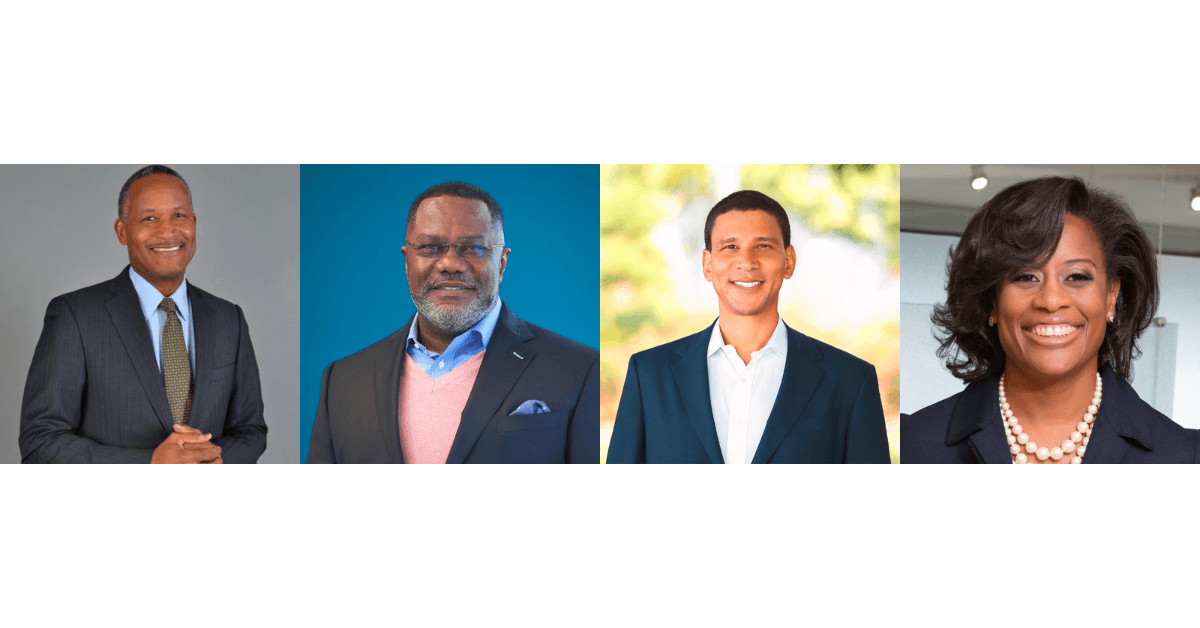

Five of seven publicly traded Black-owned or led companies identified by The Plug recently announced their earnings for the fourth quarter of 2022. They make up a handful of the over 2,000 domestic companies to report on their financials for the period ending on December 31.

The two remaining companies, Urban One, Inc., a media company led by Alfred C. Liggins III, and American Shared Hospital Services, a radiation therapy equipment company founded by Dr. Ernest A. Bates, are slated to publish their reports later this month.

Axsome Therapeutics

The biopharmaceutical company founded and led by Herriot Tabuteau, Axsome Therapeutics reported a total revenue of $24.4 million for the fourth quarter of 2022 from the sale of two products, an increase of $7.6 million from the previous quarter.

In May 2022, Axsome completed the acquisition of Sunosi, a medication to treat sleepiness due to narcolepsy or obstructive sleep apnea. Sunosi generated total net sales of $19.2 million in Q4. In October 2022, Axsome launched Auvelity, a medication for treating major depressive disorders in adults. Auvelity generated net sales of $5.2 million in Q4.

“Although it is still early days, we are encouraged by Auvelity’s launch progress,” Lori Englebert, senior vice president of commercial and business development, said in the earnings call.

Axsome generated $50 million in 2022, compared to zero the previous year.

Broadway Financial Corporation

A bank holding company led by Brian Argrett, Broadway Financial Corporation reported consolidated net earnings of $1.5 million for the fourth quarter of 2022, a $200,000 increase from Q3.

Broadway Financial Corporation attributed the increase to the investment of the proceeds from its $150 million sale of Series C Preferred Stock to the U.S. Treasury in June as part of the Emergency Capital Investment Program (ECIP). The ECIP was created to support low- and moderate-income community financial institutions’ efforts to support local small businesses and consumers.

“We intend to continue deploying the $150 million of new equity capital that we raised in June this past year to invest in and grow our business, improve the Company’s returns, and deliver on our mission and commitment to serve the financial needs of low-to-moderate income communities within our markets,” CEO Brian Argrett said in a statement.

The company reported a net earning of $5.6 million for 2022, up from a net loss of $4.1 million in 2021 due to costs from the merger of Broadway and CFBanc Corporation.

Carver Bancorp

Bank holding company Carver Bancorp, led by Michael T. Pugh, held cash and cash equivalents of $43.9 million as of December 31, a $51.6 million decrease from the previous quarter.

This quarter continued to see business challenges as banks “continue to absorb heightened regulatory costs and compete for limited loan demand” due to the sharp increase in food and energy costs as a result of inflation, the company reported in an SEC filing. The company cited the same concerns in its Q3 report.

Carver Bancorp has been particularly impacted by the economic climate in New York City where it has seven full-service branches. New York City’s unemployment rate was 5.9 percent in December compared to 3.5 percent nationally.

Compass, Inc.

Compass, a tech-enabled real estate brokerage founded and led by Robert Reffkin, initiated actions to reduce its non-GAAP operating expenses by $338 million in 2022. Revenue decreased by 31 percent year-over-year to $1.11 billion for the fourth quarter as transactions declined by 25 percent.

“2022 was a difficult year for the residential real estate market and Compass. The unexpected and rapid 18 percent decline in industry-wide transactions resulted in one of the worst years for the real estate market and a decline at the same rate as the 2007-2008 housing crisis,” Founder and CEO Robert Reffkin said in a statement.

The company expects to be cash flow positive for the full year 2023, according to Kalani Reelitz, CFO of Compass. Since its inception, Compass has generated negative cash flows from operations. As of December 31, the company held cash and cash equivalents of $361.9 million and an accumulated deficit of $2.2 billion.

RLJ Lodging Trust

RLJ Lodging Trust, a real estate investment trust company led by Leslie D. Hale, reported a total revenue of $302.2 million in Q4 of 2022, a slight decrease from the previous quarter. However, the percentage of hotel occupancy for the fourth quarter recovered to 89 percent of pre-pandemic levels.

“While the current environment remains uncertain, the continuing improvement in business travel, group booking momentum and the ongoing recovery in Urban leisure gives us confidence that Urban markets will continue to outperform the industry on a relative basis this year, which will benefit our Urban-centric portfolio,” Leslie D. Hale, president and CEO, said in a statement.

The company netted about $1.2 billion for the full year, up $408 million from the prior year. In 2022, RLJ Lodging Trust acquired 21c Hotel Nashville for $59 million and sold two non-core hotels for gross proceeds of $49.9 million.

Urban One, Inc.

Urban One Inc., the largest Black-owned and operated multi-media company, has not filed its 2022 earnings yet. However, in January the company announced a partnership with Sounder, a contextual intelligence platform for audio, to research equal monetization opportunities for BIPOC audio content creators by improving podcast ad technology.