Key Insights:

- Two Black-led publicly traded companies are set to be acquired: Ping Identity Holding for $2.8 billion, and Global Blood Therapeutics for $5.4 billion.

- Carver Bancorp has been affected by an increase in interest rates to bring down inflation which has reached a 40-year high.

- Urban One’s operating income has decreased this quarter, noting that advertisers have reduced their spending on radio advertising.

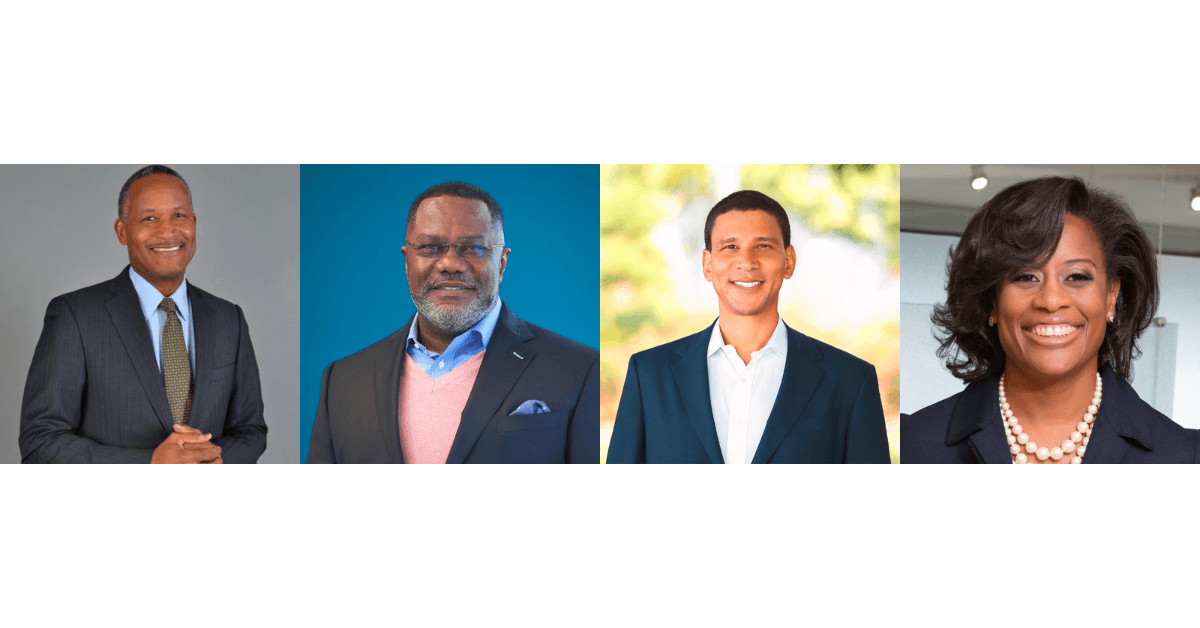

Nine companies that are publicly traded and Black-owned or Black-led recently announced their earnings for the second quarter of 2022. Though several of the companies saw revenue increase and a rise in total assets, many still grappled with the impacts of the pandemic and rising inflation rates.

For the purpose of this report, The Plug is defining Black-owned as companies that are founded and or led by an individual who identifies as Black.

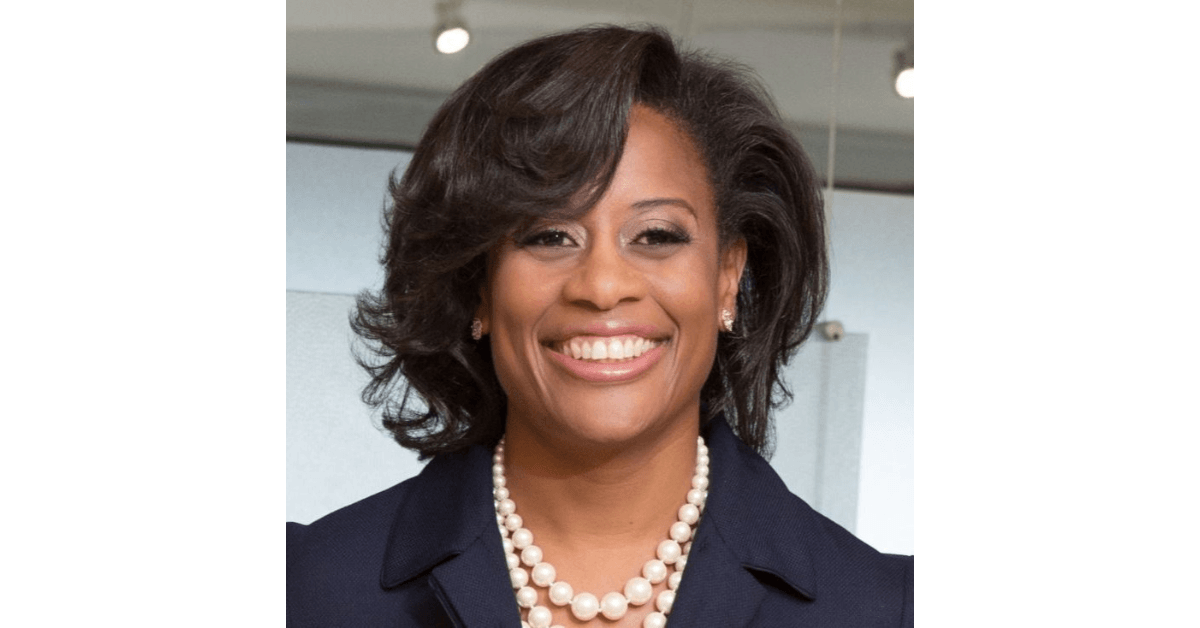

RLJ Lodging Trust

RLJ Lodging Trust, a real estate investment trust company led by Leslie D. Hale, reported a total revenue of $330.5 million and maintains a strong balance sheet with approximately $1.1 billion of liquidity, including $511.5 million of unrestricted cash.

“Our second quarter results significantly outperformed our expectations, led by the performance of our urban markets, which were the major beneficiary of strengthening business travel and greater citywide attendance, that drove outsized growth during the weekdays, in addition to robust leisure demand,” Leslie D. Hale, president and CEO of RLJ Lodging Trust, said in a press release.

Its positive performance this quarter allowed RLJ Lodging Trust to exit its covenant waiver period, which, among other things, provides for the elimination of certain spending limitations.

The company started its third quarter strong, acquiring a boutique lifestyle hotel in Nashville in July for $59 million. The 21c Museum Hotel Nashville is one of 97 hotels RLJ Lodging Trust now owns across 24 states.

Urban One

Urban One, a media company led by Alfred C. Liggins III, reported net revenue of $118.8 million, an increase of 10.4 percent from the same period in 2021. The company’s operating income for the quarter was approximately $23.8 million. This is a decrease of $14.1 million compared to the same three-month period last year.

“We had a strong finish to Q2, driven by continued robust growth in digital and cable television advertising, both of which were up double digits,” Alfred C. Liggins, III, Urban One’s CEO and president, said in a press release.

In addressing how COVID-19 affected the company, Urban One reported that advertisers reduced their spending on advertising, particularly on the company’s radio segment that derives substantial revenue from local economies, highlighting Texas, Ohio and Georgia.

The shift to remote work and a decrease in commuting has also altered the demand for broadcasting radio advertising. The company concurs that these losses may continue due to the fluctuating nature of the pandemic.

Ping Identity Holding

Ping Identity Holding, a software company acquired by Robert Smith’s Vista Equity Partners in 2016, reported that its annual recurring revenue has grown for the sixth straight quarter on a year-over-year basis to $341 million. The total revenue for the second quarter was $72 million, with 92 percent coming from subscriptions.

The company has also agreed to be acquired by Thoma Bravo, a private equity firm, for $28.50 per share in an all-cash transaction valued at approximately $2.8 billion. The deal is expected to close at the end of this year.

“We believe this is a great outcome for all stakeholders as we accelerate our vision for securing the Internet through intelligent identity while delivering extraordinary experiences for our end users,” Andre Durand, Ping Identity’s CEO, said in a press release.

Global Blood Therapeutics

Less than a week after Ping Identity’s acquisition, Global Blood Therapeutics (GBT), a biopharmaceutical company led by Ted Love, announced it entered into a definitive agreement to be acquired by Pfizer for approximately $5.4 billion.

Pfizer will acquire all the outstanding shares for $68.50 per share in cash, allowing the pharmaceutical giant to enhance its presence in rare hematology.

“Sickle cell disease is the most common inherited blood disorder, and it disproportionately affects people of African descent. We are excited to welcome GBT colleagues into Pfizer and to work together to transform the lives of patients, as we have long sought to address the needs of this underserved community,” Albert Bourla, the chairman and CEO of Pfizer, said in a press release.

“Pfizer will broaden and amplify our impact for patients and further propel much-needed innovation and resources for the care of people with sickle cell disease and other rare diseases, including populations in limited-resource countries,” Ted Love, president and CEO of GBT, added.

As of June 30, GBT reported $261.1 million in cash and cash equivalents.

Axsome Therapeutics

Axsome Therapeutics, a biopharmaceutical company led by Herriot Tabuteau, reported its first commercial sales since acquiring Sunosi, a medication to treat sleepiness due to narcolepsy or obstructive sleep apnea.

Axsome completed the acquisition of Sunosi from Jazz Pharmaceuticals on May 9 with an expectation to close the deal in the fourth quarter of 2022. From the date of acquisition to June 30, the company generated approximately $8.8 million in U.S. net sales of the drug.

Research and development expenses were $15.8 million for this year’s second quarter, up from $14.5 million for the comparable period in 2021, driven in part by personnel and clinical trial costs. The company is currently pending FDA action on its medication that could treat major depressive disorder, Alzheimer’s disease agitation and smoking cessation.

Carver Bancorp

Bank holding company Carver Bancorp, led by Michael T. Pugh, held cash and cash equivalents of $43.4 million as of June 30.

The company said the current business climate is affected by a sharp increase in food and energy costs as a result of inflation. The Federal Reserve will likely continue to increase interest rates to bring down inflation, which reached a 40-year high in June.

Carver Bancorp’s seven full-service branches, located in New York City, have impacted the business because the city has lagged behind the state of New York and the nation in restoring jobs lost due to COVID-19 and decreasing unemployment rates to pre-pandemic levels. New York City’s unemployment rate is currently 6.5 percent compared to 3.5 percent nationally.

Broadway Financial Corporation

Broadway Financial Corporation, another bank holding company led by Wayne Bradshaw, reported consolidated net earnings of $1.9 million for the second quarter of 2022, compared to $701,000 for the same period in 2021. The company merged with CFBanc Corporation on April 1, 2021, and this year’s earnings reflect that.

Total assets increased from $130.7 million to over $1.2 billion as of June 30, representing an increase of 12 percent since December 31, 2021.

“The second quarter represented a watershed for Broadway as we extended our post-integration profitability and doubled our equity base and regulatory capital through participation in the U.S. Treasury’s Emergency Capital Investment Program (ECIP),” Brian Argrett, CEO of Broadway Financial Corporation, said in a press release.

The ECIP was created to support low- and moderate-income community financial institutions’ efforts to support local small businesses and consumers.

“Over the next several years, this capital will allow us to significantly expand access to capital in underserved communities, which will benefit both those communities and our investors,” he said.

American Shared Hospital Services

American Shared Hospital Services, a radiation therapy equipment company founded by Dr. Ernest A. Bates, reported a 12.5 percent period-over-period increase in second-quarter revenue with total Q2 revenue of $5 million.

“[American Shared Hospital Services] had a strong second quarter with volumes continuing to rebound to pre-pandemic levels,” Ray Stachowiak, the CEO of the company, said in a press release.

Compass, Inc.

Compass, a real estate brokerage founded by Robert Reffkin, reported a revenue of $2 billion, up four percent year-over-year.

“Compass continued to grow revenue in the second quarter despite extremely challenging market conditions. This performance highlights the strength of our agents and our commitment to enabling their success through superior technology and other programs,” Reffkin, CEO of Compass, said in a press release.

GAAP net loss increased to $101 million compared to $7 million in the second quarter of 2021.

“Given the challenges the real estate market has faced so far this year and the likelihood that this difficult environment will continue for the foreseeable future, we are announcing a significant cost reduction program,” Reffkin said. “We have line of sight into each area that will drive these savings to our expenses, which we believe will enable us to be free cash flow positive in 2023.”